Wall Street Bullish: BlackRock ETF Poised For Massive Growth By 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Bullish: BlackRock ETF Poised for Massive Growth by 2025

BlackRock's dominance in the ETF market is set to surge, with analysts predicting exponential growth for its flagship products by 2025. The investment giant is already a heavyweight in the exchange-traded fund (ETF) arena, but new projections suggest a monumental leap in assets under management (AUM) within the next few years. This bullish outlook is fueled by several key factors, pointing to a future where BlackRock ETFs solidify their position as market leaders.

BlackRock's Unwavering Dominance in the ETF Landscape

BlackRock, the world's largest asset manager, boasts a portfolio of immensely popular ETFs, including the iShares Core US Aggregate Bond ETF (AGG) and the iShares Core S&P 500 ETF (IVV). These behemoths consistently attract billions in investment, and their continued growth is a significant driver behind the overall positive outlook. The sheer scale of BlackRock's operations, its sophisticated technology, and its robust brand reputation give it a considerable competitive advantage.

Factors Fueling the Projected Growth:

Several factors are contributing to the optimistic projections for BlackRock ETF growth by 2025:

-

Increased Retail Investor Participation: The rise of online brokerage accounts and a growing interest in passive investing strategies have significantly boosted ETF adoption among retail investors. BlackRock's user-friendly platforms and diverse ETF offerings cater perfectly to this expanding demographic.

-

Institutional Investor Demand: Institutional investors, such as pension funds and endowments, are increasingly incorporating ETFs into their portfolios due to their cost-effectiveness, transparency, and diversification benefits. BlackRock's established track record and reputation attract substantial institutional investment.

-

Innovation and Product Diversification: BlackRock continuously expands its ETF offerings, introducing new products that cater to evolving market trends and investor demands. This proactive approach ensures it remains at the forefront of innovation within the ETF space. They are particularly focusing on thematic ETFs, such as those related to sustainable investing and technology.

-

Global Market Expansion: BlackRock’s global reach allows it to capitalize on growth opportunities in emerging markets, further boosting its AUM. International diversification is a crucial component of their strategy for sustained growth.

-

Technological Advancements: BlackRock's investment in advanced technology and data analytics allows for efficient portfolio management and optimized trading strategies, contributing to superior performance and attracting more investors.

Challenges and Potential Risks:

While the outlook is overwhelmingly positive, several challenges could potentially impact BlackRock's projected growth:

-

Increased Competition: The ETF market is becoming increasingly competitive, with new entrants constantly emerging. Maintaining its market share will require BlackRock to continue innovating and delivering exceptional value to its investors.

-

Regulatory Changes: Changes in regulatory frameworks could impact the ETF industry, potentially affecting BlackRock's operations and growth trajectory.

-

Market Volatility: Unexpected market downturns could temporarily dampen investor enthusiasm and affect AUM.

Conclusion:

Despite potential challenges, the overall consensus on Wall Street remains bullish on BlackRock's ETF growth prospects. The combination of increasing investor interest, BlackRock's innovative strategies, and its established market leadership suggests a significant expansion of its AUM by 2025. This makes BlackRock ETFs a compelling investment option for both seasoned and novice investors looking to capitalize on the growing ETF market. However, investors should always conduct thorough research and consider their risk tolerance before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Bullish: BlackRock ETF Poised For Massive Growth By 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

May 7 2025 Detailed Game Chart Knicks Vs Celtics Matchup

May 09, 2025

May 7 2025 Detailed Game Chart Knicks Vs Celtics Matchup

May 09, 2025 -

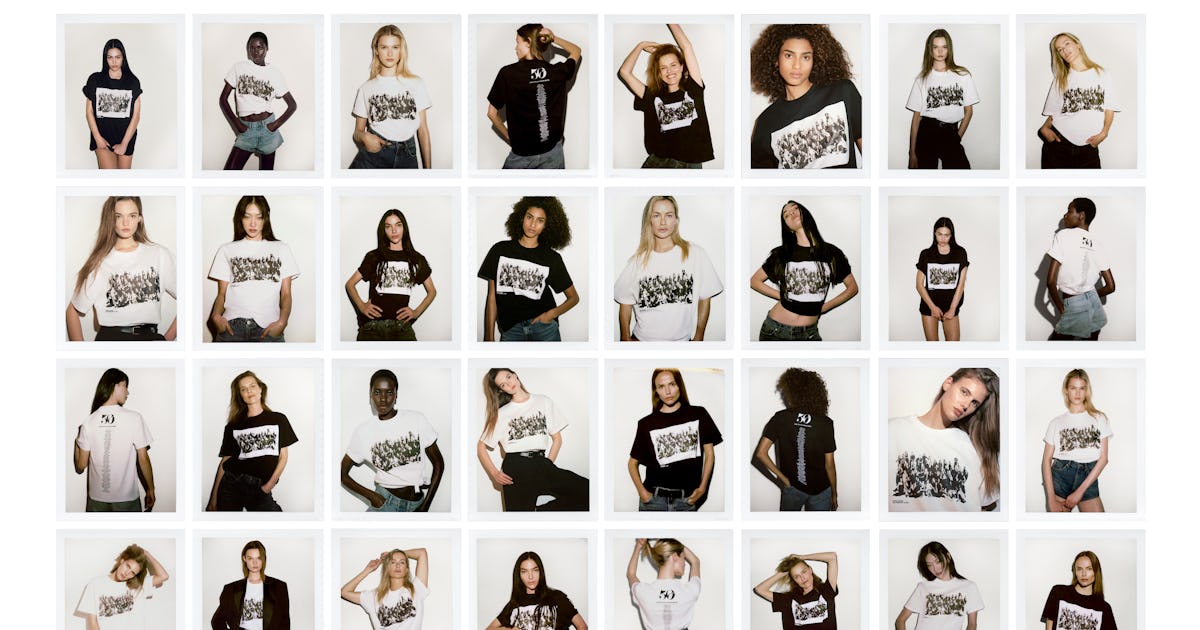

Get The Look Models From Zaras Inclusive New Campaign

May 09, 2025

Get The Look Models From Zaras Inclusive New Campaign

May 09, 2025 -

The Business Model Of Zara How It Conquered The Fashion World

May 09, 2025

The Business Model Of Zara How It Conquered The Fashion World

May 09, 2025 -

Ohtanis Market Value Could He Have Secured A 15 Year Deal

May 09, 2025

Ohtanis Market Value Could He Have Secured A 15 Year Deal

May 09, 2025 -

Is Xrp Poised For A Bullish Rally To 3 Market Analysis And Predictions

May 09, 2025

Is Xrp Poised For A Bullish Rally To 3 Market Analysis And Predictions

May 09, 2025