Wall Street Sees Green: Should You Invest In Broadcom (AVGO)?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Sees Green: Should You Invest in Broadcom (AVGO)?

Wall Street is buzzing about Broadcom (AVGO), with analysts predicting a bright future for the semiconductor giant. But should you be investing? The recent surge in AVGO stock has many investors wondering if this is a fleeting trend or a genuine opportunity for long-term growth. Let's delve into the factors driving this optimism and assess the potential risks before making any investment decisions.

Broadcom's Stellar Performance and Future Outlook:

Broadcom's Q3 2023 earnings significantly exceeded expectations, fueled by strong demand for its semiconductor solutions across various sectors. This robust performance is largely attributed to:

- Data Center Boom: The insatiable appetite for data center infrastructure continues to drive demand for Broadcom's high-performance networking chips and storage solutions. This sector is expected to remain a key growth driver for the foreseeable future.

- 5G Expansion: The global rollout of 5G networks presents a massive opportunity for Broadcom, whose chips are integral to the infrastructure powering this next-generation technology.

- Artificial Intelligence (AI) Surge: The AI boom is further bolstering Broadcom's prospects. Their chips are crucial components in the servers and data centers that power AI applications and machine learning algorithms.

- Software Defined Networking (SDN) Growth: Broadcom is strategically positioned to benefit from the growing adoption of SDN, offering solutions that enhance network efficiency and scalability.

Analyzing the Investment Risks:

While the outlook appears positive, potential investors should carefully consider the following risks:

- Economic Uncertainty: Global economic headwinds, including inflation and potential recessionary pressures, could impact demand for Broadcom's products.

- Supply Chain Challenges: The semiconductor industry remains vulnerable to supply chain disruptions, which could affect production and profitability.

- Competition: Broadcom faces intense competition from other major semiconductor companies, requiring continuous innovation and strategic maneuvering to maintain its market share.

- Geopolitical Factors: Global geopolitical instability could create uncertainty and impact the company's operations and supply chains.

Is AVGO a Buy? Weighing the Pros and Cons:

The strong financial performance and positive industry trends suggest a bullish outlook for Broadcom. However, the inherent risks associated with the semiconductor industry and broader economic factors need careful consideration. Before investing, you should:

- Conduct Thorough Due Diligence: Independently research Broadcom's financials, competitive landscape, and future growth prospects.

- Diversify Your Portfolio: Avoid putting all your eggs in one basket. Diversification is crucial to mitigate risk.

- Consider Your Risk Tolerance: Investing in AVGO carries inherent risks. Only invest an amount you're comfortable potentially losing.

- Consult a Financial Advisor: Seek professional financial advice tailored to your individual circumstances and investment goals.

Conclusion:

Broadcom (AVGO) presents a compelling investment opportunity, driven by robust growth in key sectors. However, potential investors must carefully weigh the potential risks and conduct thorough due diligence before making any investment decisions. The current market sentiment is positive, but informed decision-making is paramount to achieving long-term investment success. Remember, this is not financial advice, and individual circumstances should always guide investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Sees Green: Should You Invest In Broadcom (AVGO)?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Science And War Zones Challenges And Solutions Episode 3

May 12, 2025

Science And War Zones Challenges And Solutions Episode 3

May 12, 2025 -

From Casino Brawl To Ufc 318 The Final Showdown

May 12, 2025

From Casino Brawl To Ufc 318 The Final Showdown

May 12, 2025 -

Concert Turns Violent Fights Break Out At Tina Arena Performance

May 12, 2025

Concert Turns Violent Fights Break Out At Tina Arena Performance

May 12, 2025 -

Gws Giants Triumph Over Geelong Cats Full Vfl Match Report

May 12, 2025

Gws Giants Triumph Over Geelong Cats Full Vfl Match Report

May 12, 2025 -

Nba Playoffs Thunders Hard Fought Game 4 Victory Over Nuggets

May 12, 2025

Nba Playoffs Thunders Hard Fought Game 4 Victory Over Nuggets

May 12, 2025

Latest Posts

-

The Apple Google Symbiosis Understanding Their Interdependence

May 13, 2025

The Apple Google Symbiosis Understanding Their Interdependence

May 13, 2025 -

Full Flower Moon 2025 Your Guide To Optimal Viewing

May 13, 2025

Full Flower Moon 2025 Your Guide To Optimal Viewing

May 13, 2025 -

Ais Unexpected Role Pope Leo Xiv Explains Papal Name Choice

May 13, 2025

Ais Unexpected Role Pope Leo Xiv Explains Papal Name Choice

May 13, 2025 -

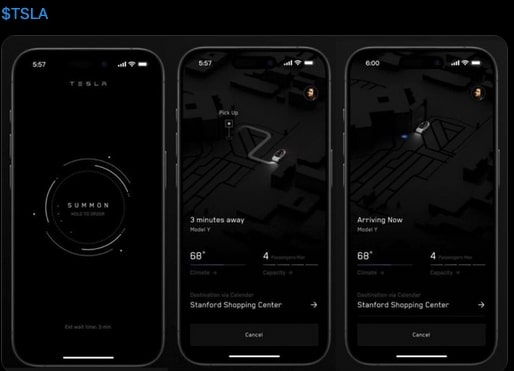

Teslas Austin Expansion June Launch Of Supervised And Unsupervised Ridesharing Anticipated

May 13, 2025

Teslas Austin Expansion June Launch Of Supervised And Unsupervised Ridesharing Anticipated

May 13, 2025 -

F 18 Fighter Jet Casualties Examining Us Navy Losses In Yemen Conflict

May 13, 2025

F 18 Fighter Jet Casualties Examining Us Navy Losses In Yemen Conflict

May 13, 2025