Wall Street Sees Strong Future For Broadcom (AVGO): Time To Invest?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Sees Strong Future for Broadcom (AVGO): Time to Invest?

Wall Street analysts are buzzing about Broadcom (AVGO), with several projecting a robust future for the semiconductor giant. This surge in optimism has many investors wondering: is now the time to buy AVGO stock? Let's delve into the reasons behind the bullish sentiment and explore whether adding Broadcom to your portfolio makes strategic sense.

Broadcom's Stellar Performance and Future Projections:

Broadcom's recent financial performance has been nothing short of impressive. The company consistently exceeds earnings expectations, demonstrating strong revenue growth driven by its diverse product portfolio, including networking equipment, wireless chips, and storage solutions. This consistent outperformance has fueled analyst confidence, leading to upward revisions in price targets.

- Dominant Market Share: Broadcom holds a significant market share in several key sectors, giving it a competitive edge and contributing to its financial strength. This dominance positions the company for continued growth even amidst market fluctuations.

- Strategic Acquisitions: Broadcom's history of strategic acquisitions, such as the recent purchase of VMware, signals its ambition for expansion and diversification into high-growth markets. These moves are viewed favorably by analysts as evidence of a forward-thinking strategy.

- Diversified Revenue Streams: The company's diverse product portfolio helps mitigate risk associated with dependence on a single market segment. This diversification provides stability and resilience in the face of economic uncertainty.

Key Growth Drivers for Broadcom:

Several factors contribute to the optimistic outlook for Broadcom's future growth:

- 5G Infrastructure Deployment: The ongoing rollout of 5G networks globally presents a significant opportunity for Broadcom, as its chips are crucial components in this infrastructure.

- Artificial Intelligence (AI) Boom: The rapid growth of the AI sector is creating high demand for advanced semiconductors, a market where Broadcom is well-positioned to capitalize.

- Data Center Expansion: The increasing demand for data center capacity fuels the need for high-performance networking and storage solutions, further bolstering Broadcom's prospects.

Is AVGO Stock a Buy? Analyzing the Risks:

While the outlook for Broadcom appears bright, potential investors should also consider the risks:

- Geopolitical Uncertainty: Global political instability and trade tensions can impact semiconductor supply chains and demand.

- Competition: The semiconductor industry is highly competitive, and new players and technological advancements could pose challenges to Broadcom's market share.

- Economic Slowdown: A broader economic slowdown could impact demand for Broadcom's products, particularly in less essential sectors.

The Verdict: A Cautious Optimism:

The positive outlook for Broadcom (AVGO) is largely justified by its strong financial performance, strategic acquisitions, and positioning in key growth markets. However, investors should remain aware of the inherent risks in the technology sector and conduct thorough due diligence before investing. Considering the company's track record and future prospects, AVGO could be a valuable addition to a well-diversified portfolio, particularly for investors with a medium-to-long-term horizon. Always consult with a financial advisor before making any investment decisions.

Keywords: Broadcom, AVGO, stock, investment, semiconductor, technology, Wall Street, analyst, earnings, growth, 5G, AI, artificial intelligence, data center, market share, acquisition, VMware, risk, investment advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Sees Strong Future For Broadcom (AVGO): Time To Invest?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rome R3 Tennis De Jong Vs Sinner And Marozsan Vs Mensik Match Previews And Winning Picks

May 13, 2025

Rome R3 Tennis De Jong Vs Sinner And Marozsan Vs Mensik Match Previews And Winning Picks

May 13, 2025 -

Virgin Media O2 And Daisy Unite Creating A 3bn Force In Business Telecoms

May 13, 2025

Virgin Media O2 And Daisy Unite Creating A 3bn Force In Business Telecoms

May 13, 2025 -

Netflix Series Poised To Surpass Game Of Thrones In Popularity

May 13, 2025

Netflix Series Poised To Surpass Game Of Thrones In Popularity

May 13, 2025 -

Ryan Mason From Tottenham Coach To West Brom Boss A Difficult Path Ahead

May 13, 2025

Ryan Mason From Tottenham Coach To West Brom Boss A Difficult Path Ahead

May 13, 2025 -

Virgin Media O2 Expands B2 B Reach With Acquisition Of Daisy Group

May 13, 2025

Virgin Media O2 Expands B2 B Reach With Acquisition Of Daisy Group

May 13, 2025

Latest Posts

-

One Bad Joke Huge Fallout Helldivers 2 Dev Faces Community Pressure

May 13, 2025

One Bad Joke Huge Fallout Helldivers 2 Dev Faces Community Pressure

May 13, 2025 -

Free Agency Move Las Vegas Raiders Sign Veteran Linebacker Robert Smith

May 13, 2025

Free Agency Move Las Vegas Raiders Sign Veteran Linebacker Robert Smith

May 13, 2025 -

Gerard Depardieu Found Guilty Sexual Assault Conviction Following Film Set Allegations

May 13, 2025

Gerard Depardieu Found Guilty Sexual Assault Conviction Following Film Set Allegations

May 13, 2025 -

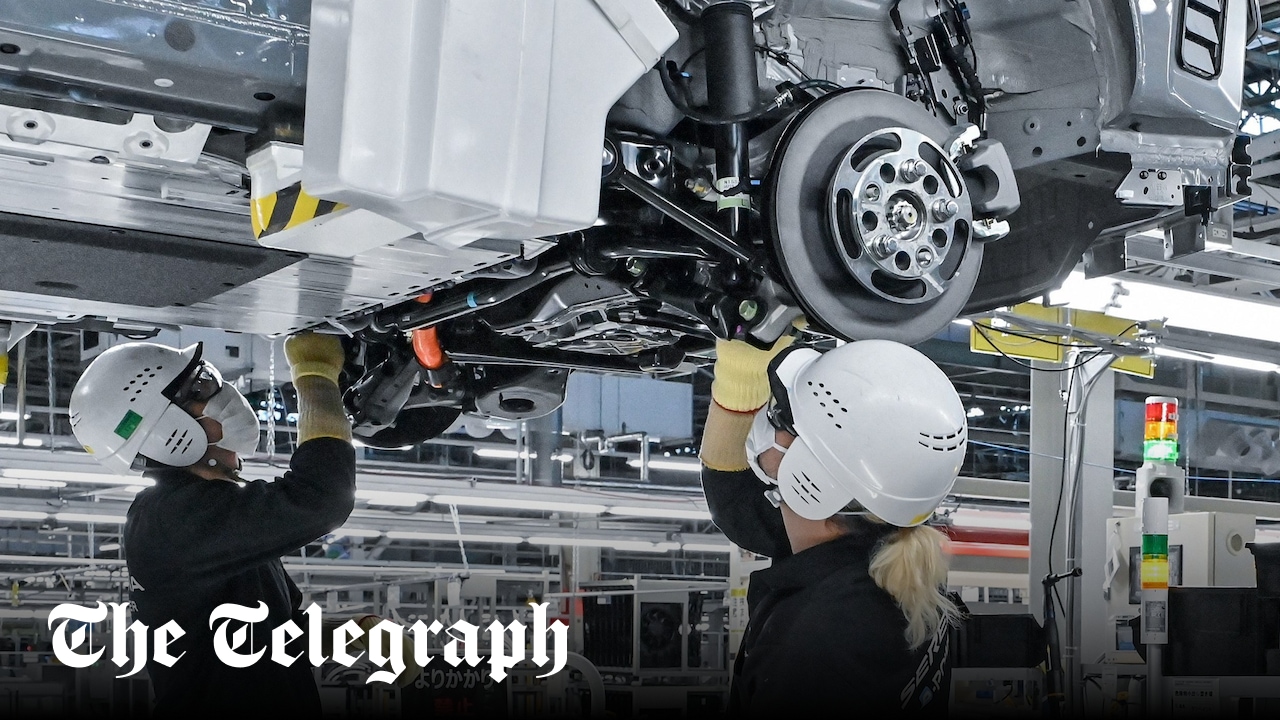

Major Restructuring Nissan To Eliminate 20 000 Positions Worldwide

May 13, 2025

Major Restructuring Nissan To Eliminate 20 000 Positions Worldwide

May 13, 2025 -

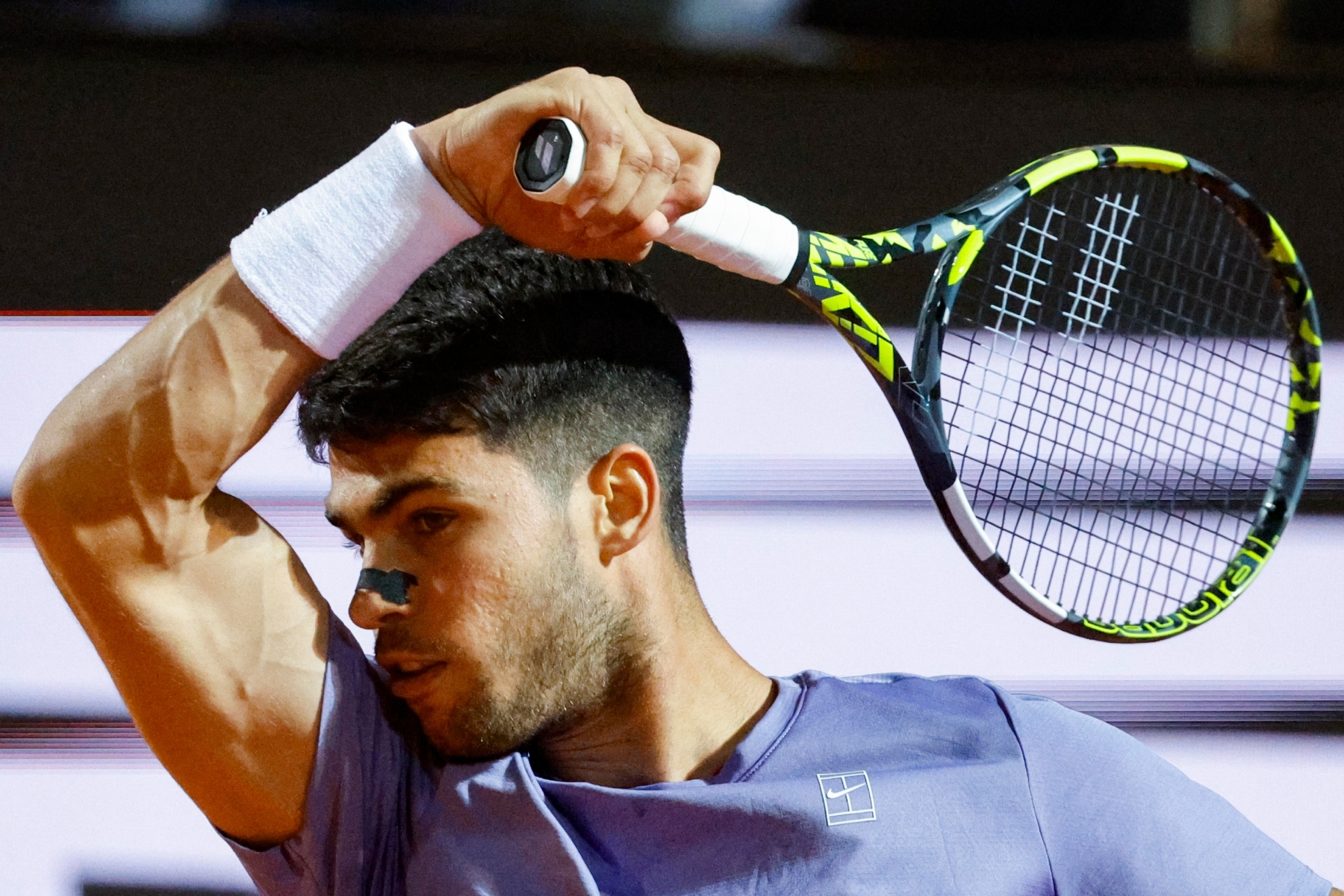

Alcaraz Vs Khachanov Sigue En Vivo Los Octavos De Final De Roma

May 13, 2025

Alcaraz Vs Khachanov Sigue En Vivo Los Octavos De Final De Roma

May 13, 2025