Wall Street's Woes Intensify: Aussie Dollar In Freefall

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street's Woes Intensify: Aussie Dollar in Freefall

Wall Street's recent turmoil has sent shockwaves across global markets, with the Australian dollar bearing the brunt of the fallout. The Aussie, already weakened by persistent inflation and rising interest rates, is experiencing a dramatic freefall, prompting concerns among investors and economists alike. This sharp decline reflects a deepening crisis of confidence in the global economy and highlights the interconnectedness of international finance.

The Perfect Storm: A Confluence of Factors

Several factors are contributing to this perfect storm impacting the Australian dollar. The ongoing conflict in Ukraine, persistent inflationary pressures, and the aggressive tightening of monetary policy by the US Federal Reserve are all playing significant roles. These events are creating uncertainty in the global market, driving investors towards safer haven assets like the US dollar, and pushing down the value of riskier currencies, including the Australian dollar.

Wall Street's Tumble: A Trigger for the Aussie's Fall

The recent slump on Wall Street has acted as a catalyst for the Aussie dollar's decline. Concerns about a potential US recession, coupled with disappointing corporate earnings reports, have fueled a sell-off in US equities. This negativity has spilled over into other markets, increasing risk aversion and further weakening the Australian dollar. The correlation between Wall Street performance and the Aussie dollar is particularly strong due to Australia's reliance on commodity exports and its close trading ties with the United States.

Interest Rate Hikes: Exacerbating the Problem

The Reserve Bank of Australia's (RBA) own efforts to combat inflation by raising interest rates are also contributing to the Aussie's weakness. While intended to curb inflation, these hikes increase borrowing costs, potentially slowing economic growth and making the Australian dollar less attractive to investors seeking higher returns. This creates a delicate balancing act for the RBA, forcing them to navigate the complex relationship between inflation control and economic stability.

What Does the Future Hold for the Aussie Dollar?

Predicting the future trajectory of the Australian dollar is challenging, given the volatile nature of global markets. However, several factors will likely play a key role in determining its future value:

- The trajectory of US interest rates: Further aggressive interest rate hikes by the Federal Reserve could continue to strengthen the US dollar and weaken the Aussie.

- Global economic growth: A slowdown in global economic growth would negatively impact demand for Australian commodities, further weakening the Aussie dollar.

- Commodity prices: Fluctuations in the prices of key Australian exports, such as iron ore and coal, will significantly impact the currency's value.

- RBA policy decisions: The RBA's future monetary policy decisions will play a crucial role in shaping the Aussie dollar's future.

Impact on Australian Businesses and Consumers:

The weakening Aussie dollar has significant implications for Australian businesses and consumers. Importers will face higher costs for imported goods, potentially leading to increased inflation. Exporters, on the other hand, may benefit from increased international competitiveness. However, the overall impact is complex and depends on various factors, including the specific industry and the nature of a business's international exposure.

Conclusion: Navigating Uncertainty

The current freefall of the Australian dollar is a stark reminder of the interconnectedness of global financial markets and the vulnerability of smaller economies to external shocks. Navigating this uncertainty requires careful monitoring of global economic developments, prudent risk management, and a watchful eye on the decisions made by central banks worldwide. The situation remains fluid, and further volatility is expected in the short term. Investors and businesses alike must remain vigilant and adapt their strategies accordingly to mitigate potential risks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street's Woes Intensify: Aussie Dollar In Freefall. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brinkers Defense Technology Promising Innovation In The 2025 Forecast

Apr 07, 2025

Brinkers Defense Technology Promising Innovation In The 2025 Forecast

Apr 07, 2025 -

Remembering Foxtel A Look Back At The Future Of Tv

Apr 07, 2025

Remembering Foxtel A Look Back At The Future Of Tv

Apr 07, 2025 -

Bulldogs Coaching Staff Overhaul A New Era Begins

Apr 07, 2025

Bulldogs Coaching Staff Overhaul A New Era Begins

Apr 07, 2025 -

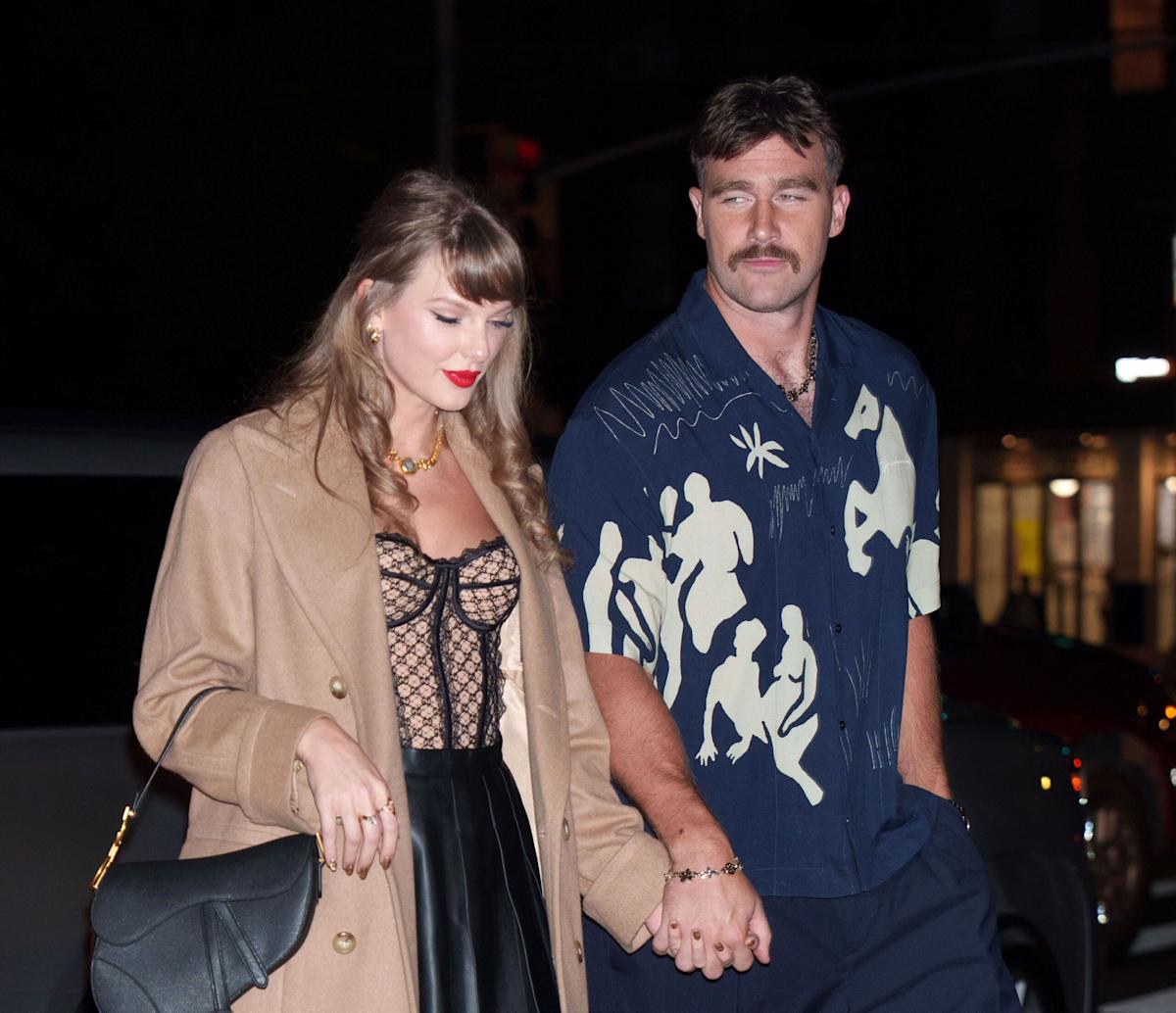

Are Taylor Swift And Travis Kelce Separated New Relationship Report Explained

Apr 07, 2025

Are Taylor Swift And Travis Kelce Separated New Relationship Report Explained

Apr 07, 2025 -

Snl Veteran Kenan Thompson Discusses His Desire For A Permanent Role

Apr 07, 2025

Snl Veteran Kenan Thompson Discusses His Desire For A Permanent Role

Apr 07, 2025