Warren Buffett Disposes Of Apple Shares: Reasons Behind The 13% Drop

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Berkshire Hathaway Sheds Apple Stock: A 13% Drop and What It Means

Oracle of Omaha's surprising move sent shockwaves through the financial world. Berkshire Hathaway, Warren Buffett's investment powerhouse, recently announced a significant reduction in its Apple holdings, shedding approximately 13% of its stake. This dramatic decrease—the largest since 2020—has sparked intense speculation and analysis across Wall Street and beyond. What prompted this unexpected shift in strategy from one of the world's most revered investors? Let's delve into the potential reasons behind this monumental decision.

The Scale of the Reduction:

The sheer size of the reduction is noteworthy. Berkshire Hathaway offloaded a substantial number of Apple shares, resulting in a decrease from over 915 million shares to approximately 788 million. This represents a considerable divestment, representing billions of dollars in value and leaving many wondering about the future of this once-unbreakable partnership.

Possible Explanations for the Apple Stock Sell-off:

Several factors could have contributed to Buffett's decision. While Berkshire Hathaway remains remarkably tight-lipped about its investment strategies, several theories are circulating:

-

Portfolio Diversification: Buffett has always stressed the importance of diversification. It's possible this move reflects a strategic realignment of Berkshire Hathaway's portfolio, aiming for a more balanced distribution of assets across various sectors. The tech sector, while lucrative, can be highly volatile, making diversification a prudent measure.

-

Valuation Concerns: Despite Apple's overall success, concerns about its valuation might have played a role. While Apple remains a dominant player, some analysts believe its stock might be overvalued in the current market climate. Buffett, known for his value investing approach, may have perceived a window of opportunity to lock in profits and reallocate capital to more undervalued assets.

-

Market Volatility: The broader economic uncertainty and market volatility in recent months could also have influenced the decision. Taking some profit off the table during periods of uncertainty is a common practice among savvy investors like Buffett.

-

Increased Focus on Other Investments: Berkshire Hathaway has been actively investing in other sectors recently, potentially indicating a shift in priorities. This move towards other opportunities might simply represent a reallocation of resources rather than a negative outlook on Apple specifically.

-

Tax Implications: While less likely to be the primary driver, strategic tax planning could have played a minor role in the timing and scale of the share reduction.

What This Means for Investors:

The impact of this sell-off is far-reaching, influencing not only Apple's stock price but also the broader market sentiment. While some investors may view this as a bearish signal for Apple, others see it as a strategic move by a seasoned investor and not necessarily a reflection of Apple's long-term prospects.

Conclusion:

The exact reasons behind Warren Buffett's decision to significantly reduce Berkshire Hathaway's Apple holdings remain shrouded in mystery. However, a combination of diversification strategies, valuation concerns, and market volatility likely played a significant role. This unexpected move underscores the ever-evolving nature of the investment landscape and serves as a reminder of the importance of adapting to changing market conditions. Only time will tell the ultimate impact of this major shift in the Oracle of Omaha's portfolio. The ongoing saga is certain to continue to be a subject of intense speculation and analysis in the weeks and months to come.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett Disposes Of Apple Shares: Reasons Behind The 13% Drop. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tv Premiere John Simm Stars In Gripping Thriller

Apr 25, 2025

Tv Premiere John Simm Stars In Gripping Thriller

Apr 25, 2025 -

Papa Francesco L Ultimo Saluto Di Migranti Transgender E Poveri A Santa Maria Maggiore

Apr 25, 2025

Papa Francesco L Ultimo Saluto Di Migranti Transgender E Poveri A Santa Maria Maggiore

Apr 25, 2025 -

The Tung Tung Tung Sahur Phenomenon Tik Toks Newest Viral Trend

Apr 25, 2025

The Tung Tung Tung Sahur Phenomenon Tik Toks Newest Viral Trend

Apr 25, 2025 -

Legal Arguments Presented In Sex Assault Case Against Ex World Junior Hockey Players

Apr 25, 2025

Legal Arguments Presented In Sex Assault Case Against Ex World Junior Hockey Players

Apr 25, 2025 -

Stream Xbox Games On Your Lg Tv Microsoft Xbox App Is Here

Apr 25, 2025

Stream Xbox Games On Your Lg Tv Microsoft Xbox App Is Here

Apr 25, 2025

Latest Posts

-

Martinellis High Stakes Arsenals Crucial Champions League Battle Against Psg

Apr 30, 2025

Martinellis High Stakes Arsenals Crucial Champions League Battle Against Psg

Apr 30, 2025 -

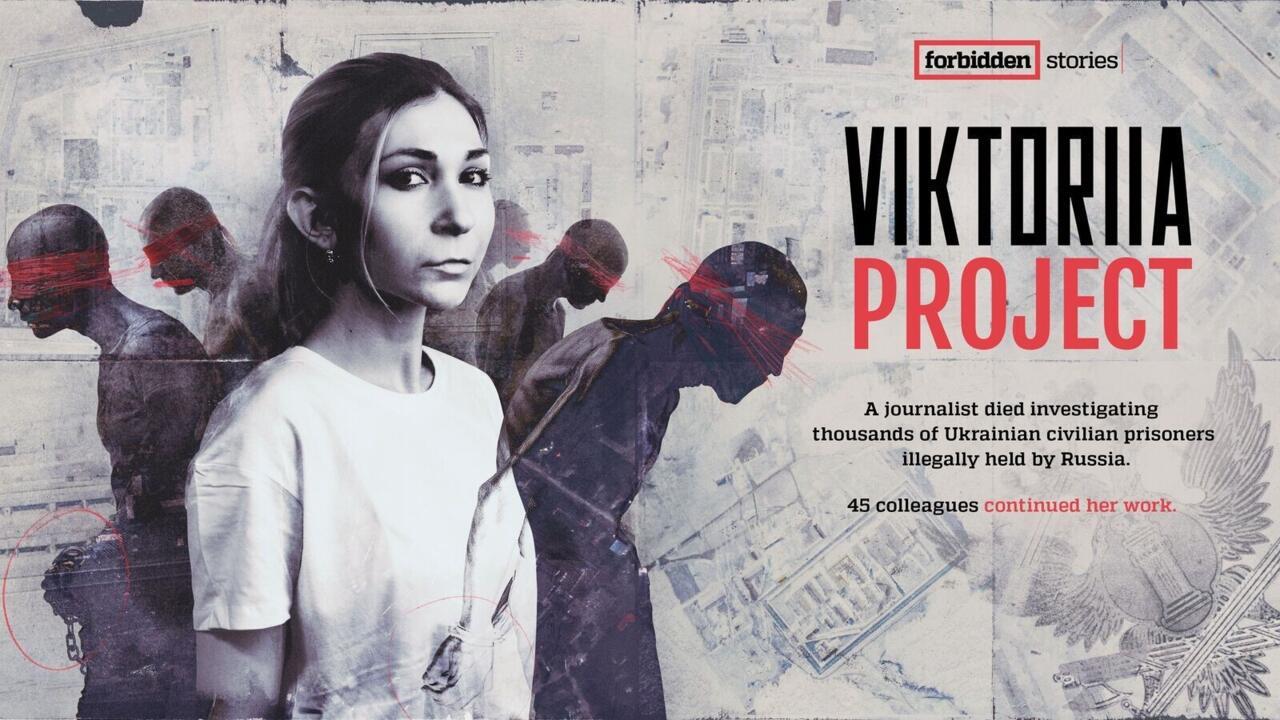

Forbidden Stories The Perilous Search For A Missing Journalist In Ukraine

Apr 30, 2025

Forbidden Stories The Perilous Search For A Missing Journalist In Ukraine

Apr 30, 2025 -

The Epic Games Store On Mobile A Retrospective And Future Outlook

Apr 30, 2025

The Epic Games Store On Mobile A Retrospective And Future Outlook

Apr 30, 2025 -

Are Ai Powered Web3 Projects Secure Exploring The Risks Of Key Access

Apr 30, 2025

Are Ai Powered Web3 Projects Secure Exploring The Risks Of Key Access

Apr 30, 2025 -

Cochise County Stronghold Fire 3 000 Acres Burned Investigation Begins

Apr 30, 2025

Cochise County Stronghold Fire 3 000 Acres Burned Investigation Begins

Apr 30, 2025