Warren Buffett Reduce Apple Stake: 13% Less And The Reasons Why

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Berkshire Hathaway Slashes Apple Stake by 13%: What Does it Mean?

Oracle of Omaha's surprising move sent shockwaves through the market. Berkshire Hathaway, Warren Buffett's investment behemoth, has reduced its Apple stake by a significant 13%, shedding millions of shares in the tech giant. This unexpected decision has sparked considerable speculation and raised questions about the future of this once-unbreakable partnership. The sale, revealed in recent SEC filings, saw Berkshire Hathaway offload approximately 3.9 million shares of Apple, significantly impacting its overall portfolio. But why the drastic change? Let's delve into the potential reasons behind this major shift in strategy.

The Mystery Behind the Massive Apple Sell-Off

While Berkshire Hathaway hasn't explicitly stated its reasoning, several factors could contribute to this significant reduction in its Apple holdings. Analyzing the economic landscape and Buffett's historical investment strategies provides some clues.

1. Profit-Taking and Portfolio Diversification: One leading theory suggests that Berkshire Hathaway might be taking profits on its massive Apple investment. The stock has enjoyed significant growth over the years, making it a lucrative asset. Realizing some of these gains allows for portfolio diversification, reducing risk by spreading investments across different sectors. This aligns with Buffett's long-held belief in diversified investing.

2. Market Volatility and Economic Uncertainty: The current global economic climate is marked by considerable uncertainty. Rising inflation, interest rate hikes, and geopolitical tensions create a volatile market environment. Reducing exposure to a single, albeit dominant, stock like Apple could be a precautionary measure to mitigate potential losses in a downturn. Buffett is known for his conservative approach during periods of economic instability.

3. Strategic Rebalancing and Shifting Investment Priorities: Berkshire Hathaway's investment strategy is not static. The company is constantly evaluating its portfolio and adjusting its holdings based on market conditions and emerging opportunities. The reduction in Apple shares might reflect a strategic rebalancing of the portfolio, freeing up capital for investments in other promising sectors. This could involve exploring opportunities in energy, infrastructure, or other areas viewed as having strong growth potential.

4. Apple's Recent Performance and Future Outlook: While Apple remains a highly profitable company, its recent performance might have influenced Buffett's decision. Factors such as supply chain disruptions, slowing iPhone sales growth, and increased competition could have prompted a reassessment of Apple's long-term prospects. Buffett's investment decisions are always driven by a thorough fundamental analysis of the underlying business.

What This Means for Investors

This development carries significant implications for both Apple and broader market sentiment. The sell-off, while substantial, doesn't necessarily signal a lack of faith in Apple's long-term potential. However, it does highlight the dynamic nature of even the most successful investment strategies. For investors, this serves as a reminder of the importance of diversification and regularly reviewing investment portfolios in light of changing market conditions. The move underlines the unpredictable nature of the stock market and the need for a robust investment strategy.

Key Takeaways:

- Berkshire Hathaway's significant reduction of its Apple stake signals a potential shift in investment strategy.

- Several factors, including profit-taking, market volatility, and strategic rebalancing, could explain this decision.

- The move underscores the importance of portfolio diversification and adapting to changing market conditions.

- While not necessarily a bearish sign for Apple, the development warrants close observation by investors.

This unexpected move by Warren Buffett raises important questions about future investment strategies and the ever-shifting landscape of the global market. Only time will tell the full impact of this significant divestment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett Reduce Apple Stake: 13% Less And The Reasons Why. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pyth Token Unlock 58 Release And Next Weeks Top Events

May 21, 2025

Pyth Token Unlock 58 Release And Next Weeks Top Events

May 21, 2025 -

Cricbuzz Dream11 And Times Internet A Winning Triangle In Online Gaming

May 21, 2025

Cricbuzz Dream11 And Times Internet A Winning Triangle In Online Gaming

May 21, 2025 -

Market Analysis Trump Stock Price Faces Resistance May 22nd Dinner A Key Factor

May 21, 2025

Market Analysis Trump Stock Price Faces Resistance May 22nd Dinner A Key Factor

May 21, 2025 -

Apple Stock Warren Buffetts Sale And The Implications Of A 13 Decrease

May 21, 2025

Apple Stock Warren Buffetts Sale And The Implications Of A 13 Decrease

May 21, 2025 -

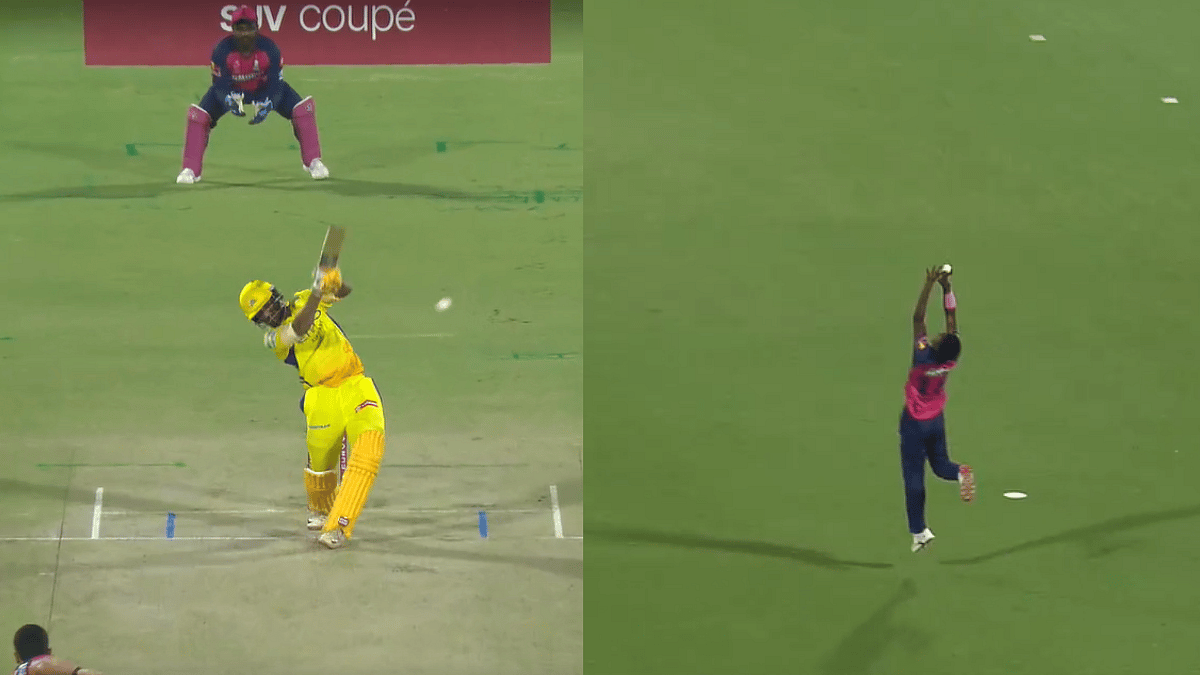

Ipl 2025 Kwena Maphakas Heroic Catch Urvil Patels Dismissal Shakes Csk Vs Rr

May 21, 2025

Ipl 2025 Kwena Maphakas Heroic Catch Urvil Patels Dismissal Shakes Csk Vs Rr

May 21, 2025