Warren Buffett Reduce Apple Stock Holdings: A 13% Decrease Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett Reduces Apple Stock Holdings: A 13% Decrease Explained

Oracle of Omaha's move sends shockwaves through the market. Warren Buffett's Berkshire Hathaway has significantly reduced its stake in Apple, shedding approximately 13% of its holdings in the first quarter of 2024. This unexpected move has sent ripples through the financial world, prompting analysts to dissect the reasons behind this strategic shift and its implications for both Apple and the broader market.

The news, revealed in Berkshire Hathaway's latest 13F filing, shows a decrease of over 39 million shares, leaving Berkshire with roughly 270 million Apple shares. This represents a significant reduction in what was once Berkshire's largest single investment, a position built over years and consistently lauded by Buffett himself. The question on everyone's mind is: why?

Potential Reasons Behind the Apple Stock Sale

While Buffett rarely publicly explains his investment decisions, several theories have emerged to explain this substantial reduction in Apple holdings:

-

Profit-Taking: With Apple stock reaching record highs in recent years, it's plausible that Berkshire Hathaway decided to lock in substantial profits. Taking some chips off the table after a significant run-up is a common strategy for savvy investors. This is especially pertinent given the current economic uncertainty.

-

Diversification Strategy: Buffett is known for his emphasis on diversification. Reducing the concentration in a single stock, even one as successful as Apple, allows Berkshire to spread its risk across a broader range of investments. This aligns with his long-term investment philosophy.

-

Market Conditions: The current economic climate, marked by high inflation and potential interest rate hikes, could have influenced Berkshire's decision. Reducing exposure to even a blue-chip stock like Apple could be seen as a prudent move in a period of uncertainty.

-

Strategic Re-allocation: The funds generated from selling Apple shares could be re-allocated to other investment opportunities that Berkshire views as more promising. This could involve investments in other sectors or companies perceived to have greater growth potential in the current market.

-

Shifting Market Sentiment: While Apple remains a dominant force, changes in consumer behavior, technological advancements, or intensifying competition could have influenced Berkshire's assessment of Apple's future growth trajectory.

Implications for Apple and the Broader Market

The impact of this decision is multifaceted:

-

Apple Stock Price: The announcement initially caused a slight dip in Apple's stock price, though the effect was relatively muted given Apple's overall market strength. However, continued selling pressure from other large investors could lead to further volatility.

-

Investor Confidence: While not a panic-inducing event, the move has raised questions about the long-term outlook for Apple among some investors. This uncertainty can impact investor confidence and trading activity.

-

Berkshire Hathaway's Investment Strategy: This move highlights Berkshire's ongoing commitment to dynamic portfolio management, adjusting its holdings based on evolving market conditions and investment opportunities.

Conclusion:

Warren Buffett's decision to reduce Berkshire Hathaway's Apple holdings is a significant development with far-reaching implications. While the exact reasons remain speculative, the move underlines the dynamic nature of even the most established investment strategies and underscores the ever-evolving landscape of the global financial markets. Further analysis will be required to fully understand the long-term consequences of this strategic shift by the legendary investor. The markets, and investors worldwide, will be watching closely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett Reduce Apple Stock Holdings: A 13% Decrease Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chelseas Decision Stalls Bournemouths Pursuit Of Kepa Arrizabalaga

May 01, 2025

Chelseas Decision Stalls Bournemouths Pursuit Of Kepa Arrizabalaga

May 01, 2025 -

From Barcelona Boy To Global Star Pedris Journey Inspired By Iniesta

May 01, 2025

From Barcelona Boy To Global Star Pedris Journey Inspired By Iniesta

May 01, 2025 -

Experience You Tube Tvs Enhanced App 9 Productivity Boosts

May 01, 2025

Experience You Tube Tvs Enhanced App 9 Productivity Boosts

May 01, 2025 -

Cartographic Conflicts How Competing Mars Maps Fueled Our Fascination

May 01, 2025

Cartographic Conflicts How Competing Mars Maps Fueled Our Fascination

May 01, 2025 -

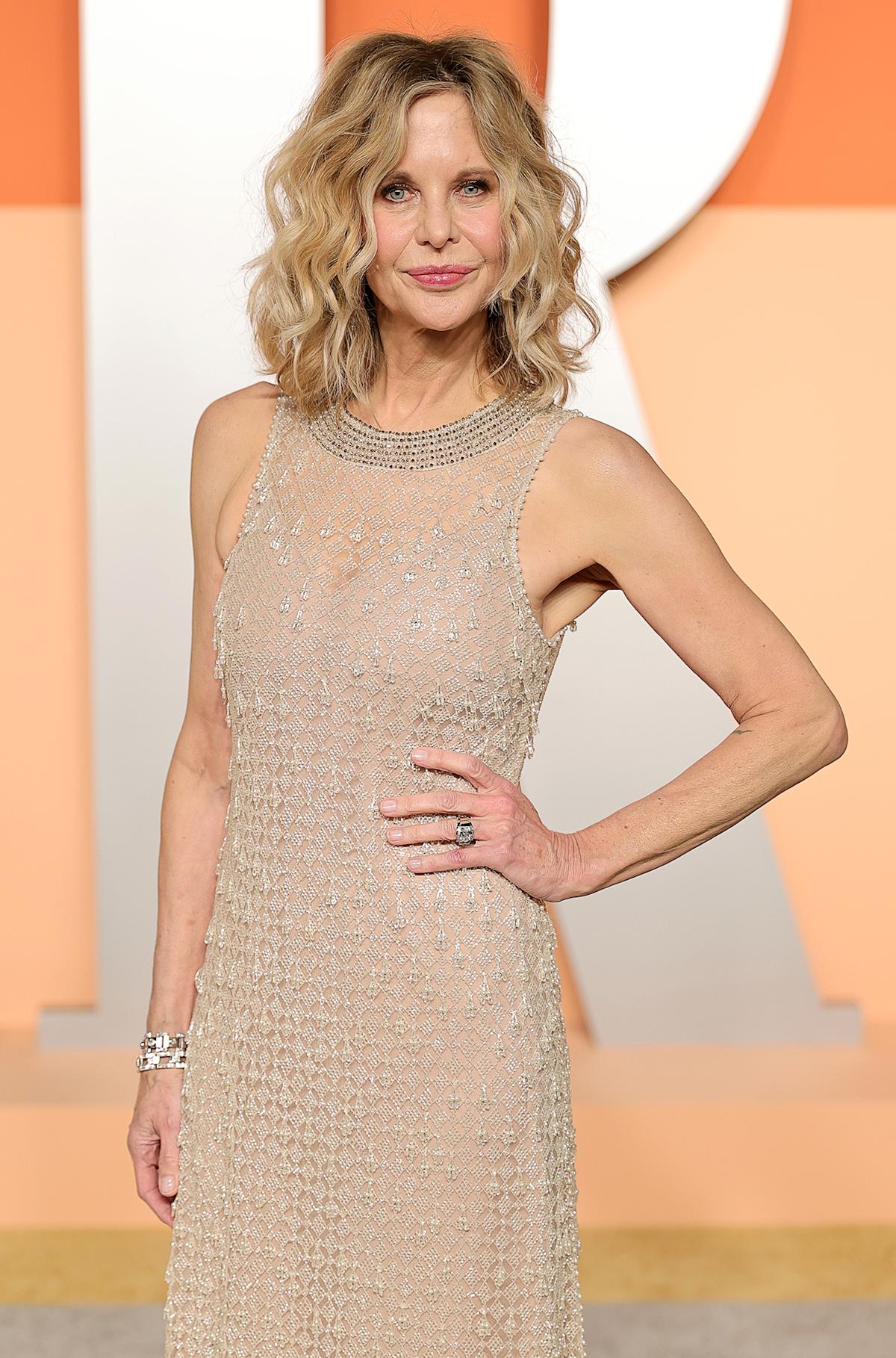

Montecito Estate Meg Ryan Lists Renovated Home For 19 5 Million

May 01, 2025

Montecito Estate Meg Ryan Lists Renovated Home For 19 5 Million

May 01, 2025