Warren Buffett Vs. Crypto: Analyzing A Contrarian Investing Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett vs. Crypto: Analyzing a Contrarian Investing Strategy

The legendary investor Warren Buffett's consistent skepticism towards cryptocurrency has become a recurring theme in the financial world. While Bitcoin and other digital assets continue to garner attention, Buffett's steadfast aversion presents a compelling case study in contrarian investing. This article delves into the reasons behind Buffett's stance, explores the potential implications for cryptocurrency investors, and analyzes the merits of a contrarian approach in such a volatile market.

Buffett's Rationale: A Value Investor's Perspective

Buffett, renowned for his value investing philosophy, emphasizes tangible assets and predictable cash flows. Cryptocurrencies, inherently volatile and lacking intrinsic value in his view, fail to meet these criteria. He's famously compared Bitcoin to "rat poison squared," highlighting his concerns about its speculative nature and potential for manipulation. His preference for established businesses with strong fundamentals underscores his distrust of crypto's decentralized and often opaque structure. This aversion isn't simply about technological misunderstanding; it's a fundamental disagreement on investment principles.

The Contrarian Argument: Riding the Volatility Wave

While Buffett's perspective is rooted in decades of successful traditional investing, many see his cryptocurrency skepticism as a contrarian indicator. The very fact that such a respected figure remains unconvinced could be interpreted as a bullish signal for some investors. This perspective suggests that the market might be undervaluing crypto's long-term potential, leading to significant upside if adoption accelerates as predicted. This contrarian approach involves betting against the established wisdom, a strategy that can yield substantial profits – but also entails considerable risk.

Understanding the Risks: Navigating the Crypto Landscape

The cryptocurrency market is notoriously volatile. Sharp price swings, regulatory uncertainty, and security risks are inherent challenges. While the potential for significant returns is undeniable, investors must carefully assess their risk tolerance before allocating funds to crypto assets. Diversification is crucial, avoiding over-exposure to a single cryptocurrency. Thorough research and due diligence are paramount in mitigating potential losses.

H2: Beyond Bitcoin: The Broader Crypto Ecosystem

The cryptocurrency ecosystem extends far beyond Bitcoin. The emergence of decentralized finance (DeFi), non-fungible tokens (NFTs), and the metaverse presents new investment opportunities and challenges. Buffett's critique might not apply equally to all aspects of this evolving landscape. Some believe that certain blockchain technologies and their applications hold significant long-term value, regardless of Buffett's stance on Bitcoin.

H3: The Importance of Independent Analysis

Ultimately, the decision to invest in cryptocurrency should be based on individual research and risk assessment, not solely on the opinions of even the most successful investors. While Buffett's perspective provides valuable context, investors should form their own conclusions based on a thorough understanding of the technology, market dynamics, and their personal financial goals. Consider consulting with a qualified financial advisor before making any investment decisions.

Conclusion: A Dynamic and Uncertain Future

The ongoing debate between Warren Buffett and the cryptocurrency market highlights the fundamental differences in investment philosophies and risk tolerance. While Buffett's approach remains grounded in traditional value investing, the potential of cryptocurrencies cannot be ignored. For investors, carefully weighing the risks and rewards, conducting thorough research, and diversifying their portfolios are critical elements of a sound investment strategy in this ever-evolving financial landscape. The future of cryptocurrency remains uncertain, but its impact on the global financial system is undeniable.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett Vs. Crypto: Analyzing A Contrarian Investing Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Crystal Palace Vs Man City Live Coverage Of The 2025 Fa Cup Final

May 18, 2025

Crystal Palace Vs Man City Live Coverage Of The 2025 Fa Cup Final

May 18, 2025 -

Humanoid Robots And Ai Musks Next Big Future Predictions For Xai And Data Centers

May 18, 2025

Humanoid Robots And Ai Musks Next Big Future Predictions For Xai And Data Centers

May 18, 2025 -

Estado De Emergencia Gerdau Pausa Operacoes No Rs Apos Fortes Precipitacoes

May 18, 2025

Estado De Emergencia Gerdau Pausa Operacoes No Rs Apos Fortes Precipitacoes

May 18, 2025 -

Dfb Pokal Kann Glasner Einen Coup Landen

May 18, 2025

Dfb Pokal Kann Glasner Einen Coup Landen

May 18, 2025 -

Hendersons Fa Cup Final Tackle A Case For Var Reform

May 18, 2025

Hendersons Fa Cup Final Tackle A Case For Var Reform

May 18, 2025

Latest Posts

-

Palmeiras Paulinho Em Repouso Vitor Roque Ausente Devido A Compromissos Pessoais

May 19, 2025

Palmeiras Paulinho Em Repouso Vitor Roque Ausente Devido A Compromissos Pessoais

May 19, 2025 -

Proactive Security Ines Continuous Cve Practice Against Emerging Threats

May 19, 2025

Proactive Security Ines Continuous Cve Practice Against Emerging Threats

May 19, 2025 -

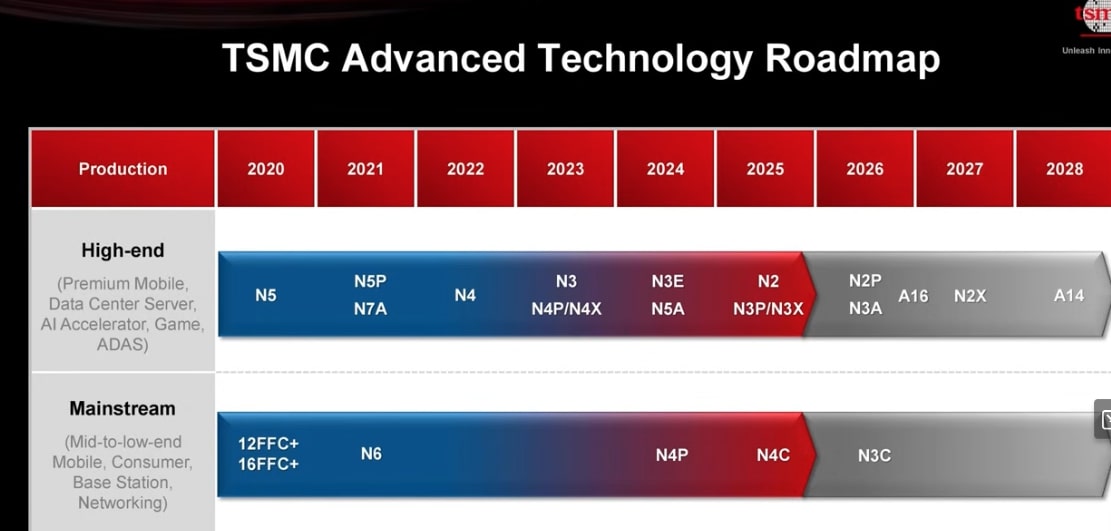

Tsmc 2028 Technology Roadmap Insights From The 2025 Technical Symposium On 1 4nm

May 19, 2025

Tsmc 2028 Technology Roadmap Insights From The 2025 Technical Symposium On 1 4nm

May 19, 2025 -

Aaron Gordon Plays Through Hamstring Injury In Nuggets Crucial Game 7

May 19, 2025

Aaron Gordon Plays Through Hamstring Injury In Nuggets Crucial Game 7

May 19, 2025 -

Upcoming Nothing Phone 3 Leak Points To Significant Hardware Improvements

May 19, 2025

Upcoming Nothing Phone 3 Leak Points To Significant Hardware Improvements

May 19, 2025