Warren Buffett Vs. Crypto: Analyzing Investment Strategies And Risk

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett vs. Crypto: Analyzing Investment Strategies and Risk

The clash of titans continues! On one side, we have Warren Buffett, the Oracle of Omaha, a staunch advocate of value investing and a long-time skeptic of cryptocurrencies. On the other, the volatile yet alluring world of crypto, attracting millions with its promise of decentralized finance and astronomical returns. This article dives deep into the contrasting investment philosophies of Buffett and the crypto market, analyzing their respective risk profiles and potential rewards.

Warren Buffett's Value Investing Approach:

Buffett's investment strategy is built on the bedrock of value investing. He focuses on identifying undervalued companies with strong fundamentals, consistent earnings, and a long-term growth trajectory. This approach prioritizes:

- Fundamental Analysis: Thorough research into a company's financials, management, and competitive landscape.

- Long-Term Perspective: Holding investments for years, even decades, allowing time for compounding returns.

- Risk Aversion: Minimizing risk through careful due diligence and avoiding speculative investments.

- Intrinsic Value: Buying assets below their intrinsic value, ensuring a margin of safety.

Buffett's aversion to crypto stems from its perceived lack of intrinsic value, its volatility, and its speculative nature. He's famously compared Bitcoin to "rat poison squared," highlighting his concerns about its unregulated nature and potential for manipulation.

The Allure and Risks of Crypto Investment:

The cryptocurrency market, in stark contrast to Buffett's approach, is characterized by:

- High Volatility: Dramatic price swings are commonplace, creating both immense profit opportunities and significant loss potential.

- Decentralization: Cryptocurrencies operate outside traditional financial systems, offering potential benefits but also posing regulatory challenges.

- Technological Innovation: The underlying blockchain technology is constantly evolving, presenting both opportunities and risks.

- Speculative Nature: Much of the cryptocurrency market is driven by speculation and hype, making it susceptible to market bubbles and crashes.

Comparing Investment Strategies:

| Feature | Warren Buffett's Value Investing | Cryptocurrency Investment |

|---|---|---|

| Risk Profile | Low to moderate | High |

| Return Potential | Steady, long-term growth | Potentially very high, but volatile |

| Investment Horizon | Long-term (years, decades) | Short-term to long-term |

| Regulation | Heavily regulated | Largely unregulated |

| Transparency | High | Varies significantly |

Which Strategy is Right for You?

The choice between Buffett's value investing approach and cryptocurrency investment depends entirely on your individual risk tolerance, investment goals, and understanding of the market.

- Risk-averse investors with a long-term horizon are better suited to Buffett's value investing strategy.

- Investors with a higher risk tolerance and a shorter time horizon might consider allocating a small portion of their portfolio to cryptocurrencies, but only after thorough research and understanding of the inherent risks.

Diversification is Key: Regardless of your chosen strategy, diversification is crucial. Don't put all your eggs in one basket, whether it's a single stock or a single cryptocurrency.

Conclusion:

The debate between Warren Buffett and the cryptocurrency market highlights the fundamental differences in investment philosophies and risk tolerance. Understanding these differences is crucial for making informed investment decisions. While cryptocurrencies offer the potential for significant returns, the high volatility and inherent risks should not be underestimated. A balanced approach, incorporating thorough research and diversification, is vital for navigating the complexities of the modern financial landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett Vs. Crypto: Analyzing Investment Strategies And Risk. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

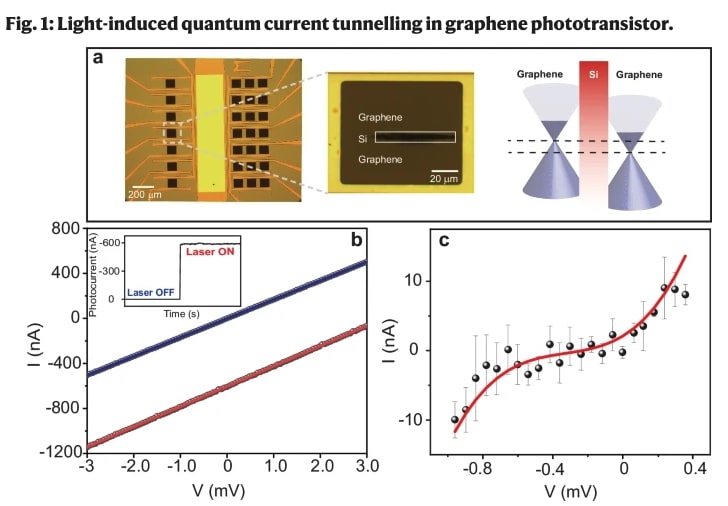

Revolutionary Advance Petahertz Speed Phototransistor Works At Room Temperature

May 24, 2025

Revolutionary Advance Petahertz Speed Phototransistor Works At Room Temperature

May 24, 2025 -

Radley On The Cusp Of A Milestone Watch The Coachs Inspiring Message

May 24, 2025

Radley On The Cusp Of A Milestone Watch The Coachs Inspiring Message

May 24, 2025 -

Hayley Atwell Discusses Wildlife Encounters That Delayed Mission Impossible Dead Reckoning Filming

May 24, 2025

Hayley Atwell Discusses Wildlife Encounters That Delayed Mission Impossible Dead Reckoning Filming

May 24, 2025 -

Shai Gilgeous Alexanders Father Calls Mvp Award 100 Surreal

May 24, 2025

Shai Gilgeous Alexanders Father Calls Mvp Award 100 Surreal

May 24, 2025 -

Hands On With The Dyson Pencil Vac Is It The Ultimate Lightweight Vacuum

May 24, 2025

Hands On With The Dyson Pencil Vac Is It The Ultimate Lightweight Vacuum

May 24, 2025