Warren Buffett's Apple Investment: 13% Reduction And Strategic Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Apple Investment: 13% Reduction and Strategic Implications

Oracle of Omaha shifts strategy: What does Berkshire Hathaway's reduced Apple stake mean for the tech giant and the wider market?

Warren Buffett's Berkshire Hathaway has sent ripples through the financial world with its recent announcement: a 13% reduction in its Apple holdings. This significant move, shedding approximately 3.9 million shares, marks a departure from the company's long-held, substantial investment in the tech giant and has sparked considerable speculation about its strategic implications. The sale, reported in the company's latest 13F filing, has investors questioning Buffett's long-term vision for Apple and the overall market sentiment.

A Decade of Devotion, Then a Downturn?

Berkshire Hathaway's investment in Apple has been a monumental success story, transforming into one of the company's most profitable ventures. For years, Buffett championed Apple's robust business model, praising its brand loyalty and consistent revenue streams. This massive stake, built over nearly a decade, became a cornerstone of Berkshire's investment portfolio. However, this recent reduction signals a potential shift in the Oracle of Omaha's perspective.

Reasons Behind the Reduction: Speculation and Analysis

While Berkshire Hathaway hasn't explicitly stated the reasons behind the reduction, several theories are circulating among analysts and financial experts:

-

Portfolio Diversification: One prominent theory suggests that Buffett is simply diversifying Berkshire's portfolio, reducing its concentration in a single stock, however dominant. This aligns with his long-standing philosophy of prudent risk management.

-

Market Volatility: The current macroeconomic climate, characterized by persistent inflation and rising interest rates, might have influenced the decision. A strategic reduction could be viewed as a precautionary measure against potential market downturns.

-

Profit-Taking: With Apple's stock price having enjoyed significant growth over the years, some analysts suggest that Berkshire might be taking profits, securing gains from a remarkably successful investment.

-

Shifting Investment Priorities: It's also possible that Berkshire is redirecting capital towards other sectors deemed more promising for future growth. This could reflect evolving investment strategies within Berkshire Hathaway.

Impact on Apple and the Broader Market

The impact of this reduction is multi-faceted:

-

Apple's Stock Price: While initially causing a minor dip, the impact on Apple's stock price has been relatively muted, suggesting confidence in the company's long-term prospects remains high.

-

Investor Sentiment: The move has, however, sparked debate and uncertainty among investors, highlighting the influence of Buffett's decisions on market sentiment.

-

Future of Berkshire Hathaway's Apple Investment: The question remains: is this a one-time reduction, or the beginning of a larger divestment? The market will be closely watching Berkshire's future moves regarding its Apple holdings.

Conclusion: Navigating Uncertainty

While the precise reasons behind Berkshire Hathaway's decision remain somewhat shrouded in mystery, the 13% reduction in its Apple holdings is a significant event with far-reaching implications. It underscores the dynamic nature of the investment world and the importance of diversification and adaptability, even for legendary investors like Warren Buffett. The market will undoubtedly continue scrutinizing Berkshire Hathaway's moves for clues to future investment strategies and overall market trends. The coming months will be crucial in determining the full impact of this strategic shift.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Apple Investment: 13% Reduction And Strategic Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Heavy Rain Triggers Emergency Evacuation Orders Stay Safe

May 20, 2025

Heavy Rain Triggers Emergency Evacuation Orders Stay Safe

May 20, 2025 -

Heavy Rain Evacuation Orders Issued For Flood Prone Areas

May 20, 2025

Heavy Rain Evacuation Orders Issued For Flood Prone Areas

May 20, 2025 -

Spanish Galleon Steals The Show At Dartmouths Peak Weekend

May 20, 2025

Spanish Galleon Steals The Show At Dartmouths Peak Weekend

May 20, 2025 -

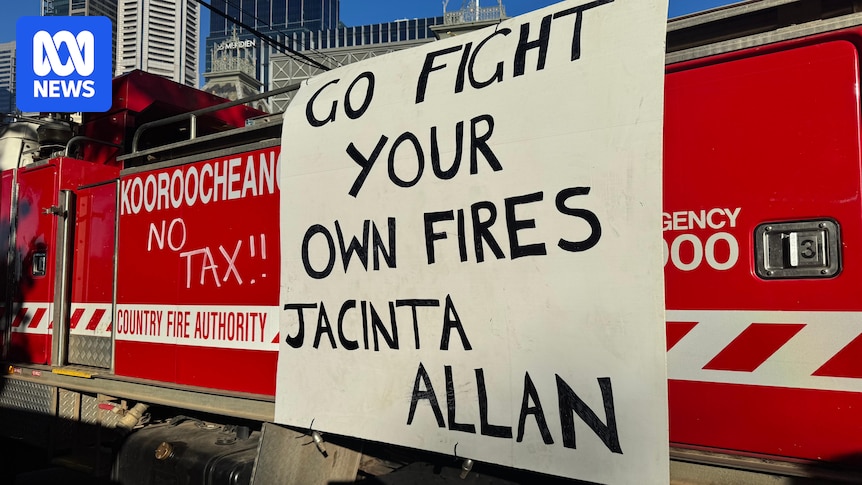

Budget Day Protest Victorian Firefighters And Farmers Fight Emergency Levy

May 20, 2025

Budget Day Protest Victorian Firefighters And Farmers Fight Emergency Levy

May 20, 2025 -

Nyt Strands Puzzle 442 Hints And Complete Solutions May 19

May 20, 2025

Nyt Strands Puzzle 442 Hints And Complete Solutions May 19

May 20, 2025