Warren Buffett's Apple Investment Cut: 13% Less And Why He Did It

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Apple Investment Cut: A 13% Reduction and the Why Behind It

Oracle of Omaha's surprising move sends shockwaves through Wall Street. Warren Buffett's Berkshire Hathaway has reduced its stake in Apple Inc. by approximately 13%, a significant move that has left investors and analysts scrambling for answers. This decision, announced [Insert Date of Announcement Here], marks a departure from Buffett's long-held bullish stance on the tech giant and raises questions about his future investment strategy. The news immediately impacted Apple's stock price, highlighting the immense influence Buffett wields in the financial world.

What happened?

Berkshire Hathaway's latest 13F filing revealed a reduction of [Insert exact number] Apple shares, representing a 13% decrease from its previous holdings. This translates to a significant reduction in value, estimated at [Insert Dollar Amount]. While still a major shareholder, the move signals a potential shift in Buffett's investment philosophy regarding Apple, a company he has famously championed for years.

Why the change?

The reasons behind this substantial reduction remain somewhat shrouded in mystery, but several key factors are likely at play:

-

Profit-Taking: One widely speculated reason is simple profit-taking. Apple's stock price has experienced considerable growth over the years, allowing Berkshire Hathaway to realize substantial gains. Reducing their position allows them to secure profits and reinvest in other potentially lucrative opportunities.

-

Market Diversification: Buffett is known for his emphasis on diversification. This reduction could be part of a broader strategy to redistribute assets across various sectors and mitigate risk. Reducing reliance on a single stock, even a blue-chip giant like Apple, is a prudent approach for a portfolio of Berkshire Hathaway's size.

-

Economic Uncertainty: The current global economic climate, characterized by inflation and potential recessionary pressures, may have influenced Buffett's decision. Reducing exposure to a company heavily reliant on consumer spending might be a precautionary measure in anticipation of economic downturn.

-

Shifting Market Dynamics: The technological landscape is constantly evolving. The emergence of new competitors and disruptive technologies could have prompted Buffett to reassess his long-term outlook for Apple's market dominance.

What does this mean for investors?

The implications of Buffett's move are far-reaching. While it doesn't necessarily signal a bearish outlook on Apple's long-term prospects, it does underscore the inherent uncertainty within the stock market. The reduction raises questions about the sustainability of Apple's growth trajectory and the potential impact of economic headwinds on the tech sector.

For investors, it serves as a reminder to conduct thorough due diligence and diversify their portfolios. Following the lead of legendary investors like Buffett can provide valuable insights, but it's crucial to remember that market conditions and investment strategies are constantly changing.

Looking Ahead:

The market will be closely watching Berkshire Hathaway's future moves to understand the underlying rationale behind this significant Apple investment cut. Further announcements from Buffett and his team are eagerly anticipated. This development serves as a powerful reminder of the dynamic nature of the investment world and the importance of staying informed about market trends and the strategies of influential investors. The Oracle of Omaha's decision will undoubtedly continue to fuel discussion and analysis within the financial community for weeks to come.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Apple Investment Cut: 13% Less And Why He Did It. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Reanalyzing Iras And Akari Data Potential Confirmation Of Planet Nine

May 06, 2025

Reanalyzing Iras And Akari Data Potential Confirmation Of Planet Nine

May 06, 2025 -

Enhanced Gaming Finance Web3 Stablecoin Debuts Exclusively On Sui

May 06, 2025

Enhanced Gaming Finance Web3 Stablecoin Debuts Exclusively On Sui

May 06, 2025 -

Uncontrolled Descent Russian Spacecrafts Fate Sealed In Earth Impact

May 06, 2025

Uncontrolled Descent Russian Spacecrafts Fate Sealed In Earth Impact

May 06, 2025 -

How 10 Lego Cars Raced The Miami F1 Track A Detailed Look

May 06, 2025

How 10 Lego Cars Raced The Miami F1 Track A Detailed Look

May 06, 2025 -

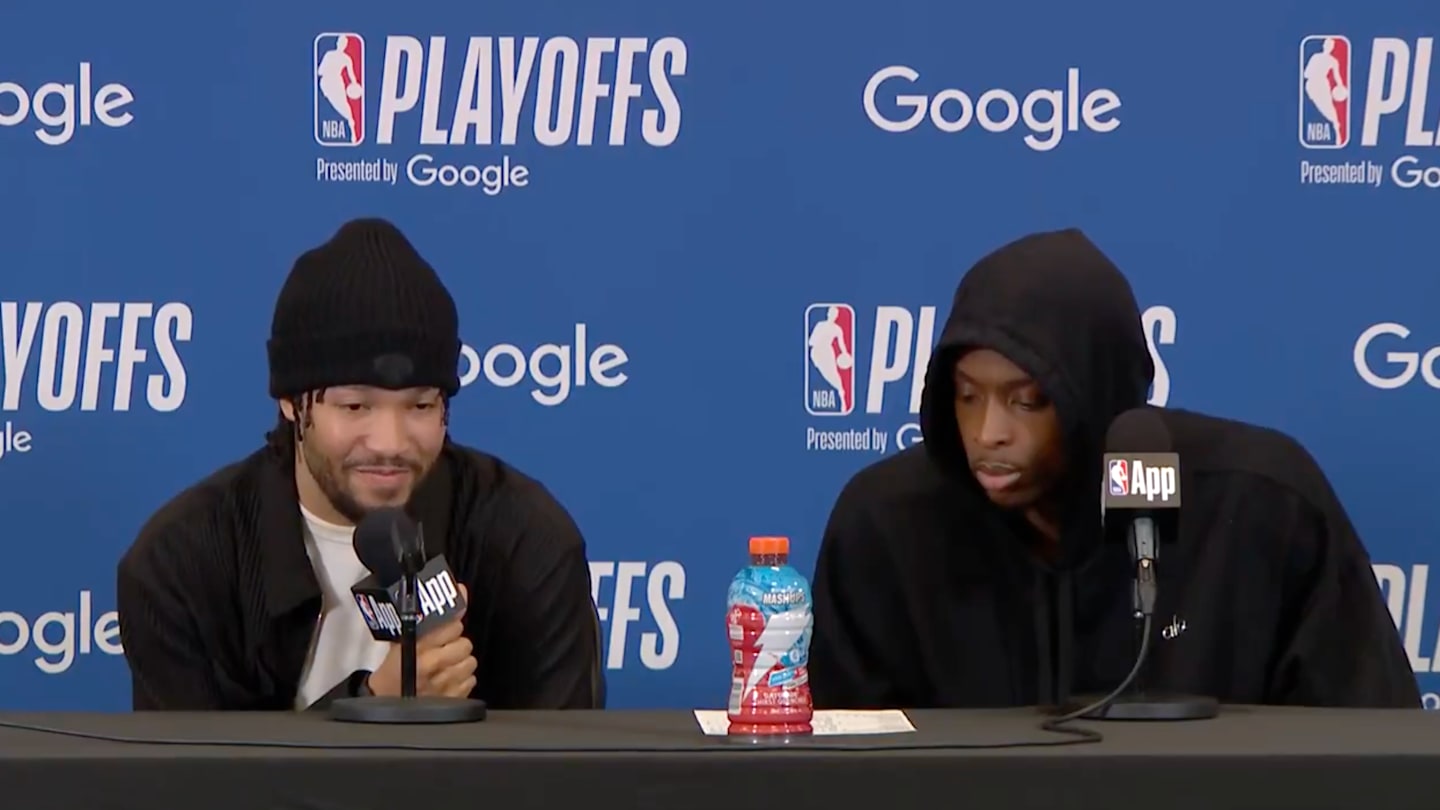

Jalen Brunson On Josh Hart The Key To The Knicks Stunning 20 Point Win

May 06, 2025

Jalen Brunson On Josh Hart The Key To The Knicks Stunning 20 Point Win

May 06, 2025

Latest Posts

-

Nba Can The Oklahoma City Thunder Maintain Momentum After Extended Layoff

May 06, 2025

Nba Can The Oklahoma City Thunder Maintain Momentum After Extended Layoff

May 06, 2025 -

23 Thoughtful Mothers Day Gifts Under 50 Jewelry Lego And Unique Finds

May 06, 2025

23 Thoughtful Mothers Day Gifts Under 50 Jewelry Lego And Unique Finds

May 06, 2025 -

Extended Visas To Fuel Tourism And Economic Boom In Asias Favorite Country

May 06, 2025

Extended Visas To Fuel Tourism And Economic Boom In Asias Favorite Country

May 06, 2025 -

Sister Wives Janelle Brown Details Garrisons Suicide

May 06, 2025

Sister Wives Janelle Brown Details Garrisons Suicide

May 06, 2025 -

He Runs At 250 Degrees Westbrooks Scorching Game 7 Fuels Ultimate Revenge

May 06, 2025

He Runs At 250 Degrees Westbrooks Scorching Game 7 Fuels Ultimate Revenge

May 06, 2025