Warren Buffett's Investing Principles And Their Application To Cryptocurrency

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Investing Principles and Their Application to Cryptocurrency: A Contrarian View

Warren Buffett, the Oracle of Omaha, is renowned for his value investing approach, built on decades of success. However, his consistent skepticism towards cryptocurrency presents a fascinating case study in applying traditional investing wisdom to a disruptive, decentralized asset class. This article explores Buffett's core principles and analyzes their relevance – or lack thereof – in the volatile world of crypto.

Buffett's Core Investing Tenets:

Buffett's philosophy centers around several key principles:

- Value Investing: Identifying undervalued assets with strong fundamentals and long-term growth potential. He looks for companies with durable competitive advantages (moats) and predictable earnings.

- Long-Term Perspective: Holding investments for the long haul, weathering market fluctuations, and focusing on intrinsic value rather than short-term price movements.

- Understanding the Business: Thorough due diligence is paramount. Buffett emphasizes understanding the underlying business model, management team, and industry landscape before investing.

- Risk Aversion: Avoiding excessive risk and prioritizing capital preservation. He famously advocates for investing in what you understand and avoiding speculative ventures.

- Intrinsic Value Focus: Determining the true worth of an asset independent of its market price. This involves analyzing financial statements, industry trends, and competitive dynamics.

Applying Buffett's Principles to Cryptocurrency:

The application of these principles to cryptocurrency presents significant challenges:

- Lack of Intrinsic Value (Arguably): Unlike established businesses with tangible assets and predictable cash flows, cryptocurrencies like Bitcoin lack inherent value. Their worth is largely determined by supply and demand, making valuation inherently complex and subjective. This directly contradicts Buffett's focus on intrinsic value.

- Volatility and Speculation: The extreme volatility of the cryptocurrency market clashes with Buffett's emphasis on long-term investing and risk aversion. The rapid price swings make it difficult to apply traditional valuation methods and increase the risk of significant losses.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains unclear in many jurisdictions. This uncertainty introduces significant risks that Buffett's risk-averse approach would likely caution against.

- Lack of Transparency: The lack of transparency in some aspects of the cryptocurrency market, particularly regarding mining operations and ownership, conflicts with Buffett's emphasis on understanding the underlying business.

- Technological Understanding: The complexity of blockchain technology and decentralized finance (DeFi) requires a high level of technical expertise, which may not align with Buffett's preference for understanding the fundamentals of a business through traditional financial analysis.

The Contrarian View: Potential Applications of Buffett's Principles

While Buffett's traditional approach may seem ill-suited for crypto, some argue that elements of his philosophy could be adapted:

- Long-Term Holding (with caution): A long-term perspective could be applied to crypto, but only after a thorough understanding of the technology and risks involved. This approach necessitates a significant risk tolerance, unlike Buffett's generally conservative strategy.

- Value Investing in Crypto Infrastructure: Instead of directly investing in volatile cryptocurrencies, one could focus on businesses that provide infrastructure or services related to the crypto ecosystem. This might align more closely with Buffett's preference for established businesses with tangible assets.

Conclusion:

While Warren Buffett's traditional investing principles have yielded remarkable success in the traditional market, their direct application to the cryptocurrency market is problematic. The inherent volatility, lack of intrinsic value, and regulatory uncertainty present significant challenges. However, aspects of his long-term perspective and focus on understanding the underlying technology can be adapted with a significantly higher risk tolerance than Buffett himself demonstrates. Ultimately, investing in crypto requires a different mindset than the one that has defined Buffett's career. It’s a high-risk, high-reward endeavor, a stark contrast to Buffett's famously cautious approach.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Investing Principles And Their Application To Cryptocurrency. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Waspada Cuaca Berawan Di Jakarta Tips Dan Informasi Penting

May 18, 2025

Waspada Cuaca Berawan Di Jakarta Tips Dan Informasi Penting

May 18, 2025 -

Xabi Alonsos Mainz 05 Defies Var Drama To Reach Europe Rb Leipzigs Crisis Deepens

May 18, 2025

Xabi Alonsos Mainz 05 Defies Var Drama To Reach Europe Rb Leipzigs Crisis Deepens

May 18, 2025 -

Hong Kong And Singapore Face Covid 19 Resurgence Watch The Video

May 18, 2025

Hong Kong And Singapore Face Covid 19 Resurgence Watch The Video

May 18, 2025 -

Logicubes Falcon Neo 2 Project Vic Validation And Vics Data Compliance

May 18, 2025

Logicubes Falcon Neo 2 Project Vic Validation And Vics Data Compliance

May 18, 2025 -

China Lowers Tariffs By 11 2 Us Raises By 9 2 Analyzing The Latest Trade Deal

May 18, 2025

China Lowers Tariffs By 11 2 Us Raises By 9 2 Analyzing The Latest Trade Deal

May 18, 2025

Latest Posts

-

Key Dodgers Players A Closer Look At Kershaw Edman Hernandez And Ohtani

May 19, 2025

Key Dodgers Players A Closer Look At Kershaw Edman Hernandez And Ohtani

May 19, 2025 -

Celtics Playoff Hopes Hinge On Adaptation Weiss On Bostons New Nba Challenges

May 19, 2025

Celtics Playoff Hopes Hinge On Adaptation Weiss On Bostons New Nba Challenges

May 19, 2025 -

Inter Milan Vs Lazio Head To Head Key Stats And Match Prediction

May 19, 2025

Inter Milan Vs Lazio Head To Head Key Stats And Match Prediction

May 19, 2025 -

Victorias Budget Free Public Transport For Under 18s Debt On The Rise

May 19, 2025

Victorias Budget Free Public Transport For Under 18s Debt On The Rise

May 19, 2025 -

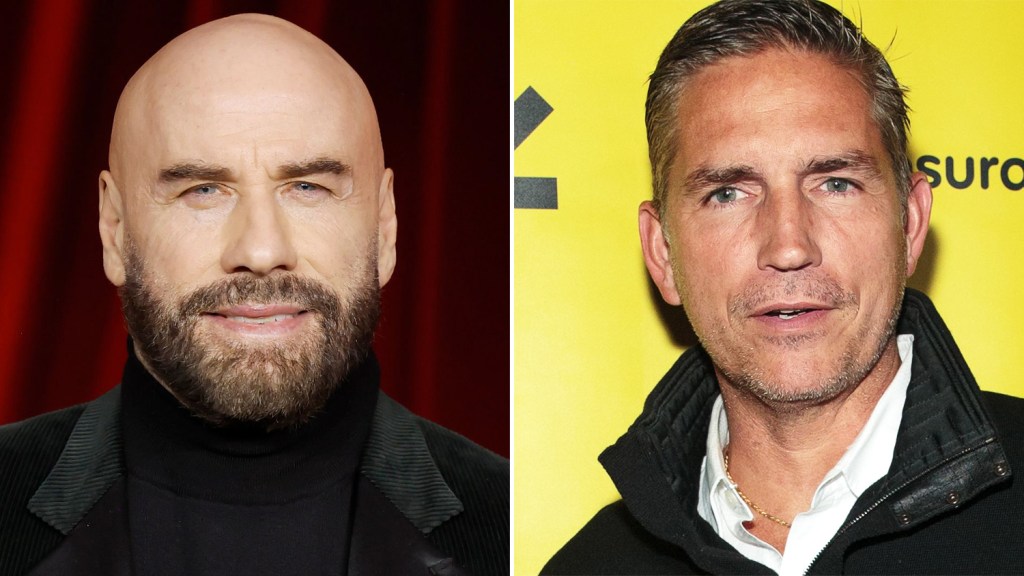

Jim Caviezel And John Travoltas Syndicate A Look At The Upcoming Action Film

May 19, 2025

Jim Caviezel And John Travoltas Syndicate A Look At The Upcoming Action Film

May 19, 2025