Warren Buffett's Investment Strategy: A 13% Reduction In Apple Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Berkshire Hathaway Slashes Apple Stake: A 13% Reduction Sends Market Ripples

Warren Buffett's Berkshire Hathaway, the investment behemoth led by the legendary investor, has announced a significant reduction in its Apple holdings. The move, representing a 13% decrease in the company's Apple shares, has sent ripples through the financial markets and ignited intense speculation about Buffett's investment strategy. This unexpected shift raises questions about the Oracle of Omaha's long-term outlook on the tech giant and the broader market.

A Decisive Downsizing: What Drove the Decision?

Berkshire Hathaway's recent 13F filing revealed the significant reduction in its Apple holdings, a position that had previously been one of the cornerstone investments in its portfolio. While the filing doesn't offer explicit reasoning, analysts and market watchers have several theories. Some speculate that the move reflects a strategic rebalancing of the portfolio, potentially driven by opportunities in other sectors showing stronger growth potential.

Others point to the current macroeconomic climate, characterized by rising interest rates and persistent inflation. These factors can influence investment decisions, leading companies to adjust their holdings to mitigate risk and capitalize on shifting market dynamics. The tech sector, particularly, has experienced volatility recently, impacting valuations and potentially influencing Buffett's decision.

- Diversification Strategy: A possible explanation is Buffett's renowned emphasis on diversification. Reducing the concentration in a single stock, however large and successful, is consistent with his long-term strategy of spreading risk across various sectors and asset classes.

- Profit Taking: Another possibility is that the reduction reflects a strategic decision to take profits on a previously highly successful investment. Apple's stock has seen substantial growth over the years, making a partial divestment a prudent move for realizing gains.

- Market Sentiment: The overall market sentiment and the performance of other attractive investment opportunities might have played a significant role. Buffett is known for his opportunistic approach, seizing advantages wherever he finds them.

Implications for Apple and the Broader Market

The news of Berkshire Hathaway's reduced Apple stake immediately impacted Apple's stock price, causing a minor dip. However, the long-term implications are less certain. Apple remains a highly valued and fundamentally strong company, and this move doesn't necessarily signal a bearish outlook on the company's future prospects.

Nevertheless, the move underscores the dynamic nature of even the most established investment strategies. It serves as a reminder that even legendary investors like Warren Buffett constantly adapt their portfolios based on changing market conditions and emerging opportunities. For investors, the event highlights the importance of continuous monitoring, adaptability, and a diversified investment approach.

Analyzing Buffett's Long-Term Vision

Buffett's investment decisions are always closely scrutinized, and this reduction in Apple shares is no exception. It's important to avoid knee-jerk reactions based on short-term market fluctuations. Instead, we should consider the broader context of Berkshire Hathaway's overall portfolio and Buffett's long-term investment philosophy. The move should be seen as one piece of a larger, complex strategy rather than an indicator of a definitive shift in market sentiment towards Apple itself. Further analysis of Berkshire Hathaway's future moves will offer valuable insights into the evolving investment landscape. The Oracle of Omaha's next moves will be watched closely by investors worldwide.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Investment Strategy: A 13% Reduction In Apple Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nrl Rumours David Fifitas Potential Exit From The Gold Coast Titans

May 07, 2025

Nrl Rumours David Fifitas Potential Exit From The Gold Coast Titans

May 07, 2025 -

Comprehensive Mlb Team Analysis Strengths Weaknesses And Required Adjustments

May 07, 2025

Comprehensive Mlb Team Analysis Strengths Weaknesses And Required Adjustments

May 07, 2025 -

Warriors Coach Kerr Uncovers Pre Game 7 Weakness Against Houston Rockets

May 07, 2025

Warriors Coach Kerr Uncovers Pre Game 7 Weakness Against Houston Rockets

May 07, 2025 -

Golden State Warriors Vs Minnesota Timberwolves Playoffs Preview And Prediction

May 07, 2025

Golden State Warriors Vs Minnesota Timberwolves Playoffs Preview And Prediction

May 07, 2025 -

Factors Influencing The Papal Election Age Ideology And The Trump Factor

May 07, 2025

Factors Influencing The Papal Election Age Ideology And The Trump Factor

May 07, 2025

Latest Posts

-

2nd And 3rd Stimulus Checks Eligibility And Claiming In Pennsylvania

May 08, 2025

2nd And 3rd Stimulus Checks Eligibility And Claiming In Pennsylvania

May 08, 2025 -

Can Andrew Wiggins Meet The Miami Heats Elevated Expectations Next Year

May 08, 2025

Can Andrew Wiggins Meet The Miami Heats Elevated Expectations Next Year

May 08, 2025 -

Safety Concerns Taiwan Government Advises Citizens To Leave India Pakistan Border Area

May 08, 2025

Safety Concerns Taiwan Government Advises Citizens To Leave India Pakistan Border Area

May 08, 2025 -

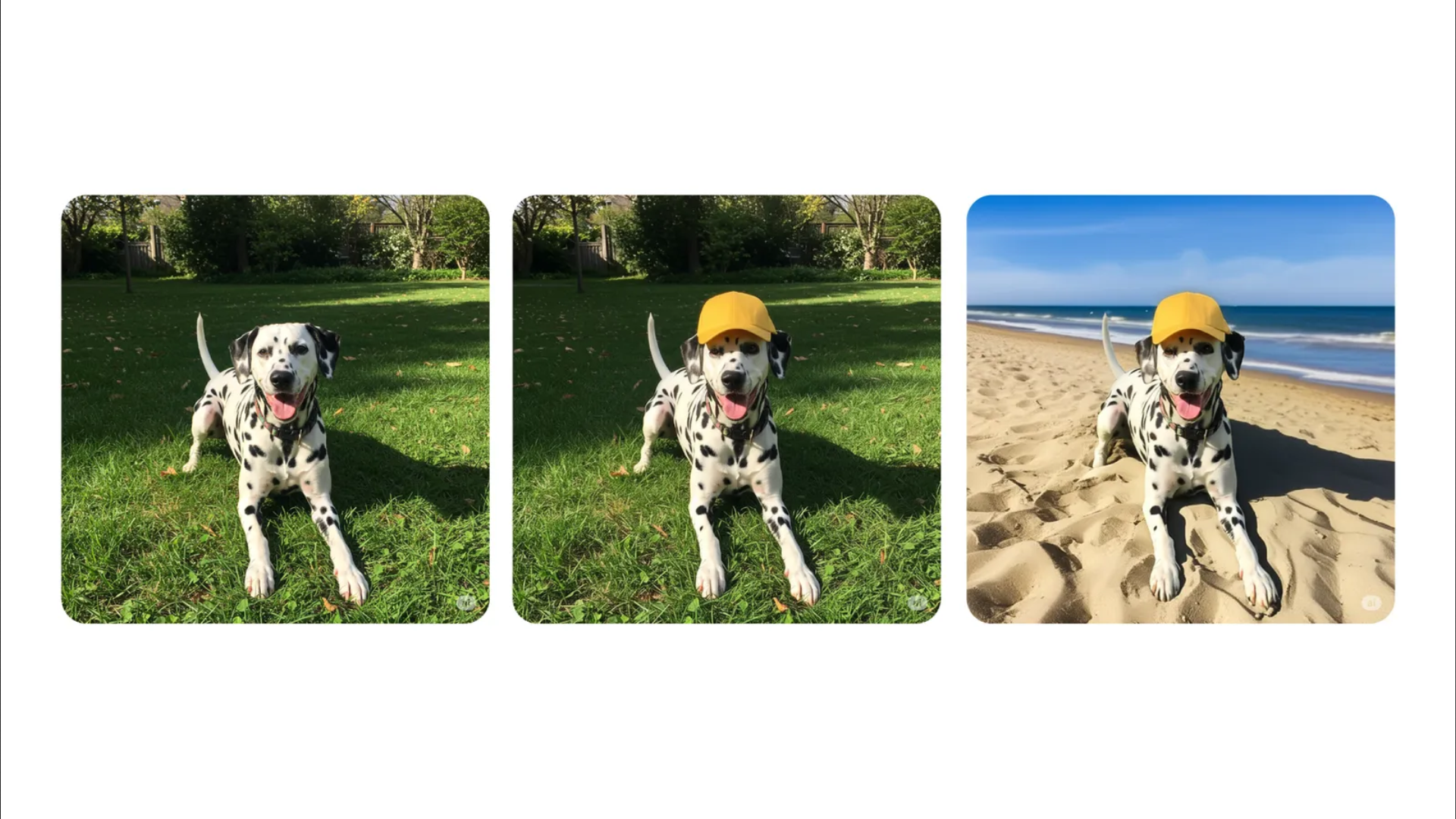

Edit Images Directly In Gemini Streamlined Workflow Explained

May 08, 2025

Edit Images Directly In Gemini Streamlined Workflow Explained

May 08, 2025 -

Buffalos Skeleton Hdd A Unique Look At Hard Drive Internals

May 08, 2025

Buffalos Skeleton Hdd A Unique Look At Hard Drive Internals

May 08, 2025