Warren Buffett's Investment Strategy: Details On The 13% Apple Share Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Apple Strategy Shifts: A 13% Share Reduction Explained

Warren Buffett's Berkshire Hathaway recently reduced its Apple stake by 13%, sending ripples through the investment world. This significant move, disclosed in the company's 13F filing, has sparked considerable speculation about the Oracle of Omaha's future investment plans and the potential outlook for Apple stock. But what does this reduction actually mean, and what can investors learn from Buffett's strategic decision?

This article delves into the details of Berkshire Hathaway's Apple share reduction, examining the potential reasons behind the move and its implications for both seasoned investors and those new to the market. We'll explore Buffett's long-term investment philosophy and how this seemingly contradictory action aligns with his overall strategy.

The Numbers Behind the News:

Berkshire Hathaway's 13F filing revealed a decrease of approximately 86 million Apple shares, representing a 13% reduction in its holdings. While still a significant investment, this marks the first substantial reduction in Apple shares since Berkshire Hathaway began accumulating them in 2016. The exact reasons remain undisclosed, but several factors are likely at play.

Possible Explanations for the Apple Share Reduction:

Several theories attempt to explain Buffett's decision to reduce Berkshire Hathaway's Apple holdings:

-

Portfolio Diversification: Buffett is known for his focus on diversification. This reduction could reflect a strategy to redistribute capital into other promising sectors or companies deemed undervalued in the current market. This isn't necessarily a negative indicator for Apple, but rather a strategic realignment of Berkshire's portfolio.

-

Profit-Taking: Given Apple's impressive performance over the years, a portion of the share reduction could be attributed to securing significant profits. While counterintuitive to his long-term buy-and-hold strategy, strategically taking profits on a winning investment isn't unusual.

-

Market Conditions: Macroeconomic factors, such as inflation, rising interest rates, and potential recessionary pressures, could have influenced the decision. Adjusting holdings in response to broader market volatility is a common practice among even the most seasoned investors.

-

Valuation Concerns: While Apple remains a strong company, there might be internal assessments suggesting the current valuation is less attractive compared to other potential investment opportunities. Buffett is famously known for seeking value investments.

What This Means for Investors:

Buffett's actions always generate considerable interest. While this reduction doesn't necessarily signal a bearish outlook for Apple, it underscores the importance of:

-

Dynamic Investment Strategies: Even legendary investors adapt their strategies in response to changing market conditions. This highlights the necessity of regular portfolio reviews and adjustments.

-

Due Diligence: Before making any investment decision, thorough research and understanding of the underlying company and market conditions are crucial. Don't blindly follow any single investor, no matter how successful.

-

Long-Term Perspective: While short-term market fluctuations can be unnerving, maintaining a long-term investment strategy remains essential for success.

Conclusion:

Berkshire Hathaway's 13% reduction in its Apple stake is a significant development, prompting analysis and speculation. While the exact reasons behind this decision remain partially undisclosed, it underscores the dynamic nature of even the most successful investment strategies. Investors should view this event as a reminder to continuously reassess their portfolios, conduct thorough research, and maintain a long-term perspective. The key takeaway isn't necessarily about Apple's future, but rather a masterclass in adaptable investment strategies from one of the world's greatest investors. This event underscores the enduring relevance of Warren Buffett's investment philosophy even in the face of changing market dynamics.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Investment Strategy: Details On The 13% Apple Share Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Who Won The Millennial Canon Bracket The Final Verdict

May 11, 2025

Who Won The Millennial Canon Bracket The Final Verdict

May 11, 2025 -

Wolfspeed Issues Going Concern Warning Shares Crumble 26

May 11, 2025

Wolfspeed Issues Going Concern Warning Shares Crumble 26

May 11, 2025 -

Wwe Backlash 2025 Preview Can Orton Defeat Cena

May 11, 2025

Wwe Backlash 2025 Preview Can Orton Defeat Cena

May 11, 2025 -

Major Bomb Plot Against Lady Gagas Rio Concert Prevented

May 11, 2025

Major Bomb Plot Against Lady Gagas Rio Concert Prevented

May 11, 2025 -

Ufc 315 Scorecards Muhammad Vs Della Maddalena Official Results

May 11, 2025

Ufc 315 Scorecards Muhammad Vs Della Maddalena Official Results

May 11, 2025

Latest Posts

-

Team Name Cruises To Grand Final After Dominant Victory Over Adelaide

May 12, 2025

Team Name Cruises To Grand Final After Dominant Victory Over Adelaide

May 12, 2025 -

Bitcoin Price Surges Past 100 K Massive Short Squeeze Unleashed

May 12, 2025

Bitcoin Price Surges Past 100 K Massive Short Squeeze Unleashed

May 12, 2025 -

Chimaev Faces Difficult Test Middleweight Contenders Prediction

May 12, 2025

Chimaev Faces Difficult Test Middleweight Contenders Prediction

May 12, 2025 -

Vfl Round Recap Geelongs Loss To Giants At Gmhba Stadium

May 12, 2025

Vfl Round Recap Geelongs Loss To Giants At Gmhba Stadium

May 12, 2025 -

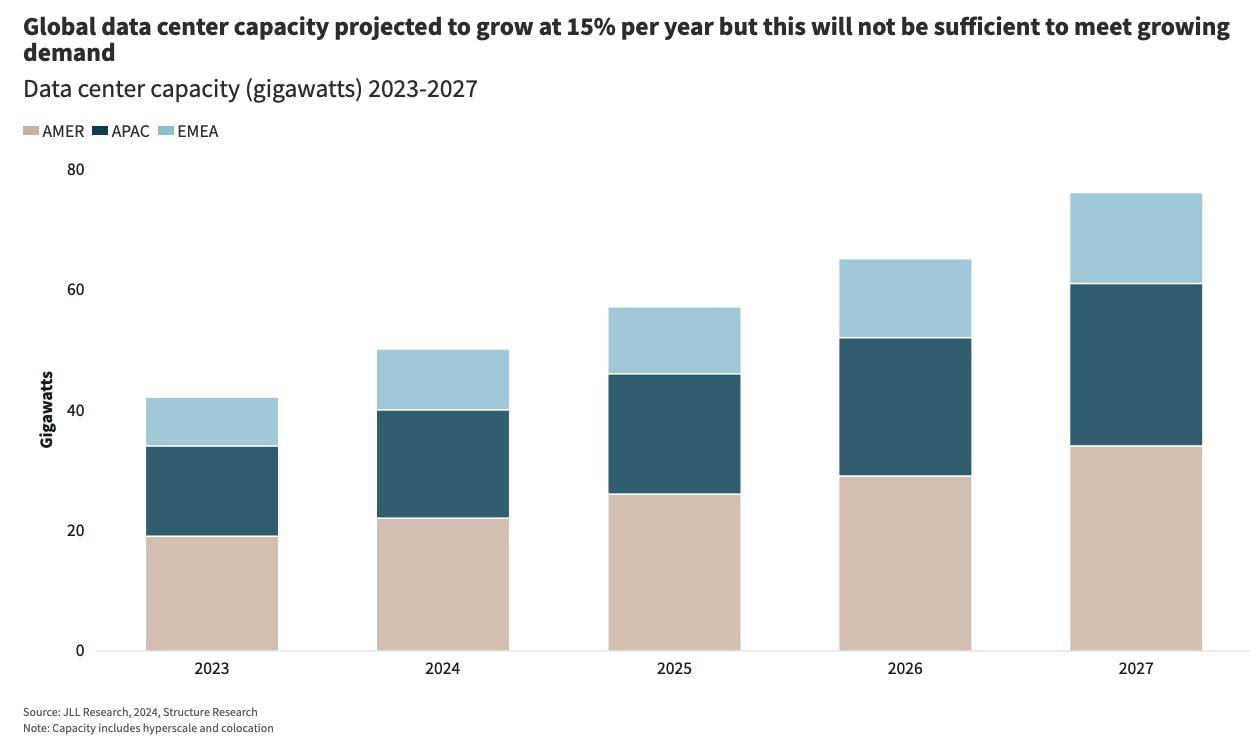

The Future Of Global Ai Data Centers Growth Trends And Key Players

May 12, 2025

The Future Of Global Ai Data Centers Growth Trends And Key Players

May 12, 2025