Warren Buffett's Massive Cash Pile: A Strategic Shift?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Massive Cash Pile: A Strategic Shift or Sign of Caution?

Warren Buffett's Berkshire Hathaway is sitting on a record-breaking cash hoard, sparking intense speculation among investors and financial analysts. The staggering sum, exceeding $150 billion, represents a significant departure from Buffett's historical preference for deploying capital aggressively. Is this a strategic shift, a cautious response to economic uncertainty, or something else entirely? Let's delve into the potential explanations behind this unprecedented cash pile.

The Enormous Cash Reserve: A Closer Look

Berkshire Hathaway's Q2 2024 earnings report revealed a cash position far surpassing previous records. While Buffett has always maintained substantial reserves, this level is unprecedented. This massive cash pile is fueling considerable debate, with various theories emerging to explain its existence.

Possible Explanations for Buffett's Cautious Approach:

-

Economic Uncertainty: The current global economic climate is undeniably complex. Inflation, geopolitical tensions, and potential recessionary pressures are all contributing factors. A significant cash reserve allows Berkshire Hathaway to weather potential economic storms and capitalize on opportunities arising from market downturns. Buffett himself has expressed concerns about the current economic outlook, suggesting this prudence is a direct response to perceived risks.

-

Attractive Investment Scarcity: Despite the vast cash reserves, Buffett and his team haven't found sufficiently compelling investment opportunities. This isn't necessarily a sign of pessimism, but rather a reflection of their high standards for investment selection. They are known for their long-term value investing strategy, focusing on companies with strong fundamentals and sustainable competitive advantages. Finding such companies in the current market may prove challenging.

-

Strategic Acquisitions on the Horizon: Buffett has a history of making significant acquisitions when the opportunity arises. The substantial cash pile could be positioned to facilitate a large-scale acquisition in a specific sector or industry that Berkshire Hathaway deems strategically valuable. This could be a significant game changer for the company's future direction.

-

Share Buybacks: Berkshire Hathaway has engaged in share buybacks in the past, using excess cash to repurchase its own stock, thereby increasing shareholder value. This remains a possibility, especially if compelling external investment opportunities remain scarce. Share buybacks are a key tool used by many companies to manage capital and boost return on investment.

What This Means for Investors:

Buffett's actions are always closely scrutinized by the market. This massive cash hoard could be interpreted in several ways:

-

A sign of caution: Investors might perceive this as a bearish signal, indicating a lack of confidence in the current market conditions.

-

A strategic move: Alternatively, it could be viewed as a strategic repositioning, setting the stage for future acquisitions or share buybacks, potentially creating significant value in the long term.

-

Wait-and-see approach: It's also possible that this is a more passive approach, waiting for a clearer economic picture before deploying capital.

Ultimately, only time will tell the true meaning behind Warren Buffett's unprecedented cash pile. However, its sheer magnitude warrants attention and further analysis from investors, economists, and market observers alike. The coming quarters will be crucial in understanding Buffett’s ultimate strategy. This situation reinforces the importance of long-term investment strategies and adapting to changing market conditions. The continued success of Berkshire Hathaway depends greatly on its ability to navigate this period of uncertainty successfully.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Massive Cash Pile: A Strategic Shift?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

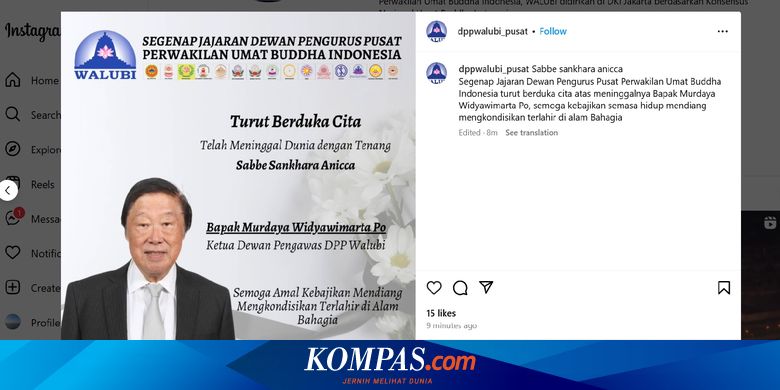

Murdaya Poo Meninggal Dunia Jejak Karier Dan Kontribusi Sang Pengusaha

Apr 07, 2025

Murdaya Poo Meninggal Dunia Jejak Karier Dan Kontribusi Sang Pengusaha

Apr 07, 2025 -

2 2 Thriller Analyzing Ac Milan And Fiorentinas April 5th 2025 Match

Apr 07, 2025

2 2 Thriller Analyzing Ac Milan And Fiorentinas April 5th 2025 Match

Apr 07, 2025 -

Psgs Champions League Test Can They Conquer English Opposition

Apr 07, 2025

Psgs Champions League Test Can They Conquer English Opposition

Apr 07, 2025 -

New Stock Market Losses Exacerbate Tariff Tensions Trump Reacts

Apr 07, 2025

New Stock Market Losses Exacerbate Tariff Tensions Trump Reacts

Apr 07, 2025 -

Clippers Vs Mavericks Game Observer Notes Underlying Tension Possible Dig At Nico Harrison

Apr 07, 2025

Clippers Vs Mavericks Game Observer Notes Underlying Tension Possible Dig At Nico Harrison

Apr 07, 2025