Weak Retail Sales Data: Will The RBA Cut Interest Rates Again?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Weak Retail Sales Data: Will the RBA Cut Interest Rates Again?

Australia's retail sector is showing signs of weakness, sparking renewed speculation about whether the Reserve Bank of Australia (RBA) will cut interest rates again. The latest retail sales figures paint a concerning picture, raising questions about the health of the broader economy and the effectiveness of previous monetary policy decisions. Will the RBA respond with another rate cut, or are other measures needed to stimulate growth?

Retail Sales Slump Fuels Rate Cut Speculation

The recent release of retail sales data revealed a significant downturn, falling [Insert Percentage]% in [Month, Year]. This follows a [previous trend, e.g., similarly weak performance in the previous month] and represents a considerable deceleration from [previous period's growth]. Economists have attributed this decline to several factors, including:

- High Inflation: Persistent inflation continues to erode consumer purchasing power, forcing households to cut back on discretionary spending. The rising cost of living, particularly in areas like groceries and energy, is leaving less disposable income for non-essential purchases.

- Increased Interest Rates: The RBA's previous interest rate hikes, aimed at curbing inflation, have significantly increased borrowing costs for consumers and businesses. This has led to reduced consumer confidence and a reluctance to take on new debt for major purchases.

- Global Economic Uncertainty: The global economic outlook remains uncertain, impacting consumer sentiment and investment decisions. Geopolitical instability and concerns about a potential recession are further dampening spending.

Will the RBA Respond with Another Rate Cut?

The weak retail sales data adds pressure on the RBA to consider further interest rate cuts. While previous hikes aimed to control inflation, the current slowdown suggests a potential overcorrection. However, the RBA faces a difficult balancing act. Cutting rates too aggressively could risk reigniting inflationary pressures, while inaction could deepen the economic slowdown.

Several factors will influence the RBA's decision:

- Inflation Trajectory: The RBA will closely monitor inflation figures in the coming months. A sustained decline in inflation could pave the way for further rate cuts.

- Unemployment Rate: The unemployment rate is another key indicator. A rising unemployment rate could signal a weakening labor market and increase the pressure for rate cuts to stimulate job growth.

- Consumer Confidence: Improving consumer confidence could indicate a potential turnaround in spending, reducing the urgency for immediate rate cuts.

Alternative Policy Options

Beyond interest rate adjustments, the RBA could consider alternative policy measures to boost economic activity, such as:

- Quantitative Easing: This involves injecting liquidity into the financial system by purchasing government bonds.

- Targeted Fiscal Stimulus: The government could implement fiscal measures to stimulate specific sectors of the economy.

Looking Ahead:

The coming months will be crucial in determining the RBA's next move. Further analysis of economic data, particularly inflation and unemployment figures, will be critical in informing their decision. The weak retail sales figures raise serious concerns about the Australian economy's health and suggest a significant challenge lies ahead for policymakers. The RBA's response will have a significant impact on businesses, consumers, and the overall economic outlook for Australia. Stay tuned for further updates as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Weak Retail Sales Data: Will The RBA Cut Interest Rates Again?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

League Of Legends And Valorant Players Can Now Use Coinbase For In Game Purchases

May 09, 2025

League Of Legends And Valorant Players Can Now Use Coinbase For In Game Purchases

May 09, 2025 -

Investigating Us Navy F 18 Losses Friendly Fire And Operational Challenges

May 09, 2025

Investigating Us Navy F 18 Losses Friendly Fire And Operational Challenges

May 09, 2025 -

Josh Hartnetts Unexpected Comeback A Deep Dive Into His New Movie

May 09, 2025

Josh Hartnetts Unexpected Comeback A Deep Dive Into His New Movie

May 09, 2025 -

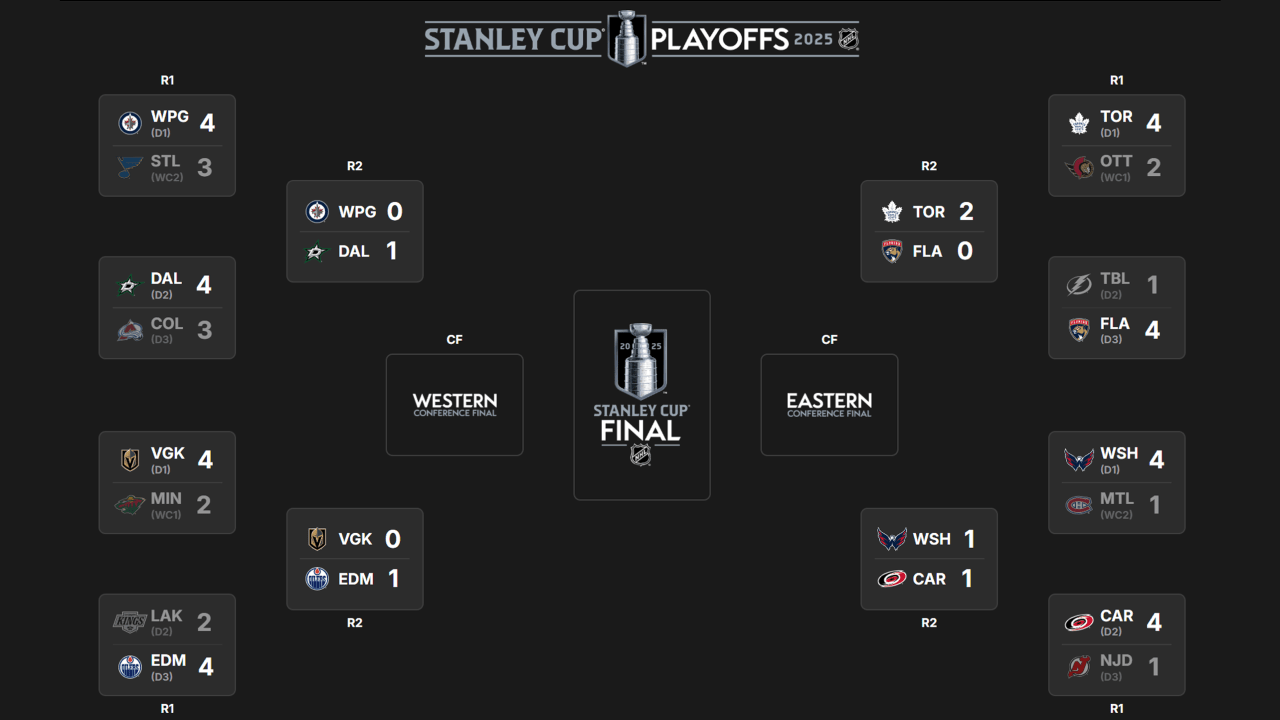

Nhl 2025 Stanley Cup Playoffs Second Round Game Schedule And Details

May 09, 2025

Nhl 2025 Stanley Cup Playoffs Second Round Game Schedule And Details

May 09, 2025 -

Can Nigerias Flying Eagles Overcome Senegal To Secure World Cup Spot

May 09, 2025

Can Nigerias Flying Eagles Overcome Senegal To Secure World Cup Spot

May 09, 2025