Weak Start For Chinese Equities: Monday's Market Opens In The Red

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Weak Start for Chinese Equities: Monday's Market Opens in the Red

Monday's trading session on the Chinese mainland saw a significant dip in equity markets, raising concerns among investors. The Shanghai Composite Index and the Shenzhen Component Index both opened lower, signaling a potentially challenging week ahead for Chinese stocks. This downturn follows a period of relative volatility and comes amidst growing global economic uncertainty. Understanding the reasons behind this weak start is crucial for investors navigating the complex landscape of the Chinese market.

Key Factors Contributing to the Market Dip

Several factors are believed to have contributed to the negative opening on Monday. These include:

-

Global Economic Slowdown: The ongoing global economic slowdown, fueled by high inflation and rising interest rates in major economies, is casting a shadow over global markets, including China. Concerns about reduced export demand and potential supply chain disruptions are weighing heavily on investor sentiment.

-

Property Sector Woes: The persistent challenges within China's property sector continue to be a major source of concern. The ongoing debt crisis at several major real estate developers is impacting investor confidence and creating uncertainty about the broader economy. This sector's struggles have a ripple effect, impacting related industries and the overall market stability.

-

Regulatory Uncertainty: Lingering regulatory uncertainty in various sectors is also dampening investor enthusiasm. While recent regulatory adjustments have aimed to create a more stable and predictable business environment, some ambiguity remains, causing hesitancy among investors.

-

Geopolitical Tensions: Heightened geopolitical tensions, particularly concerning the ongoing US-China relationship, contribute to the overall market nervousness. These tensions create uncertainty and can lead to capital flight.

Shanghai Composite and Shenzhen Component Indices: A Closer Look

The Shanghai Composite Index, a key indicator of the Chinese stock market, opened significantly lower on Monday, mirroring the weakness seen in other major Asian markets. Similarly, the Shenzhen Component Index, which focuses on smaller, technology-focused companies, also experienced a substantial drop. These declines signal a broader trend affecting different sectors within the Chinese economy.

Analyst Predictions and Investor Sentiment

Analysts are divided on the short-term outlook for Chinese equities. Some believe this dip represents a temporary correction, while others express concern about a more prolonged period of weakness. Investor sentiment remains cautious, with many adopting a wait-and-see approach before making significant investment decisions. The coming days will be crucial in determining the direction of the market.

Navigating the Uncertainty: Strategies for Investors

Given the current market conditions, investors are advised to adopt a cautious and diversified approach. Thorough due diligence, careful risk assessment, and a long-term investment horizon are crucial for navigating the uncertainty. Consulting with a financial advisor is highly recommended, particularly for those with significant exposure to the Chinese market.

The weak start to the week underscores the complex interplay of global and domestic factors impacting the Chinese equity market. Investors need to stay informed and adapt their strategies accordingly to navigate this challenging environment. Further updates and analysis will be provided as the week progresses and market trends become clearer.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Weak Start For Chinese Equities: Monday's Market Opens In The Red. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Amazon Stock Plummets Amidst Rising Tariffs Is This A Buying Opportunity

Apr 08, 2025

Amazon Stock Plummets Amidst Rising Tariffs Is This A Buying Opportunity

Apr 08, 2025 -

Is The Nintendo Switch 2 The Key To Resurrecting The Gaming Industry

Apr 08, 2025

Is The Nintendo Switch 2 The Key To Resurrecting The Gaming Industry

Apr 08, 2025 -

Esl Mobile Masters 2025 12 Tim Berebut Gelar Juara Di Fase Grup

Apr 08, 2025

Esl Mobile Masters 2025 12 Tim Berebut Gelar Juara Di Fase Grup

Apr 08, 2025 -

Double Trouble For Okx 1 2 M Malta Fine Follows 500 M Us Penalty For Aml Issues

Apr 08, 2025

Double Trouble For Okx 1 2 M Malta Fine Follows 500 M Us Penalty For Aml Issues

Apr 08, 2025 -

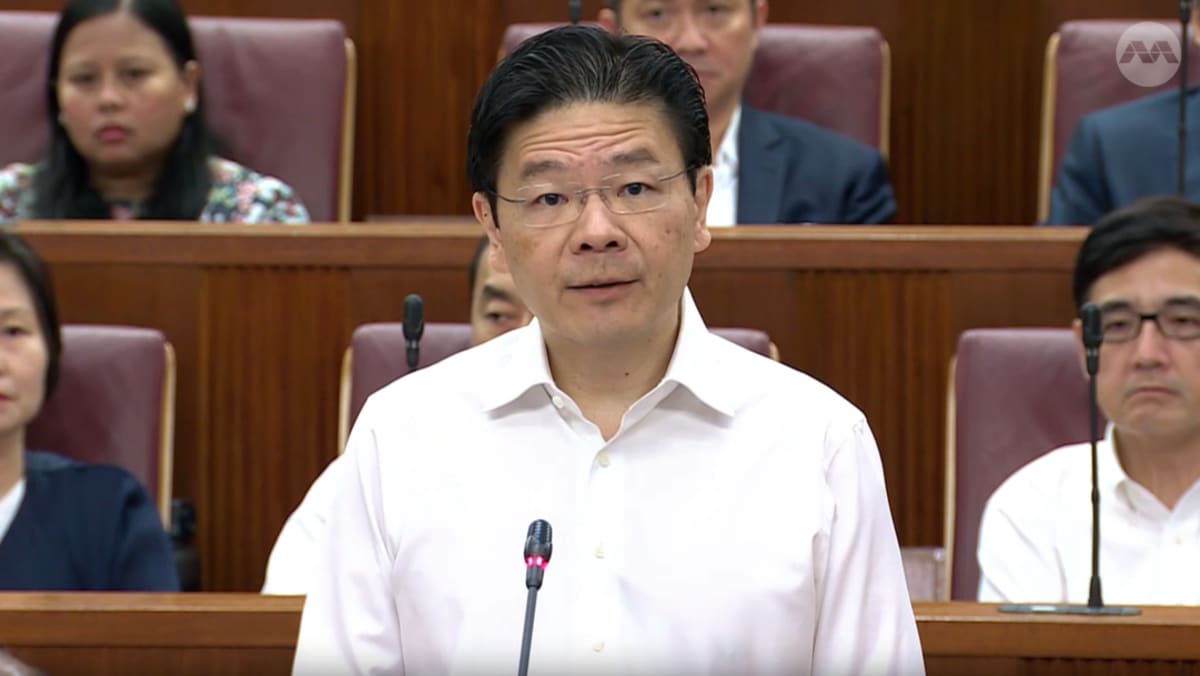

Impact Of Trump Tariffs On Singapore Government Forms Task Force To Aid Businesses

Apr 08, 2025

Impact Of Trump Tariffs On Singapore Government Forms Task Force To Aid Businesses

Apr 08, 2025