What Makes A Company Investment-Worthy? Nick Jonas Explains

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

What Makes a Company Investment-Worthy? Nick Jonas Explains

Singer, actor, and entrepreneur Nick Jonas offers insights into his investment strategy, revealing the key factors he considers before backing a company.

Nick Jonas, renowned for his successful career in music and acting, has quietly built a formidable reputation as a shrewd investor. Beyond the glitz and glamour, Jonas possesses a keen eye for identifying promising ventures, leading him to back companies across diverse sectors. But what’s his secret? What criteria does he apply before investing his hard-earned money? Recently, Jonas offered some valuable insights into his investment philosophy, shedding light on the key characteristics he looks for in an investment-worthy company.

Beyond the Bottom Line: Jonas' Holistic Approach to Investing

Jonas doesn't just focus on financial projections; he takes a holistic approach. His investment decisions are driven by a blend of financial analysis and a deeper understanding of the company's potential for long-term growth and societal impact. He emphasizes the importance of:

1. Strong Leadership and Team:

"The team is everything," Jonas recently stated in an interview. "I'm investing in people as much as I'm investing in an idea. A passionate, experienced, and adaptable leadership team is crucial for navigating challenges and seizing opportunities." He highlights the importance of a team's ability to execute its vision and adapt to changing market conditions as key indicators of success. This focus on human capital aligns with modern investment trends that prioritize strong company culture and employee engagement.

2. A Scalable and Disruptive Business Model:

Jonas seeks out companies with business models that have the potential for significant scaling and disruption within their respective markets. "I'm looking for something that can grow exponentially, something that has the potential to truly change the game," he explained. He's particularly drawn to innovative companies leveraging technology to solve real-world problems or improve existing processes. This focus on scalability and disruption is a hallmark of successful venture capital investments.

3. Market Opportunity and Competitive Advantage:

A large and growing market is essential for any investment. However, Jonas emphasizes the critical importance of a company’s ability to carve out a unique competitive advantage within that market. This could be through proprietary technology, superior branding, a strong network effect, or a unique business model. "Understanding the competitive landscape and how a company differentiates itself is paramount," Jonas noted. This speaks to the importance of thorough due diligence and a comprehensive market analysis.

4. Socially Responsible Impact:

Jonas isn't afraid to invest in companies with a strong commitment to social responsibility and sustainability. He believes that businesses can and should contribute positively to society. This alignment with his personal values suggests a growing trend among investors who consider Environmental, Social, and Governance (ESG) factors crucial to long-term investment success. This focus on ESG investing is attracting both ethical and financially-minded investors alike.

5. Clear Exit Strategy:

While long-term growth is a priority, Jonas also acknowledges the importance of having a clear exit strategy. This could involve an acquisition by a larger company, an initial public offering (IPO), or another form of liquidity event. A well-defined exit strategy provides a path for investors to realize their returns on investment.

Investing Wisely: Learning from Nick Jonas's Approach

Nick Jonas's investment philosophy offers valuable lessons for both seasoned investors and those just starting out. His focus on strong leadership, scalability, competitive advantage, social responsibility, and a clear exit strategy demonstrates a comprehensive and insightful approach to identifying investment-worthy companies. By understanding and applying these principles, aspiring investors can significantly improve their chances of success in the dynamic world of business. His story serves as a powerful reminder that successful investing goes beyond simply looking at numbers; it's about identifying companies with the potential for significant, lasting impact.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on What Makes A Company Investment-Worthy? Nick Jonas Explains. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Toyota C Hr Ev All Electric Compact Suv Confirmed For Us Launch

May 15, 2025

Toyota C Hr Ev All Electric Compact Suv Confirmed For Us Launch

May 15, 2025 -

Belichicks Panthers Future A Prediction For Week 1 And Beyond

May 15, 2025

Belichicks Panthers Future A Prediction For Week 1 And Beyond

May 15, 2025 -

A Legacy Of Giving Millers 200th Blood Donation Inspires Community

May 15, 2025

A Legacy Of Giving Millers 200th Blood Donation Inspires Community

May 15, 2025 -

Rome Semifinals Gauff Sabalenka Zheng Andreeva The Final Four Contenders

May 15, 2025

Rome Semifinals Gauff Sabalenka Zheng Andreeva The Final Four Contenders

May 15, 2025 -

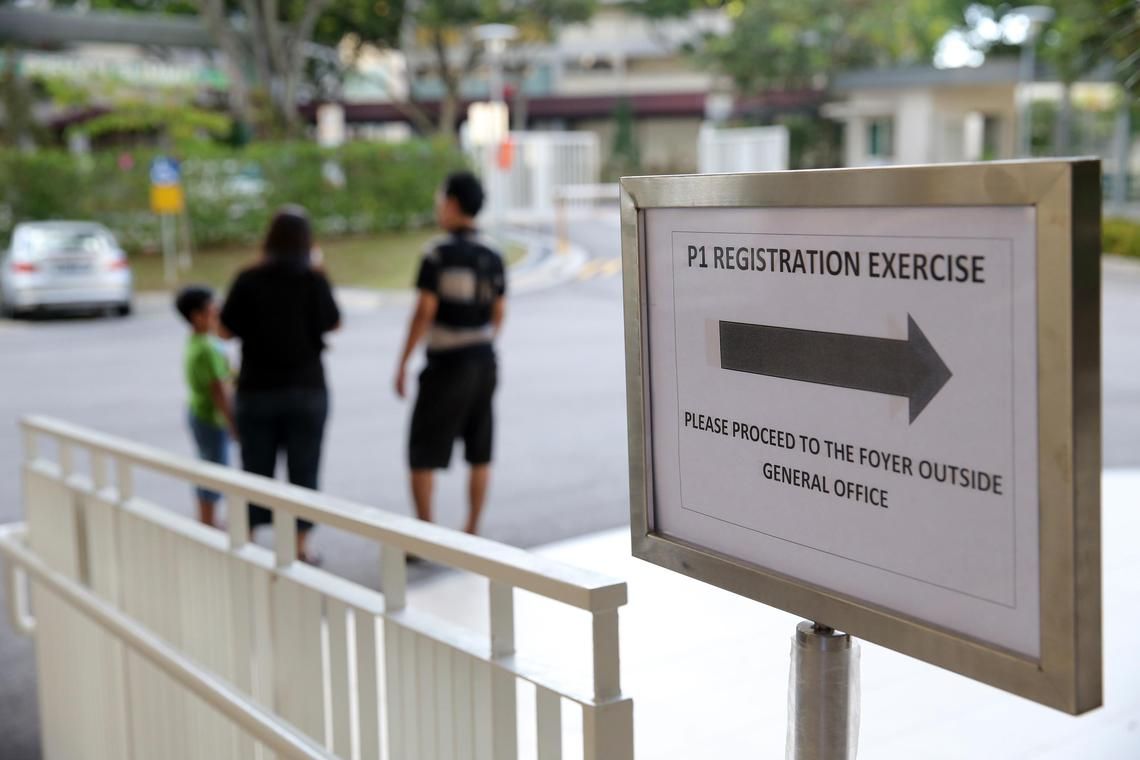

Townsville And Damai Primary Schools Relocating P1 Registration Opens July 1 2026

May 15, 2025

Townsville And Damai Primary Schools Relocating P1 Registration Opens July 1 2026

May 15, 2025

Latest Posts

-

Atp Rome Hurkacz Paul Semifinal Preview Paolinis First Semifinal Match

May 15, 2025

Atp Rome Hurkacz Paul Semifinal Preview Paolinis First Semifinal Match

May 15, 2025 -

Olipop Snackpass And Magic Spoon A Look At Nick Jonass Strategic Investments

May 15, 2025

Olipop Snackpass And Magic Spoon A Look At Nick Jonass Strategic Investments

May 15, 2025 -

Micro Strategys Bitcoin Bet Will Mstr Stock Outpace Btcs Price In February 2025

May 15, 2025

Micro Strategys Bitcoin Bet Will Mstr Stock Outpace Btcs Price In February 2025

May 15, 2025 -

Identifying Mutants In Marvel Rivals A Comprehensive Character List

May 15, 2025

Identifying Mutants In Marvel Rivals A Comprehensive Character List

May 15, 2025 -

Full Fixture List Revealed Rd 16 To 23 Matchups

May 15, 2025

Full Fixture List Revealed Rd 16 To 23 Matchups

May 15, 2025