Where Will Nvidia (NVDA) Stock Be In 5 Years? A Realistic Forecast

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Where Will Nvidia (NVDA) Stock Be in 5 Years? A Realistic Forecast

Nvidia (NVDA) has been on an absolute tear, catapulting to record highs fueled by the explosive growth of artificial intelligence (AI). But where will this tech titan be in five years? Predicting the future of any stock is inherently risky, but by analyzing current trends, market dynamics, and Nvidia's strategic positioning, we can formulate a realistic forecast.

The AI Boom: Nvidia's Engine of Growth

Nvidia's current success is undeniably linked to the burgeoning AI industry. Their GPUs, initially designed for gaming, have become the workhorses of AI development, powering everything from large language models like ChatGPT to sophisticated image recognition systems. This dominance gives Nvidia a significant competitive advantage, allowing them to command premium pricing and enjoy high profit margins. The continued expansion of AI across various sectors – healthcare, finance, autonomous vehicles – will be crucial to Nvidia's future growth.

Challenges on the Horizon: Competition and Economic Uncertainty

While the outlook is bright, Nvidia isn't without its challenges. Increased competition from AMD and other chipmakers is inevitable. Furthermore, macroeconomic headwinds, including potential economic slowdowns and inflation, could impact consumer and enterprise spending on technology, potentially dampening demand for Nvidia's products. Successfully navigating these challenges will be key to sustained growth.

Key Factors Influencing NVDA Stock in the Next 5 Years:

- AI Adoption Rate: The speed at which AI is adopted across various industries will be a primary driver of Nvidia's performance. Faster adoption translates to higher demand and revenue growth.

- Competitive Landscape: Nvidia's ability to maintain its technological leadership and fend off competition will be crucial. Innovation and strategic partnerships will be key.

- Global Economic Conditions: A robust global economy will support continued investment in technology, while a downturn could significantly impact demand.

- New Product Launches and Innovation: Nvidia's ability to innovate and introduce new products and technologies that meet evolving market needs will be critical to its long-term success. This includes advancements in areas like data centers and autonomous vehicles.

- Regulatory Scrutiny: Increasing regulatory scrutiny of the tech industry could impact Nvidia's operations and growth trajectory.

A Realistic Forecast: Cautious Optimism

Predicting a precise price target for NVDA in five years is impossible. However, considering the current trajectory and potential challenges, a cautious optimistic approach is warranted. While expecting the meteoric rise of the past year to continue unabated is unrealistic, continued growth seems highly probable.

Assuming a conservative annual growth rate of 15-20%, factoring in potential market corrections and competitive pressures, a price range of $600 to $1000 per share in five years seems plausible. This, of course, depends heavily on the factors outlined above.

Investing in NVDA: A Long-Term Perspective

Investing in Nvidia involves both significant potential rewards and substantial risks. Investors should conduct thorough due diligence and understand their own risk tolerance before investing in any stock. A long-term investment strategy, coupled with regular portfolio diversification, is recommended for mitigating risk. The future of AI is bright, and Nvidia is well-positioned to benefit, but market volatility and unforeseen events can always impact even the most promising companies.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Where Will Nvidia (NVDA) Stock Be In 5 Years? A Realistic Forecast. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Queensland Politics Labor Expels Brisbane Mp In Shock Decision

May 13, 2025

Queensland Politics Labor Expels Brisbane Mp In Shock Decision

May 13, 2025 -

Rugby League News Taylan May Announces Return Date

May 13, 2025

Rugby League News Taylan May Announces Return Date

May 13, 2025 -

American Idol 2024 Top 5 Contestants Vie For Victory

May 13, 2025

American Idol 2024 Top 5 Contestants Vie For Victory

May 13, 2025 -

How To Watch American Idol For Free Tonight Simple Guide And Whos Left

May 13, 2025

How To Watch American Idol For Free Tonight Simple Guide And Whos Left

May 13, 2025 -

Indias Virat Kohli Announces Retirement From Test Matches

May 13, 2025

Indias Virat Kohli Announces Retirement From Test Matches

May 13, 2025

Latest Posts

-

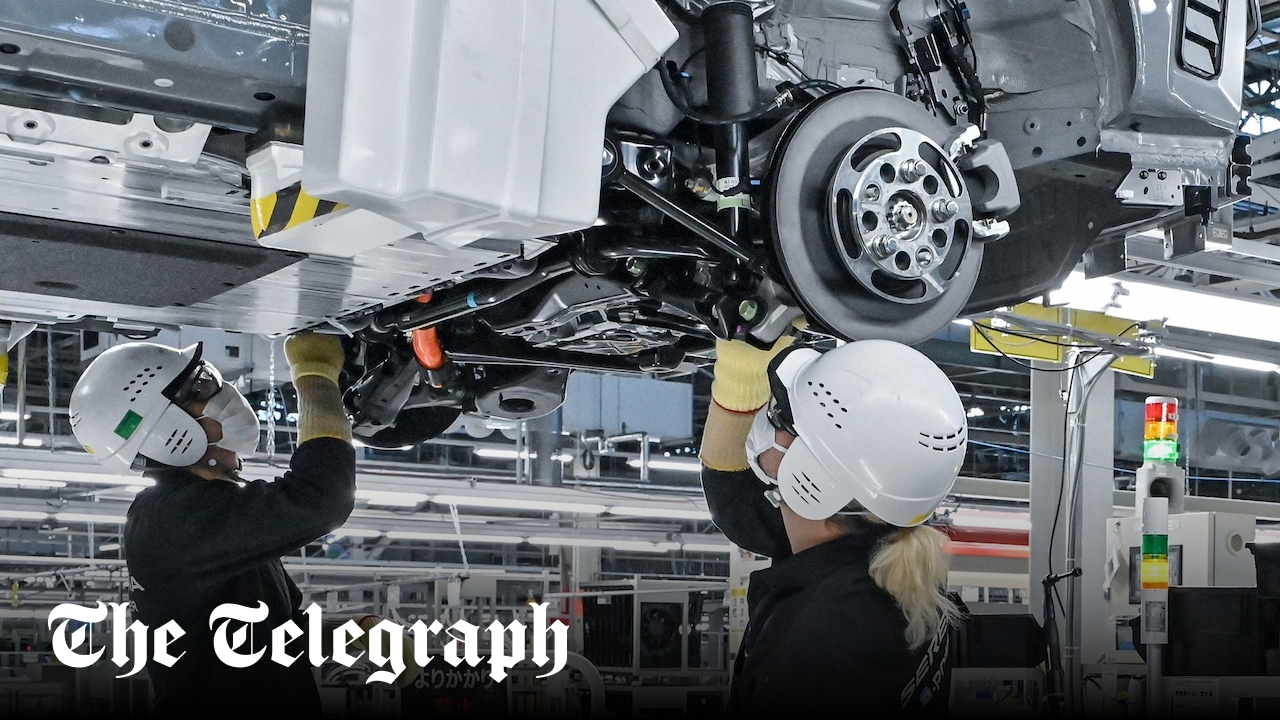

20 000 Job Losses Announced As Nissan Undergoes Restructuring

May 13, 2025

20 000 Job Losses Announced As Nissan Undergoes Restructuring

May 13, 2025 -

Texas Faces Largest Measles Outbreak In Over Two Decades

May 13, 2025

Texas Faces Largest Measles Outbreak In Over Two Decades

May 13, 2025 -

Nyt Wordle Today Solution And Hints For Game 1423 May 12

May 13, 2025

Nyt Wordle Today Solution And Hints For Game 1423 May 12

May 13, 2025 -

Us Gulf Economic Relations Trumps Saudi Arabia Trip And Its Implications

May 13, 2025

Us Gulf Economic Relations Trumps Saudi Arabia Trip And Its Implications

May 13, 2025 -

Digital Taste Exploring The Possibilities Of Taste Recording

May 13, 2025

Digital Taste Exploring The Possibilities Of Taste Recording

May 13, 2025