Which Is The Better Buy Now: Palo Alto Networks Or Nvidia?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Palo Alto Networks vs. Nvidia: Which Tech Stock Is the Better Buy Now?

The tech sector is a battlefield of giants, and two titans currently vying for investor attention are Palo Alto Networks (PANW) and Nvidia (NVDA). Both companies are leaders in their respective fields – cybersecurity and AI – but which presents the better investment opportunity right now? This in-depth analysis will weigh the pros and cons of each, helping you make an informed decision.

Understanding the Giants: A Quick Overview

-

Palo Alto Networks (PANW): A cybersecurity leader, PANW offers a comprehensive suite of solutions protecting businesses from increasingly sophisticated cyber threats. Their focus on cloud security, next-generation firewalls, and threat intelligence platforms positions them well for continued growth in a rapidly evolving digital landscape.

-

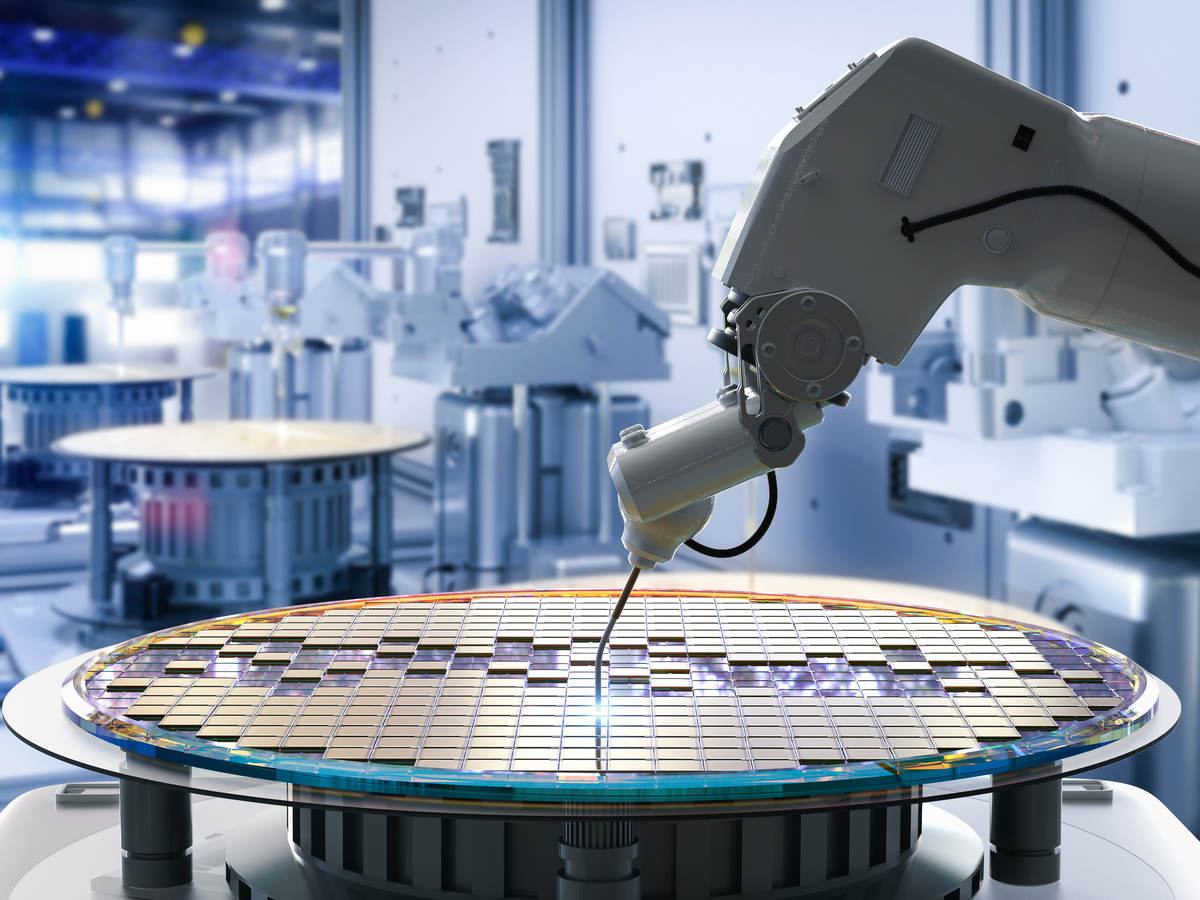

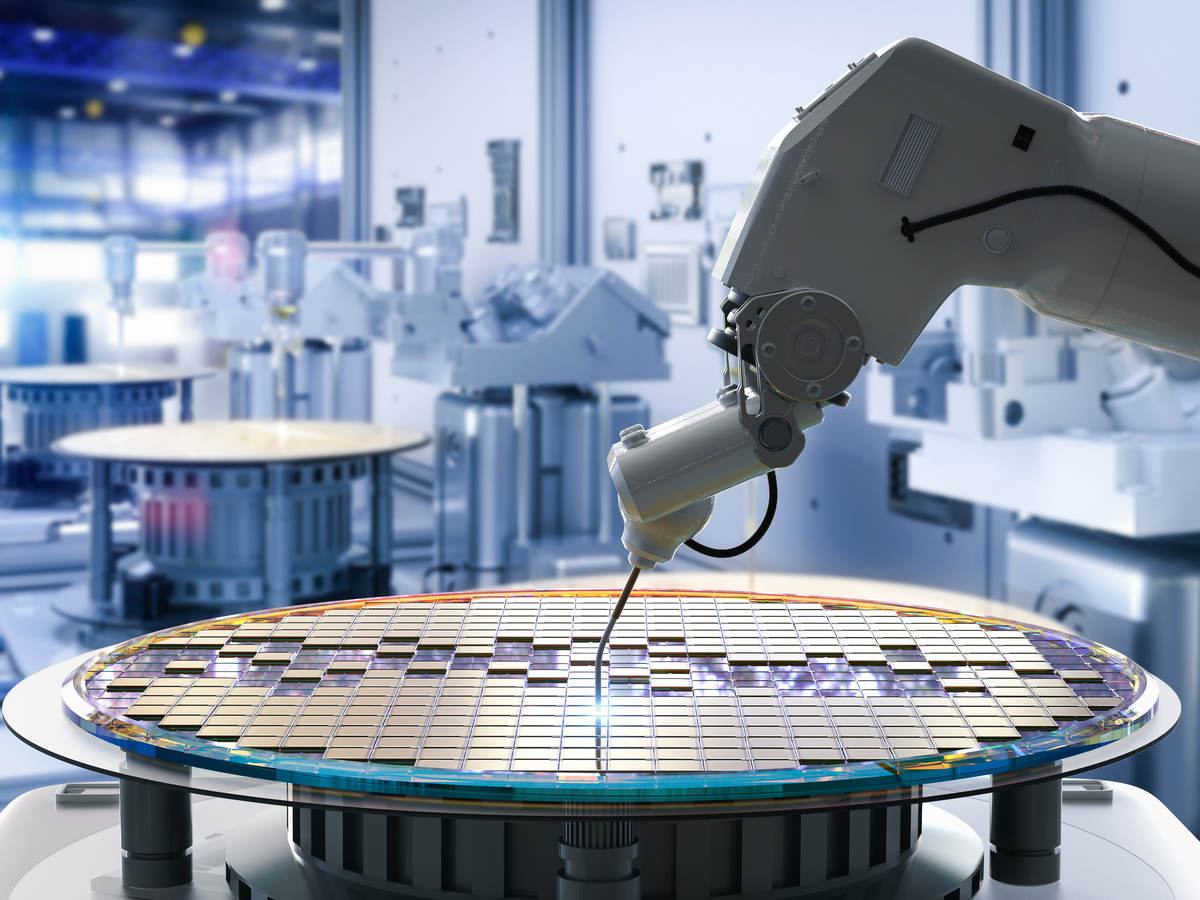

Nvidia (NVDA): A dominant force in the graphics processing unit (GPU) market, NVDA is at the forefront of the artificial intelligence revolution. Their GPUs power AI data centers, self-driving cars, and high-performance computing, making them a key player in many burgeoning technologies.

Palo Alto Networks: Strengths and Weaknesses

Strengths:

- Strong Growth Potential: The cybersecurity market is booming, with businesses constantly needing enhanced protection against evolving threats. This provides a solid foundation for PANW's continued growth.

- Recurring Revenue Model: A significant portion of PANW's revenue comes from subscription-based services, creating a predictable and stable revenue stream. This is attractive to investors seeking long-term stability.

- Innovation: PANW consistently invests in research and development, ensuring they remain at the cutting edge of cybersecurity technology. This commitment to innovation fuels their market leadership.

Weaknesses:

- Premium Valuation: PANW stock often trades at a higher price-to-earnings (P/E) ratio compared to its peers, making it potentially more vulnerable to market corrections.

- Competition: The cybersecurity landscape is competitive, with established players and emerging startups vying for market share.

Nvidia: Strengths and Weaknesses

Strengths:

- AI Dominance: NVDA's GPUs are essential for the development and deployment of AI, positioning them for immense growth as AI adoption accelerates across industries.

- Data Center Growth: The demand for high-performance computing in data centers is skyrocketing, fueling NVDA's revenue growth.

- Diversification: While known for GPUs, NVDA is diversifying into other areas like autonomous vehicles and high-performance computing, reducing reliance on a single market.

Weaknesses:

- Overvaluation Concerns: Similar to PANW, NVDA's stock price has experienced significant growth, leading to concerns about potential overvaluation.

- Geopolitical Risks: NVDA's business is impacted by global geopolitical events and regulatory changes, creating potential uncertainty.

- Competition in Specific Markets: While dominant overall, NVDA faces increasing competition in specific segments of the GPU market.

The Verdict: Which is the Better Buy?

Choosing between PANW and NVDA depends on your investment goals and risk tolerance.

-

For investors seeking strong, consistent growth with a relatively lower risk profile, Palo Alto Networks offers a compelling case. Their recurring revenue model and established market position provide a degree of stability.

-

For investors with a higher risk tolerance seeking potentially explosive growth, Nvidia's exposure to the rapidly expanding AI market is undeniably attractive. However, this comes with the potential for greater volatility.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions. The stock market is inherently risky, and past performance is not indicative of future results. Both PANW and NVDA are subject to market fluctuations and unforeseen events.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Which Is The Better Buy Now: Palo Alto Networks Or Nvidia?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Metas Llama 4 And Open Ais Powerful New Model A Showdown In Open Source Ai

Apr 08, 2025

Metas Llama 4 And Open Ais Powerful New Model A Showdown In Open Source Ai

Apr 08, 2025 -

Tasmanian Devils Face New Stadium Challenge Mlc Vote Looms

Apr 08, 2025

Tasmanian Devils Face New Stadium Challenge Mlc Vote Looms

Apr 08, 2025 -

Qodrat 2 Dan Jumbo Analisis Box Office Dan Persaingan Film Horor

Apr 08, 2025

Qodrat 2 Dan Jumbo Analisis Box Office Dan Persaingan Film Horor

Apr 08, 2025 -

Dmitry Bivols Legal Team Faces Wbc Backlash Over Belt Vacancy Plea

Apr 08, 2025

Dmitry Bivols Legal Team Faces Wbc Backlash Over Belt Vacancy Plea

Apr 08, 2025 -

Tributes Pour In Remembering A Rugby League Legend And Activist

Apr 08, 2025

Tributes Pour In Remembering A Rugby League Legend And Activist

Apr 08, 2025