Which Tech Stock Is A Better Deal Post-Nasdaq Decline: PANW Or NVDA?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Which Tech Stock is a Better Deal Post-Nasdaq Decline: PANW or NVDA?

The recent Nasdaq decline has left many investors wondering which tech stocks offer the best value. Two giants frequently mentioned are Palo Alto Networks (PANW) and Nvidia (NVDA), both experiencing significant growth but with differing risk profiles. This analysis dives deep into both companies, comparing their performance, future prospects, and overall investment potential post-market downturn.

Understanding the Post-Decline Landscape:

The tech sector's recent correction presented both challenges and opportunities. While valuations adjusted, fundamentally strong companies saw their stock prices dip, creating potential entry points for savvy investors. Both PANW and NVDA, despite their resilience, weren't immune to the broader market pressure. This presents a chance to analyze their current standing and determine which offers a more attractive risk-reward profile.

Palo Alto Networks (PANW): Cybersecurity's Steady Hand

Palo Alto Networks is a leading cybersecurity firm, providing a diverse range of solutions for enterprises and individuals. Its consistent growth and strong market position make it an appealing option for investors seeking stability.

-

Strengths: PANW boasts a robust and expanding product portfolio, catering to evolving cybersecurity threats. Their subscription-based model ensures recurring revenue streams, contributing to financial predictability. The company’s focus on cloud security solutions aligns perfectly with the growing demand in this sector. Furthermore, PANW enjoys strong customer loyalty and a proven track record of successful acquisitions.

-

Weaknesses: Competition in the cybersecurity market is fierce, with numerous players vying for market share. While PANW enjoys a strong position, maintaining its competitive edge requires continuous innovation and investment in R&D. High valuation multiples compared to some peers might be a deterrent for some investors.

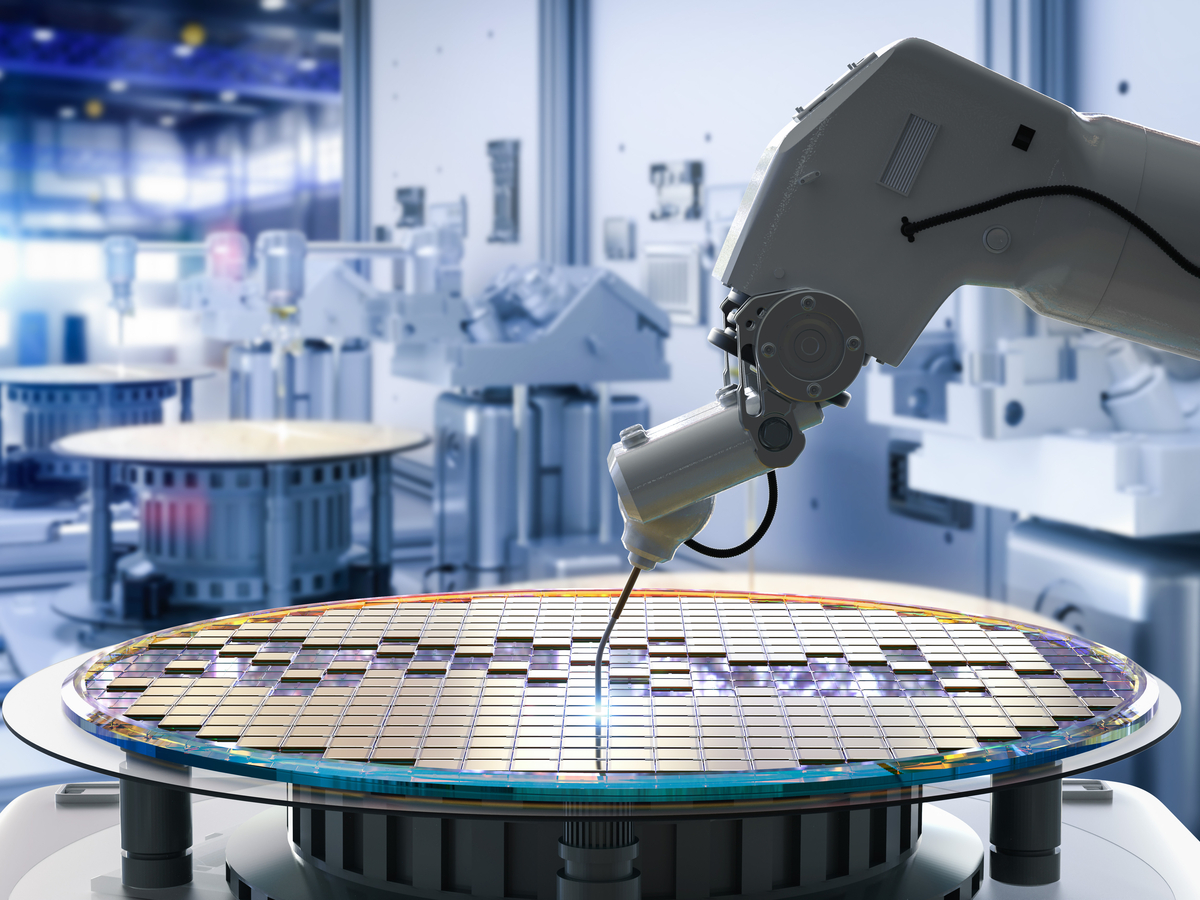

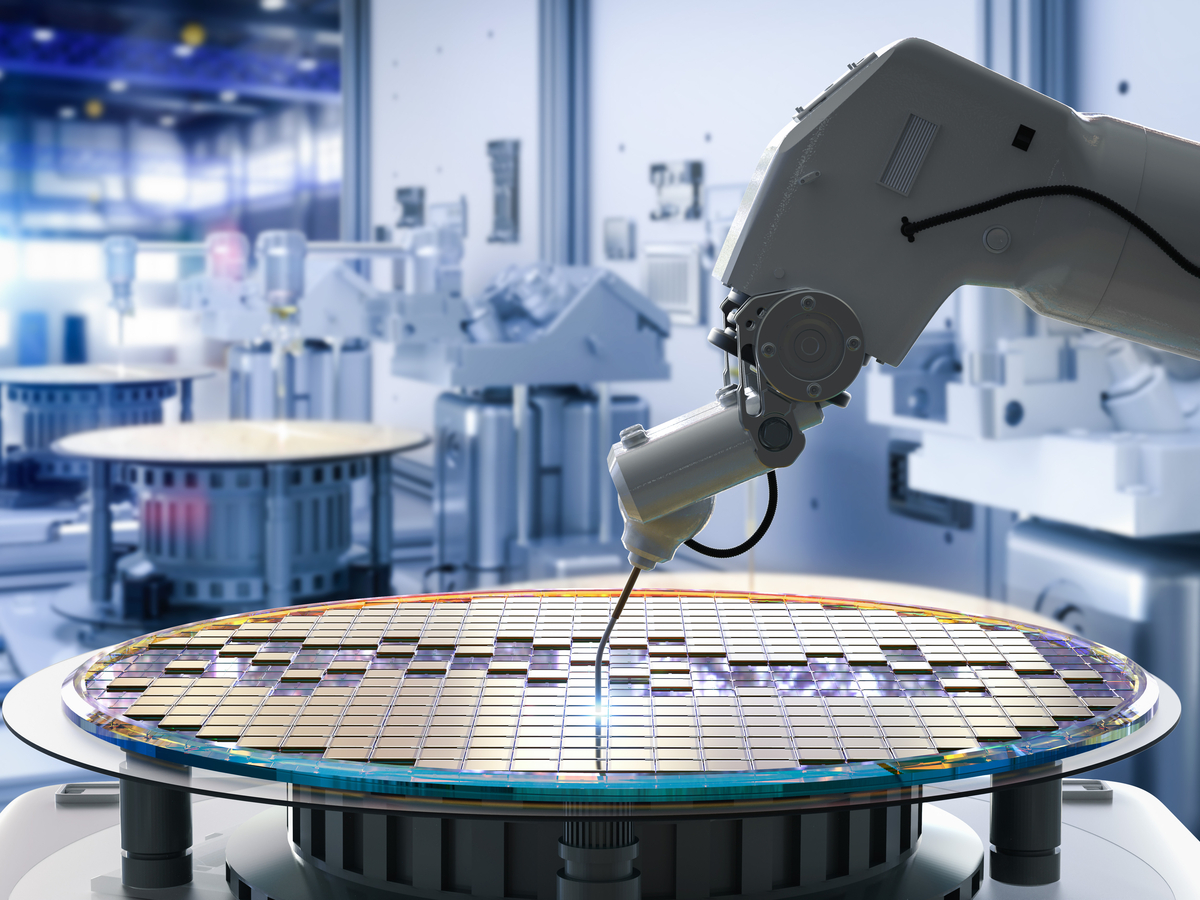

Nvidia (NVDA): The AI Powerhouse

Nvidia's dominance in the GPU market, particularly its pivotal role in artificial intelligence (AI) and machine learning (ML), makes it a high-growth, high-risk investment.

-

Strengths: NVDA is a clear leader in AI hardware, benefiting immensely from the burgeoning AI sector's exponential growth. The demand for its high-performance GPUs is surging across various applications, from data centers to autonomous vehicles. This positions NVDA at the forefront of a technological revolution. Their consistent innovation in GPU technology ensures they stay ahead of the competition.

-

Weaknesses: NVDA’s stock price is significantly more volatile than PANW's, reflecting its higher risk profile. Over-reliance on the AI sector could expose the company to significant downturns if the AI boom slows down. Furthermore, increasing competition in the GPU market could eventually impact their market share and profitability.

PANW vs. NVDA: The Verdict

Choosing between PANW and NVDA depends largely on your risk tolerance and investment horizon.

-

For conservative investors seeking steady growth and lower volatility: Palo Alto Networks (PANW) presents a more attractive option. Its strong fundamentals, recurring revenue model, and established market position provide a degree of stability.

-

For aggressive investors seeking potentially higher returns but accepting higher risk: Nvidia (NVDA) remains an enticing prospect. Its leading position in the rapidly expanding AI market offers significant growth potential, despite the inherent volatility.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions. The stock market is inherently risky, and past performance is not indicative of future results. Always invest responsibly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Which Tech Stock Is A Better Deal Post-Nasdaq Decline: PANW Or NVDA?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Aussie Airport Mayday Pilot Forced To Declare Emergency

Apr 08, 2025

Aussie Airport Mayday Pilot Forced To Declare Emergency

Apr 08, 2025 -

Sabrina Carpenter Fortnite Skin How To Get It With The Music Pass

Apr 08, 2025

Sabrina Carpenter Fortnite Skin How To Get It With The Music Pass

Apr 08, 2025 -

Shootout Victory For Abbotsford Canucks Over Laval Rocket 3 2

Apr 08, 2025

Shootout Victory For Abbotsford Canucks Over Laval Rocket 3 2

Apr 08, 2025 -

Mid April Deadline Irs Brings Back Fired Probationary Staff

Apr 08, 2025

Mid April Deadline Irs Brings Back Fired Probationary Staff

Apr 08, 2025 -

Ice Storm Damage Two Schools Remain Closed Assessment Underway

Apr 08, 2025

Ice Storm Damage Two Schools Remain Closed Assessment Underway

Apr 08, 2025