Why Is Meta (META) Stock Trading Higher Today? Analysis And Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why is Meta (META) Stock Trading Higher Today? Analysis and Outlook

Meta Platforms (META), the parent company of Facebook, Instagram, and WhatsApp, saw its stock price climb today, defying recent market trends. This unexpected surge has investors wondering: what's driving this upward momentum? Let's delve into the potential factors contributing to META's positive performance and analyze the outlook for the tech giant.

Positive Earnings Surprise and Future Projections:

While official earnings reports are still pending, market whispers and analyst predictions point towards a better-than-expected performance for the second quarter of 2024. Several factors are contributing to this optimism:

- Increased Advertising Revenue: Despite economic headwinds, Meta appears to be successfully navigating the advertising landscape. Reports suggest a robust increase in ad revenue, possibly fueled by improved targeting capabilities and a renewed focus on Reels, Instagram's short-form video platform, which is proving to be a strong competitor to TikTok.

- Cost-Cutting Measures: Meta's aggressive cost-cutting initiatives, including significant layoffs, are likely paying dividends. Streamlined operations and increased efficiency are contributing to improved profitability.

- AI Investments Bearing Fruit: Meta's significant investments in artificial intelligence are starting to yield positive results. Improved algorithms, personalized content delivery, and enhanced advertising capabilities are all contributing to revenue growth. The company's advancements in generative AI are also attracting investor attention.

H2: Beyond the Numbers: Other Contributing Factors

While strong financial performance is the primary driver, other factors could be influencing META's stock price increase:

- Improved User Engagement: Reports indicate a resurgence in user engagement across Meta's platforms, signaling a positive trend in user retention and growth. This is crucial for attracting advertisers and boosting revenue.

- Regulatory Headwinds Easing (Potentially): While regulatory scrutiny remains a concern for large tech companies, there might be a perception among investors that the worst is behind Meta. Any positive developments on this front would naturally boost investor confidence.

- Overall Market Sentiment: A general improvement in overall market sentiment, especially in the tech sector, could be lifting META's stock along with other tech giants.

H2: Outlook and Potential Risks

While today's price increase is encouraging, investors should approach the outlook with a degree of caution. Several potential risks remain:

- Competition: The competitive landscape remains intense, with TikTok posing a significant challenge, especially in the short-form video market. Meta needs to continue innovating to maintain its edge.

- Economic Uncertainty: Global economic uncertainty could still impact advertising spending, potentially affecting Meta's revenue stream.

- Regulatory Scrutiny: The regulatory environment for tech companies remains complex and unpredictable. Future regulatory actions could negatively impact Meta's operations and profitability.

H2: Conclusion: A Cautiously Optimistic View

The recent rise in META's stock price suggests a potential turning point for the company. Strong financial performance, driven by increased advertising revenue and cost-cutting measures, is a positive sign. However, investors should remain aware of the persistent challenges, including competition and economic uncertainty. While the outlook appears cautiously optimistic, it's crucial to monitor the situation closely and assess the upcoming official earnings report before making any significant investment decisions. Further analysis and expert opinions will be crucial in gauging the long-term sustainability of this upward trend. Stay tuned for further updates and in-depth analyses as they become available.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Is Meta (META) Stock Trading Higher Today? Analysis And Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dutch Mh 17 Fact Finding Team Responds To Icao Verdict

May 14, 2025

Dutch Mh 17 Fact Finding Team Responds To Icao Verdict

May 14, 2025 -

The Office Legacy Continues The Paper Spin Off Coming To Peacock In September

May 14, 2025

The Office Legacy Continues The Paper Spin Off Coming To Peacock In September

May 14, 2025 -

Decouvrez L Interview Exclusive De Brigitte Bardot Son Premier Entretien Filme En Dix Ans

May 14, 2025

Decouvrez L Interview Exclusive De Brigitte Bardot Son Premier Entretien Filme En Dix Ans

May 14, 2025 -

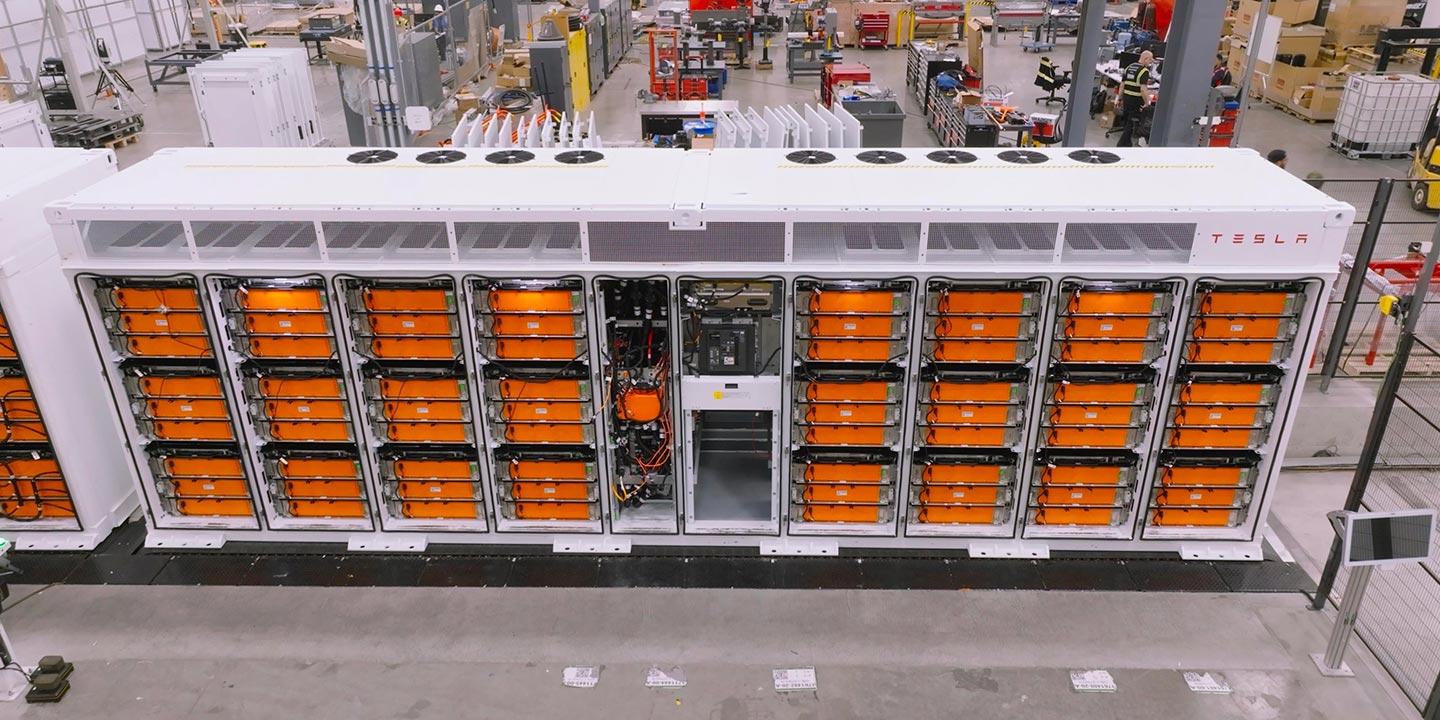

Teslas Battery Supply Chain Challenges And Solutions

May 14, 2025

Teslas Battery Supply Chain Challenges And Solutions

May 14, 2025 -

Mothers Day Pain Malaysian Elephants Sorrow Over Lost Calf Goes Viral

May 14, 2025

Mothers Day Pain Malaysian Elephants Sorrow Over Lost Calf Goes Viral

May 14, 2025

Latest Posts

-

Cannes Film Festivals Stricter Dress Code Is Naked Dressing Officially Out

May 14, 2025

Cannes Film Festivals Stricter Dress Code Is Naked Dressing Officially Out

May 14, 2025 -

Celtics Knicks Series 5 Crucial Moments That Defined Game 4

May 14, 2025

Celtics Knicks Series 5 Crucial Moments That Defined Game 4

May 14, 2025 -

The Resilience Of Evergreen A Case Study In Dualities

May 14, 2025

The Resilience Of Evergreen A Case Study In Dualities

May 14, 2025 -

The Paper New Office Spinoff Headlines Peacocks 2025 26 Fall Lineup

May 14, 2025

The Paper New Office Spinoff Headlines Peacocks 2025 26 Fall Lineup

May 14, 2025 -

The Launch Of Zohran Mamdanis Wife Context And Implications

May 14, 2025

The Launch Of Zohran Mamdanis Wife Context And Implications

May 14, 2025