Why Is Meta (META) Stock Up? Examining Recent Market Trends

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why is Meta (META) Stock Up? Examining Recent Market Trends

Meta Platforms (META), formerly known as Facebook, has seen its stock price experience significant fluctuations in recent years. However, recent upward trends have investors curious. This article delves into the key factors contributing to the rise in META stock, examining the recent market trends and offering insights into the future potential of this tech giant.

H2: The Resurgence of Meta: Key Factors Driving Stock Growth

Several interconnected factors have contributed to the recent boost in Meta's stock price. It's not a single event, but a confluence of positive developments:

-

Stronger-than-Expected Earnings Reports: Meta's recent financial reports have exceeded analysts' expectations, showcasing a robust recovery in advertising revenue and a growing user base. This positive financial performance reassures investors, demonstrating the company's ability to navigate economic headwinds and capitalize on emerging opportunities. The focus on efficiency and cost-cutting measures has also played a significant role in improved profitability.

-

The Rise of Reels and Short-Form Video: Meta's aggressive push into short-form video content, mirroring the success of TikTok, has proven fruitful. Reels, Meta's answer to TikTok, is attracting a significant younger demographic, boosting engagement and, consequently, advertising revenue. This strategic adaptation demonstrates Meta's willingness to innovate and compete effectively in a rapidly evolving digital landscape.

-

Investment in the Metaverse: While still in its early stages, Meta's continued investment in the metaverse continues to garner attention. Though profitability in this sector remains elusive, the long-term potential is seen by some analysts as a significant driver of future growth. The persistent focus on AR/VR technologies and the development of immersive experiences keeps Meta relevant in the forefront of technological innovation.

-

Improved User Engagement and Retention: Increased user engagement across its platforms—Facebook, Instagram, WhatsApp, and Messenger—demonstrates the enduring appeal of Meta's ecosystem. Higher engagement translates to greater opportunities for targeted advertising, a crucial revenue stream for the company. This improved retention speaks to the platform's ability to remain a central hub for social interaction.

-

Overall Market Sentiment: The broader tech sector has experienced periods of growth, positively impacting Meta's stock price. Investor confidence in the tech industry, coupled with the company's own positive performance indicators, has contributed to a more bullish outlook on META.

H2: Challenges and Risks Remaining for Meta

Despite the recent positive trends, Meta still faces significant challenges:

-

Competition: The intense competition from other social media platforms, particularly TikTok, remains a significant hurdle. Maintaining its market share and attracting new users requires continuous innovation and adaptation.

-

Regulatory Scrutiny: Meta continues to face regulatory scrutiny regarding data privacy and antitrust concerns. The ongoing legal battles and potential fines could negatively impact the company's financial performance and investor confidence.

-

Economic Uncertainty: The global economic climate remains uncertain, with potential for recessionary pressures. This macroeconomic uncertainty could dampen advertising spending, impacting Meta's revenue streams.

H2: Conclusion: A Cautiously Optimistic Outlook for META

While the recent upward trend in Meta's stock price is encouraging, investors should maintain a balanced perspective. The company's success depends on its ability to navigate ongoing challenges, continue to innovate, and deliver consistent financial performance. The factors mentioned above suggest a cautiously optimistic outlook for META, but careful monitoring of the market and company developments is crucial for informed investment decisions. The long-term potential of the metaverse and the continued strength of its core platforms remain key factors to watch.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Is Meta (META) Stock Up? Examining Recent Market Trends. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Conheca As Melhores Opcoes De Fracionamento De Casas De Praia E Campo

May 13, 2025

Conheca As Melhores Opcoes De Fracionamento De Casas De Praia E Campo

May 13, 2025 -

Singer Tina Arena Calls Out Concertgoers For Improper Toilet Use

May 13, 2025

Singer Tina Arena Calls Out Concertgoers For Improper Toilet Use

May 13, 2025 -

Health Alert Rising Measles Cases Expected During Summer Travel Season

May 13, 2025

Health Alert Rising Measles Cases Expected During Summer Travel Season

May 13, 2025 -

Tech Deep Dive Exploring Panasonics Entire 2025 Television Offering

May 13, 2025

Tech Deep Dive Exploring Panasonics Entire 2025 Television Offering

May 13, 2025 -

Wiggins From Cycling Glory To Cocaine Addiction Battle

May 13, 2025

Wiggins From Cycling Glory To Cocaine Addiction Battle

May 13, 2025

Latest Posts

-

Honda Profits To Plummet Impact Of Trumps Tariffs On Japans Automaker

May 14, 2025

Honda Profits To Plummet Impact Of Trumps Tariffs On Japans Automaker

May 14, 2025 -

Dutch Mh 17 Fact Finding Team Responds To Icao Verdict

May 14, 2025

Dutch Mh 17 Fact Finding Team Responds To Icao Verdict

May 14, 2025 -

Panasonics 2025 Oled Tvs A Comprehensive Overview Of The New Range

May 14, 2025

Panasonics 2025 Oled Tvs A Comprehensive Overview Of The New Range

May 14, 2025 -

Lawsuit Claims Paid Sex Act Urination And Diddys Alleged Involvement

May 14, 2025

Lawsuit Claims Paid Sex Act Urination And Diddys Alleged Involvement

May 14, 2025 -

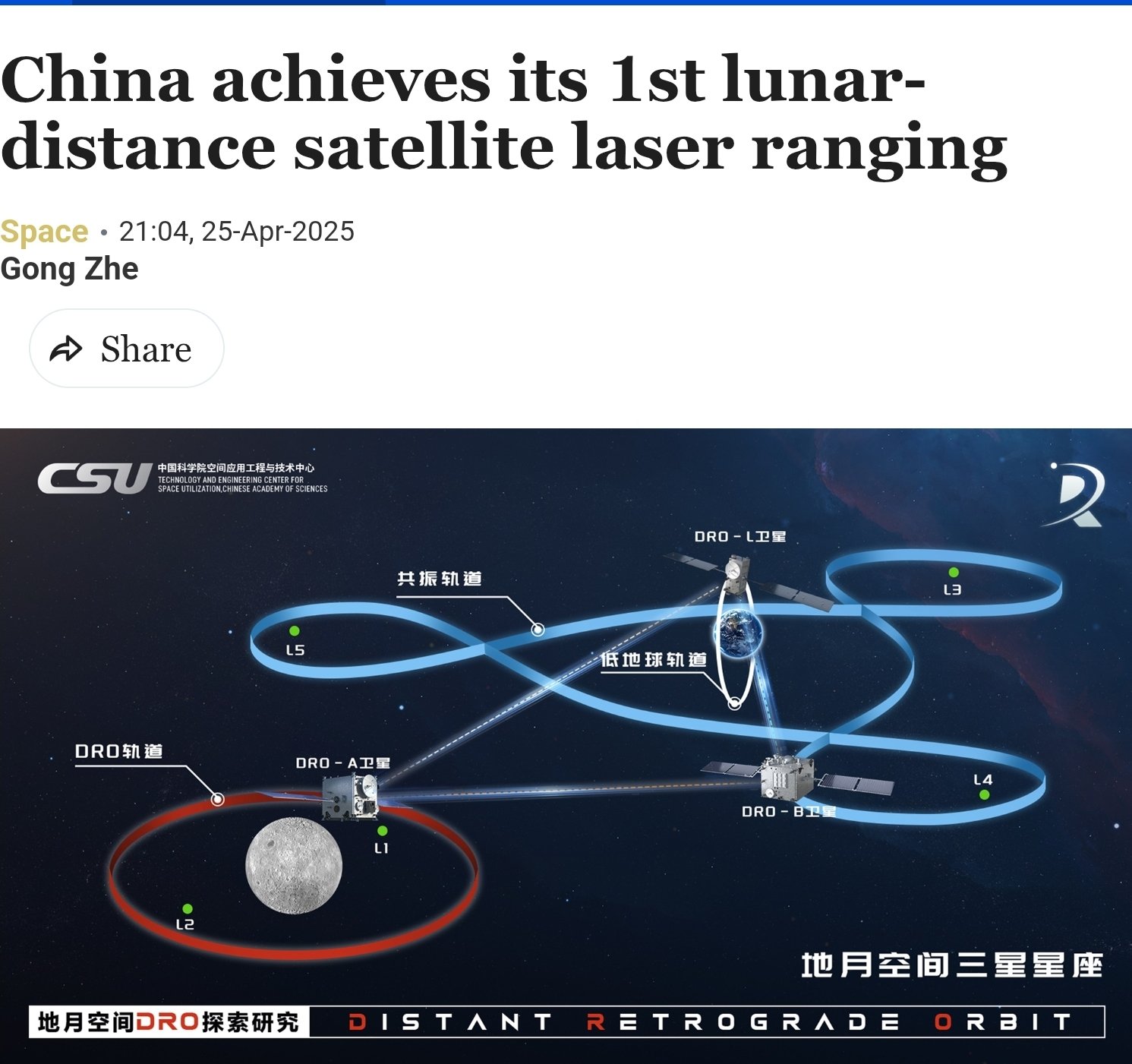

Analysis Of Chinas Successful Satellite Laser Ranging To The Moon

May 14, 2025

Analysis Of Chinas Successful Satellite Laser Ranging To The Moon

May 14, 2025