Why Is Tesla Stock Falling? Analyzing Today's Market Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why is Tesla Stock Falling? Analyzing Today's Market Performance

Tesla, the electric vehicle giant, has seen its stock price experience significant volatility in recent months. Today's market performance is just the latest chapter in this ongoing saga, leaving investors wondering: what's driving this downturn? Let's delve into the key factors contributing to Tesla's falling stock price and analyze the current market situation.

The Perfect Storm: A Confluence of Factors

Several interconnected factors are contributing to Tesla's recent stock decline. It's not a single issue, but rather a perfect storm of challenges impacting investor confidence.

1. Elon Musk's Influence and Twitter: Elon Musk's actions, particularly his controversial acquisition and management of Twitter, have undeniably impacted Tesla's stock performance. His frequent tweets, sometimes controversial or unpredictable, create uncertainty among investors. This uncertainty translates into market volatility and can trigger sell-offs. The perceived distraction Musk's Twitter involvement presents to his core responsibilities at Tesla is a major concern for many analysts.

2. Increased Competition in the EV Market: The electric vehicle market is rapidly expanding, with established automakers like Ford, General Motors, and Volkswagen aggressively entering the fray. This intensifying competition puts pressure on Tesla's market share and profit margins, impacting investor sentiment. The rise of new Chinese EV manufacturers further complicates the landscape.

3. Macroeconomic Headwinds: Global macroeconomic factors also play a significant role. Rising interest rates, inflation, and recessionary fears are impacting the overall market, and Tesla is not immune. Investors are becoming more risk-averse, leading to sell-offs in growth stocks like Tesla.

4. Production and Delivery Challenges: While Tesla continues to ramp up production, challenges related to supply chain disruptions and logistics can impact delivery timelines and ultimately affect quarterly earnings. Any shortfall in meeting production targets can negatively impact investor confidence.

5. Valuation Concerns: Tesla's stock price has historically been driven by high growth expectations. However, as competition increases and economic uncertainty looms, concerns about Tesla's valuation relative to its future earnings become more pronounced. Some analysts believe the stock is overvalued compared to its current performance.

Analyzing Today's Specific Market Performance:

Today's drop in Tesla's stock price is likely a result of a combination of these factors. News headlines, analyst reports, and even social media sentiment all contribute to the daily fluctuations. To understand today's specific decline, it's crucial to look at the news cycle and identify any specific triggers, such as:

- New competitor announcements: A major announcement from a competitor could trigger sell-offs.

- Negative earnings reports or forecasts: Any news suggesting a slowdown in Tesla's growth or lower-than-expected earnings will negatively impact the stock.

- Regulatory developments: Changes in regulations or government policies affecting the EV industry can create uncertainty.

What Does the Future Hold for Tesla Stock?

Predicting the future of Tesla's stock is challenging, but understanding these key drivers is crucial for investors. The company's long-term prospects still hinge on its innovation, ability to maintain market share in a competitive environment, and the overall health of the global economy. Investors should carefully consider their risk tolerance and diversification strategies before making any investment decisions.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Is Tesla Stock Falling? Analyzing Today's Market Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ai Driven Job Cuts Ibm And Crowdstrike Lay Off Hundreds

May 13, 2025

Ai Driven Job Cuts Ibm And Crowdstrike Lay Off Hundreds

May 13, 2025 -

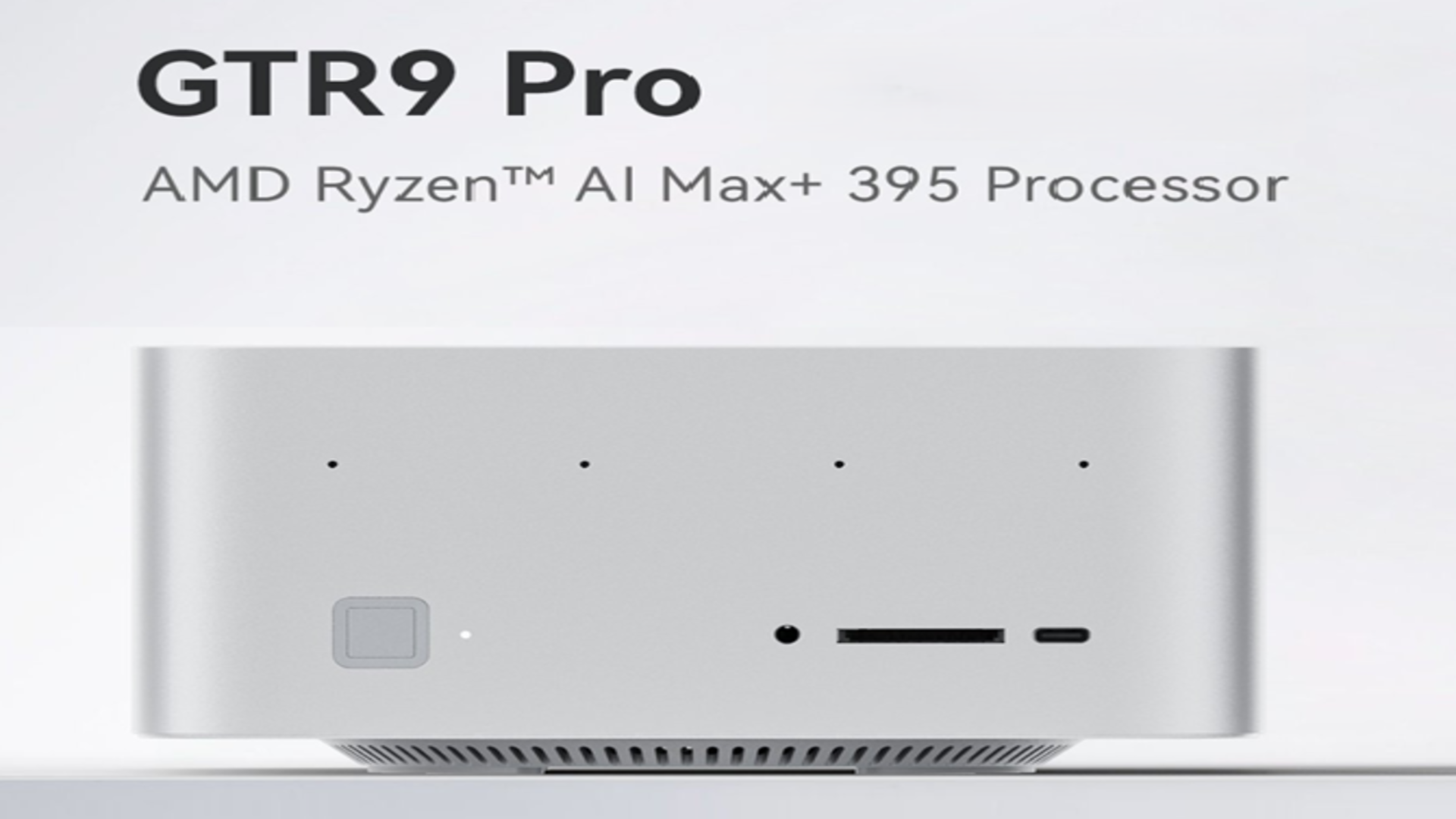

Amd Based Ai Workstation From Obscure Chinese Firm Rivals Nvidias Dgx Spark

May 13, 2025

Amd Based Ai Workstation From Obscure Chinese Firm Rivals Nvidias Dgx Spark

May 13, 2025 -

Farewell To A Great Bob Cowpers Passing Saddens Australian Cricket

May 13, 2025

Farewell To A Great Bob Cowpers Passing Saddens Australian Cricket

May 13, 2025 -

Upcoming Sony Xperia 1 Vii A Comprehensive Leak Details Design And Specs

May 13, 2025

Upcoming Sony Xperia 1 Vii A Comprehensive Leak Details Design And Specs

May 13, 2025 -

Your Thoughts Your Reality The Power Of Mental Strength

May 13, 2025

Your Thoughts Your Reality The Power Of Mental Strength

May 13, 2025

Latest Posts

-

Greg Abel Assume O Leme Dos Investimentos Da Berkshire Sucessao De Buffett Definida

May 13, 2025

Greg Abel Assume O Leme Dos Investimentos Da Berkshire Sucessao De Buffett Definida

May 13, 2025 -

Panama Ports Dispute Li Ka Shings Retirement Doesnt Explain The High Stakes

May 13, 2025

Panama Ports Dispute Li Ka Shings Retirement Doesnt Explain The High Stakes

May 13, 2025 -

Trump Xi Agree To 90 Day Trade War Pause

May 13, 2025

Trump Xi Agree To 90 Day Trade War Pause

May 13, 2025 -

Is Apple Rescuing Google Examining Their Strategic Partnership

May 13, 2025

Is Apple Rescuing Google Examining Their Strategic Partnership

May 13, 2025 -

Episode 3 Why Scientific Research Matters Even In War

May 13, 2025

Episode 3 Why Scientific Research Matters Even In War

May 13, 2025