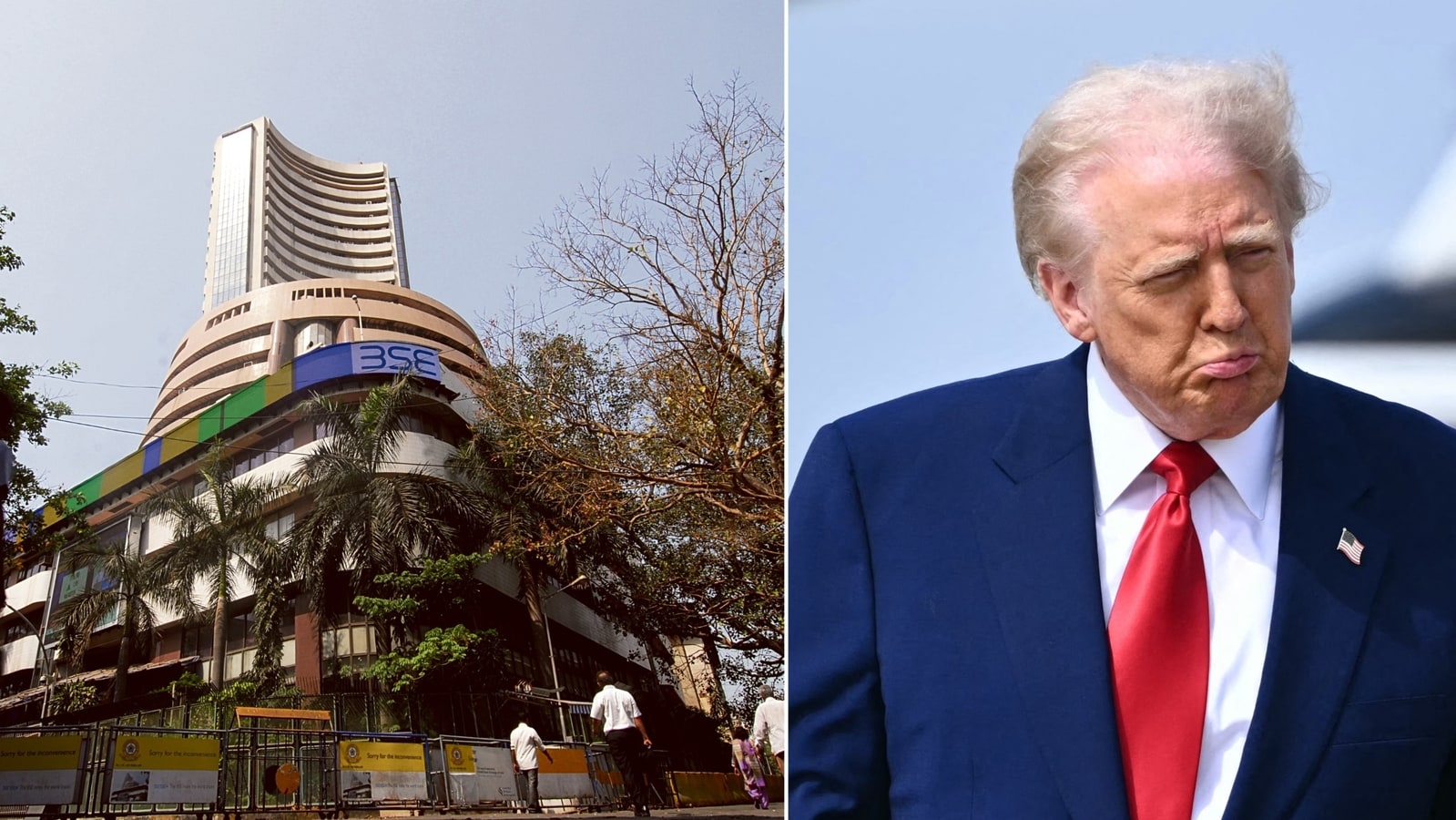

Why Is The Indian Stock Market Crashing? Analyzing The Sensex And Nifty Drop

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why is the Indian Stock Market Crashing? Analyzing the Sensex and Nifty Drop

The Indian stock market, once a beacon of steady growth, has recently experienced a significant downturn, leaving investors worried and analysts scrambling for explanations. The Sensex and Nifty, key indicators of the market's health, have witnessed considerable drops, prompting urgent questions about the underlying causes and potential future trajectories. This article delves into the factors contributing to this market correction, offering a comprehensive analysis for investors and market enthusiasts alike.

The Global Impact: A Ripple Effect on India

The global economic landscape plays a significant role in India's market performance. The current downturn isn't isolated; global uncertainties are contributing significantly.

-

Inflationary Pressures: Persistent global inflation, fueled by supply chain disruptions and geopolitical instability, has led to aggressive interest rate hikes by central banks worldwide. This directly impacts borrowing costs for businesses, slowing down economic activity and reducing investor confidence. Higher interest rates make investments in stocks less attractive compared to bonds offering higher returns.

-

US Federal Reserve Actions: The US Federal Reserve's monetary policy decisions have a profound impact on emerging markets like India. Aggressive rate hikes in the US attract capital away from developing economies, putting downward pressure on their currencies and stock markets. This capital flight is a major factor contributing to the current Sensex and Nifty drop.

-

Geopolitical Tensions: The ongoing Russia-Ukraine conflict and escalating geopolitical tensions create uncertainty in the global market. This uncertainty discourages investment and contributes to market volatility, impacting even relatively stable economies like India's.

Domestic Challenges: Internal Factors Fueling the Decline

While global factors play a crucial role, internal challenges within the Indian economy are also contributing to the market's decline.

-

High Crude Oil Prices: India is a significant importer of crude oil. Sustained high crude oil prices increase the country's import bill, widening the current account deficit and putting pressure on the Rupee. This weakens investor confidence and can lead to a sell-off in the stock market.

-

Rupee Depreciation: The weakening of the Indian Rupee against the US dollar further exacerbates the situation. Imports become more expensive, impacting inflation and reducing the attractiveness of Indian assets to foreign investors.

-

Domestic Inflation: While global inflation contributes, domestic inflationary pressures, driven by factors like food and fuel prices, are also impacting consumer sentiment and business confidence, leading to a bearish market outlook.

Analyzing the Sensex and Nifty Drop: A Closer Look

The Sensex and Nifty, representing the 30 largest and 50 largest companies listed on the National Stock Exchange of India (NSE) and Bombay Stock Exchange (BSE), respectively, are reflecting the broader market sentiment. Their recent decline indicates a general lack of investor confidence. The specific impact on individual stocks varies depending on their sector and exposure to global and domestic factors.

What's Next? Potential Scenarios and Investor Strategies

The future trajectory of the Indian stock market remains uncertain. While the current downturn is concerning, it's crucial to avoid panic selling. Investors should adopt a long-term perspective and consider the following:

-

Diversification: A well-diversified portfolio can help mitigate risk. Spreading investments across various asset classes and sectors can lessen the impact of market fluctuations.

-

Risk Assessment: Understanding your risk tolerance is vital. Investors with a lower risk tolerance may consider shifting to less volatile investment options.

-

Long-Term Investment: Market corrections are a natural part of the economic cycle. A long-term investment strategy, focused on fundamental analysis and sound financial planning, can help weather these storms.

Conclusion:

The Indian stock market's current decline is a complex issue stemming from both global and domestic factors. While the immediate outlook may seem bearish, understanding the underlying causes and adopting a strategic approach can help investors navigate this period of uncertainty. Continuous monitoring of economic indicators, geopolitical developments, and company-specific performance is crucial for making informed investment decisions. Remember to consult with a financial advisor for personalized guidance tailored to your specific financial situation and risk tolerance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Is The Indian Stock Market Crashing? Analyzing The Sensex And Nifty Drop. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Actor Jacob Elordi Discusses His Role In The Narrow Road To The Deep North

Apr 07, 2025

Actor Jacob Elordi Discusses His Role In The Narrow Road To The Deep North

Apr 07, 2025 -

Dampak Perang Dagang Bagaimana China Bisa Mempengaruhi Ekonomi As

Apr 07, 2025

Dampak Perang Dagang Bagaimana China Bisa Mempengaruhi Ekonomi As

Apr 07, 2025 -

I Make Things Up Mac Kenzie Weegar On Dealing With Communication Challenges

Apr 07, 2025

I Make Things Up Mac Kenzie Weegar On Dealing With Communication Challenges

Apr 07, 2025 -

The Complete Guide To Ai Understanding And Harnessing The Power Of Artificial Intelligence

Apr 07, 2025

The Complete Guide To Ai Understanding And Harnessing The Power Of Artificial Intelligence

Apr 07, 2025 -

Bth Mbashr Mbarat Brshlwnt Wryal Bytys Rabt Mshahdt Hsry

Apr 07, 2025

Bth Mbashr Mbarat Brshlwnt Wryal Bytys Rabt Mshahdt Hsry

Apr 07, 2025