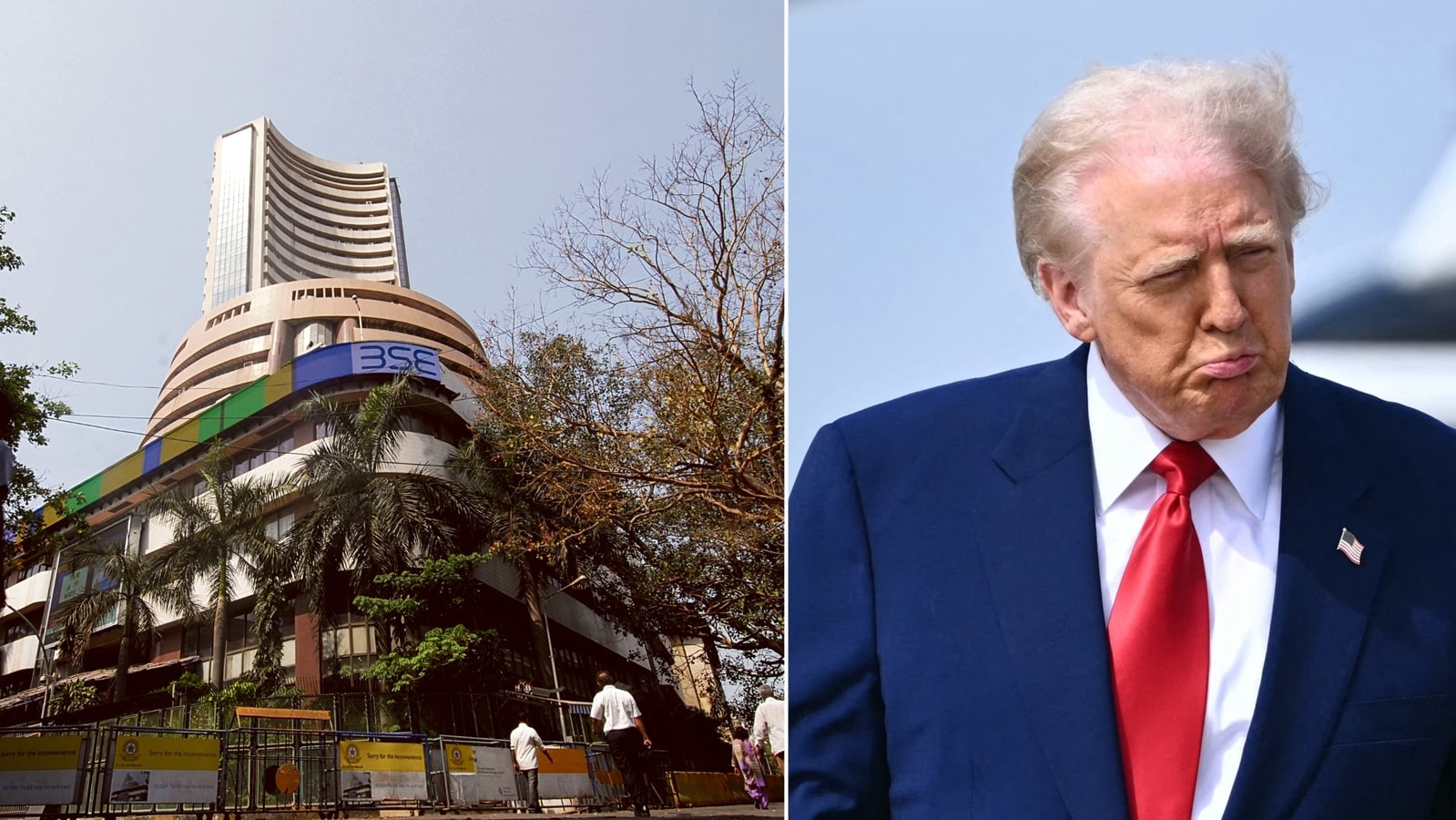

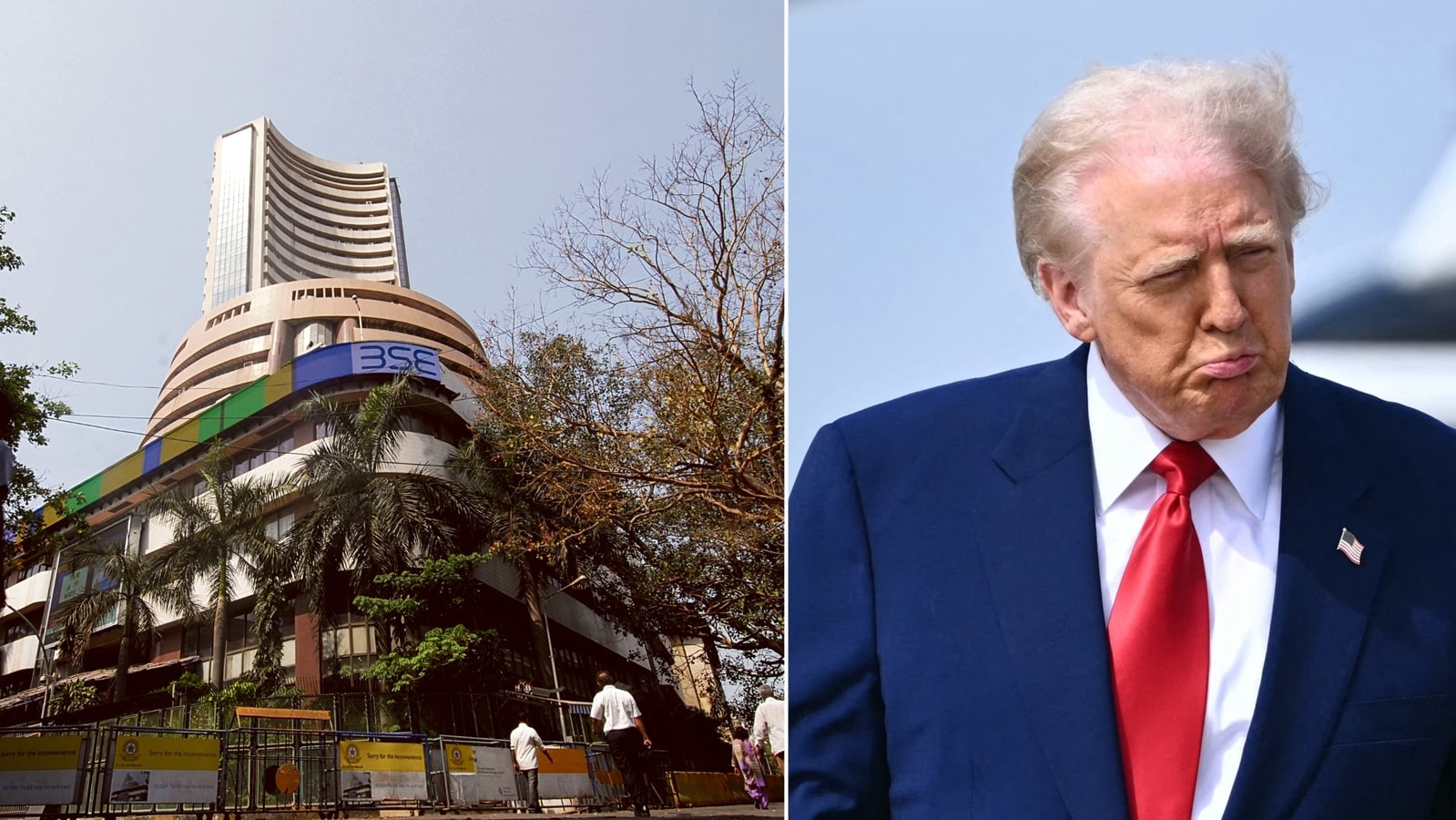

Why Is The Indian Stock Market Crashing? Understanding The Sensex And Nifty Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why is the Indian Stock Market Crashing? Understanding the Sensex and Nifty Decline

The Indian stock market, reflected in the Sensex and Nifty indices, has recently experienced a significant downturn, leaving investors worried and seeking answers. While market fluctuations are normal, the current decline warrants a closer look at the contributing factors. This article delves into the key reasons behind the Sensex and Nifty's recent fall, providing a comprehensive understanding for both seasoned investors and newcomers to the market.

Global Economic Headwinds: A Major Contributor

The primary driver of the current market downturn is the challenging global economic landscape. Several interconnected factors are at play:

-

Global Inflation and Interest Rate Hikes: Persistent inflation globally has forced central banks, including the US Federal Reserve, to aggressively raise interest rates. This impacts India indirectly, as higher interest rates in developed economies attract foreign investment away from emerging markets like India, reducing liquidity and putting downward pressure on the rupee. The stronger dollar also makes Indian exports more expensive.

-

Geopolitical Uncertainty: The ongoing Russia-Ukraine conflict continues to disrupt global supply chains and fuel energy prices, contributing to inflationary pressures worldwide. Geopolitical instability generally creates uncertainty in the market, leading to risk aversion among investors.

-

Slowing Global Growth: Forecasts for global economic growth are being revised downward, fueling concerns about a potential global recession. This negative sentiment naturally spills over into emerging markets like India.

Domestic Concerns Adding to the Pressure

While global factors play a significant role, several domestic issues are exacerbating the decline of the Sensex and Nifty:

-

High Inflation in India: While inflation is easing slightly, it remains a concern for the Reserve Bank of India (RBI), which continues its own interest rate hikes to control prices. Higher interest rates increase borrowing costs for businesses, impacting investment and potentially slowing economic growth.

-

Rupee Depreciation: The weakening Indian rupee against the US dollar increases the cost of imports, further fueling inflation and potentially impacting corporate earnings.

-

Foreign Institutional Investor (FII) Outflows: FIIs have been net sellers in the Indian stock market recently, withdrawing significant capital. This outflow reduces liquidity and puts further downward pressure on prices. Concerns about global economic slowdown and rising interest rates are key drivers of this trend.

-

Sector-Specific Challenges: Certain sectors within the Indian economy, such as technology and real estate, are facing specific challenges impacting their stock performance.

Understanding the Sensex and Nifty

The Sensex (BSE SENSEX) and Nifty 50 (NSE NIFTY 50) are the two most prominent stock market indices in India. They track the performance of 30 and 50 of the largest and most actively traded companies listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), respectively. Their movements reflect the overall health of the Indian economy and investor sentiment.

What Investors Should Do

The current market volatility presents both challenges and opportunities. Investors should:

-

Maintain a Long-Term Perspective: Market fluctuations are inevitable. A long-term investment strategy, focused on fundamental analysis and diversification, is crucial to weathering short-term downturns.

-

Review Your Portfolio: Assess your risk tolerance and rebalance your portfolio if necessary. Consider shifting towards less volatile assets if needed.

-

Stay Informed: Keep up-to-date with economic news and market trends to make informed decisions.

Conclusion

The decline in the Sensex and Nifty is a complex issue stemming from a combination of global and domestic factors. While the current situation presents challenges, investors who maintain a long-term perspective, diversify their investments, and stay informed can navigate the volatility and potentially benefit from future market rebounds. Understanding the underlying causes provides a crucial foundation for making informed investment decisions in these uncertain times.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Is The Indian Stock Market Crashing? Understanding The Sensex And Nifty Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fake Contest Of Ideas Hobart Stadiums Agonocracy Event

Apr 07, 2025

Fake Contest Of Ideas Hobart Stadiums Agonocracy Event

Apr 07, 2025 -

Near Miss Boeing Starliners Tense Docking Attempt At The Iss

Apr 07, 2025

Near Miss Boeing Starliners Tense Docking Attempt At The Iss

Apr 07, 2025 -

Los Angeles Angels Offense Unleashed In Dominant Win Against Cleveland Guardians

Apr 07, 2025

Los Angeles Angels Offense Unleashed In Dominant Win Against Cleveland Guardians

Apr 07, 2025 -

Tense Moments Boeing Starliners Near Miss During International Space Station Docking

Apr 07, 2025

Tense Moments Boeing Starliners Near Miss During International Space Station Docking

Apr 07, 2025 -

2 Promising Stocks Amidst Market Uncertainty

Apr 07, 2025

2 Promising Stocks Amidst Market Uncertainty

Apr 07, 2025