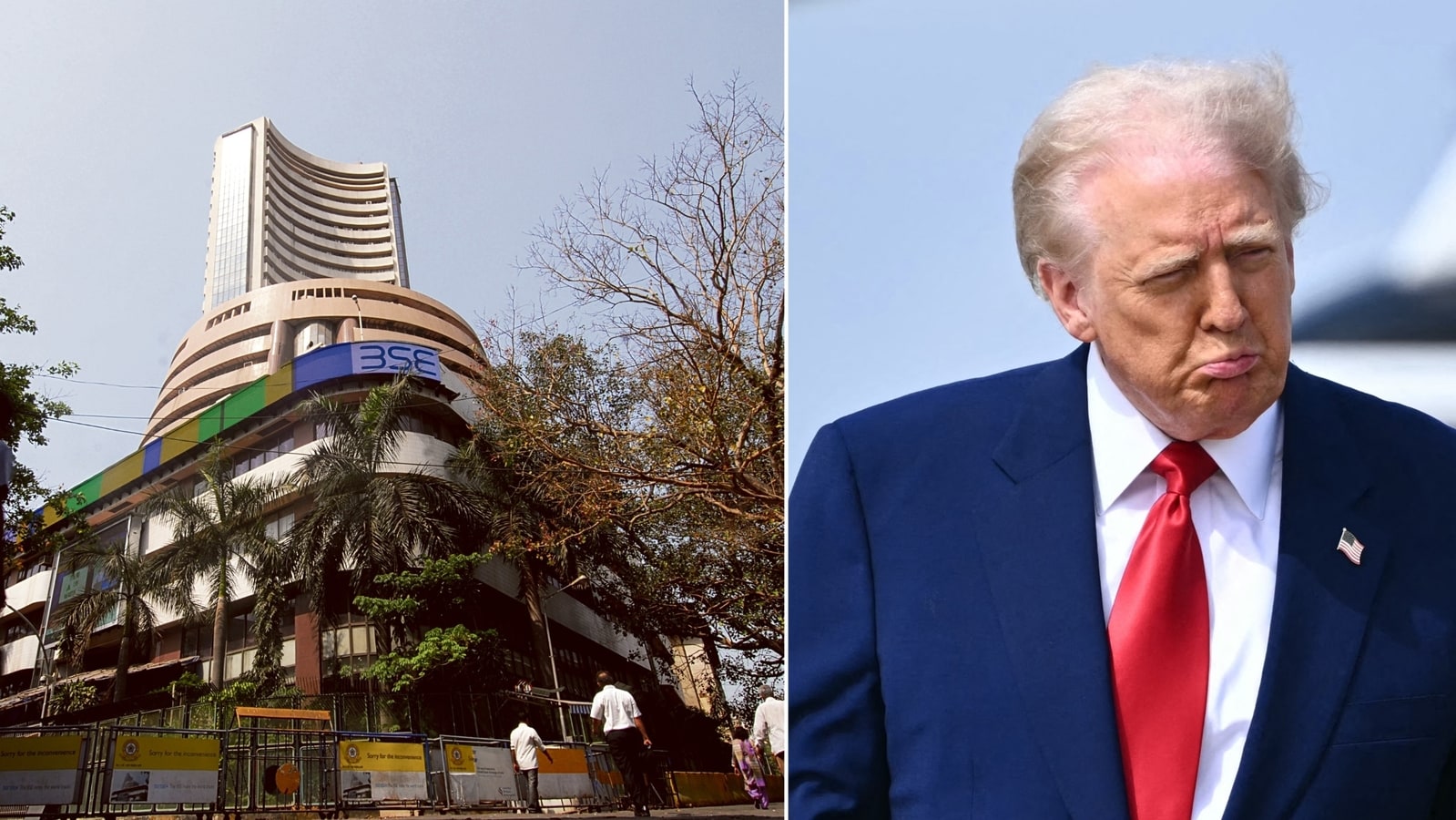

Why Is The Indian Stock Market Crashing? Understanding Today's Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why is the Indian Stock Market Crashing? Understanding Today's Decline

The Indian stock market experienced a significant downturn today, leaving investors wondering about the causes behind this sudden decline. While pinpointing a single reason is impossible, a confluence of factors likely contributed to the market's volatility. Understanding these contributing elements is crucial for navigating the current uncertainty and making informed investment decisions.

Global Economic Headwinds: The global economy is facing a complex interplay of challenges. High inflation rates in many developed nations have forced central banks to aggressively raise interest rates. This tightening monetary policy aims to curb inflation but also slows economic growth, impacting global markets, including India's. The ripple effects of the ongoing war in Ukraine, persistent supply chain disruptions, and a potential global recession are all weighing heavily on investor sentiment. These global uncertainties often translate into risk aversion, leading to capital flight from emerging markets like India.

Domestic Economic Concerns: Beyond global factors, domestic economic concerns also play a significant role. While India's economy continues to show resilience, challenges remain. Rising inflation, although easing slightly, still impacts consumer spending and business investment. Concerns about the monsoon season's impact on agricultural output and rural demand also contribute to investor anxiety. Furthermore, any potential policy changes or regulatory announcements can trigger market fluctuations.

Foreign Institutional Investor (FII) Outflow: FIIs have been significant players in the Indian stock market. Their investment decisions, often driven by global macroeconomic trends and risk appetite, can heavily influence market movements. Recent outflows by FIIs, driven by concerns about global economic slowdown and rising interest rates in developed markets, have contributed to the current market decline. This capital outflow puts downward pressure on stock prices.

Sector-Specific Weakness: The market decline isn't uniform across all sectors. Certain sectors are experiencing more significant pressure than others. For example, technology stocks, often sensitive to interest rate hikes and global economic growth, have seen a considerable downturn. Understanding the specific factors affecting individual sectors is vital for assessing risk and opportunity.

Technical Factors: Beyond fundamental economic factors, technical analysis plays a role in understanding market movements. Factors such as chart patterns, trading volume, and market sentiment indicators can provide clues about potential price direction. Short-term corrections and profit-booking are also common occurrences in any market, leading to temporary declines.

What Investors Should Do:

- Stay informed: Keep abreast of global and domestic economic developments to understand the broader context of the market's movement.

- Diversify your portfolio: Don't put all your eggs in one basket. A diversified portfolio across different asset classes and sectors can mitigate risk.

- Long-term perspective: Market fluctuations are normal. Maintain a long-term investment strategy based on your financial goals and risk tolerance.

- Consult a financial advisor: Seek professional advice tailored to your individual circumstances before making significant investment decisions.

The Indian stock market's recent decline is a complex issue with multiple contributing factors. While the current volatility is concerning, understanding the underlying causes can help investors make more informed decisions and navigate this challenging period. Remember that markets fluctuate, and a long-term perspective is crucial for successful investing. Stay informed, stay diversified, and consult with a financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Is The Indian Stock Market Crashing? Understanding Today's Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

When Is Tik Tok Banned A Comprehensive Overview

Apr 08, 2025

When Is Tik Tok Banned A Comprehensive Overview

Apr 08, 2025 -

Australias Matildas Face South Korea In Friendly Live Updates

Apr 08, 2025

Australias Matildas Face South Korea In Friendly Live Updates

Apr 08, 2025 -

Controversy Swirls As Former Nhl Player Named Cambridge Redhawks Coach

Apr 08, 2025

Controversy Swirls As Former Nhl Player Named Cambridge Redhawks Coach

Apr 08, 2025 -

Community Impact Two Schools Stay Shut After Severe Ice Storm

Apr 08, 2025

Community Impact Two Schools Stay Shut After Severe Ice Storm

Apr 08, 2025 -

Decentralized Gamings Resilience Analyzing Web3 Game Fi Growth Despite Price Corrections

Apr 08, 2025

Decentralized Gamings Resilience Analyzing Web3 Game Fi Growth Despite Price Corrections

Apr 08, 2025