Will Bitcoin Become Legal Tender In The US? Lessons From El Salvador's Experiment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Bitcoin Become Legal Tender in the US? Lessons from El Salvador's Experiment

Bitcoin's meteoric rise has sparked fervent debate worldwide, with one question consistently dominating headlines: will Bitcoin become legal tender in the United States? While the prospect remains highly unlikely in the near future, examining El Salvador's controversial experiment offers valuable lessons for understanding the complexities and potential pitfalls of such a dramatic monetary shift. This article delves into the El Salvadorian experience, analyzing its successes and failures to shed light on the challenges facing any nation considering Bitcoin legalization.

El Salvador's Bold Move: A Bitcoin Gamble?

In September 2021, El Salvador became the first country to adopt Bitcoin as legal tender, alongside the US dollar. President Nayib Bukele championed the move, promising financial inclusion and economic growth. The initial rollout was met with a mix of excitement and skepticism, with proponents touting Bitcoin's potential to bypass traditional banking systems and attract foreign investment.

Initial Hype vs. Harsh Reality: Analyzing the El Salvadorian Experience

While the initial adoption saw a surge in Bitcoin adoption among some segments of the population, particularly those unbanked, the reality proved far more complex. The experiment hasn't been without its significant challenges:

-

Volatility Concerns: Bitcoin's inherent volatility presented immediate problems. The value of Bitcoin fluctuated wildly, impacting the purchasing power of Salvadorans and causing economic uncertainty. This volatility made it difficult for businesses to price goods and services effectively.

-

Lack of Infrastructure: Insufficient infrastructure to support Bitcoin transactions hampered widespread adoption. Many Salvadorans lacked the technological literacy or access to the necessary devices to utilize Bitcoin effectively. The Chivo wallet, the government-backed Bitcoin wallet, faced numerous technical glitches and security concerns, further exacerbating the problem.

-

Resistance from the Population: A significant portion of the Salvadoran population resisted the adoption of Bitcoin, preferring the stability of the US dollar. This resistance, combined with the lack of widespread understanding of cryptocurrency, hindered the overall success of the initiative.

-

Environmental Impact Concerns: Bitcoin's energy-intensive mining process raised significant environmental concerns, a factor largely ignored during the initial push for adoption.

The US Scenario: A Different Landscape

The US context differs significantly from El Salvador's. The US boasts a robust and established financial infrastructure, a highly developed banking system, and a sophisticated regulatory framework. Introducing Bitcoin as legal tender would require navigating a complex web of legal, regulatory, and economic considerations. The potential consequences for the US economy, given its global influence, would be far-reaching and potentially destabilizing.

Key Differences and Obstacles to US Bitcoin Legal Tender Status:

-

Regulatory Hurdles: The US regulatory landscape poses significant challenges. Multiple agencies, including the Securities and Exchange Commission (SEC) and the Federal Reserve, would need to agree on a framework for Bitcoin regulation before it could be considered as legal tender.

-

Economic Stability Concerns: The US dollar's dominance in global finance makes any shift away from it exceptionally risky. The introduction of a volatile cryptocurrency like Bitcoin could destabilize the economy and erode public trust in the financial system.

-

Security Risks and Cyber Threats: The potential for increased cybercrime and money laundering associated with Bitcoin adoption is a serious concern that would need to be addressed before any widespread legalization could be considered.

Conclusion: A Long Shot for the US

While El Salvador's experiment provides valuable insights into the challenges of Bitcoin adoption as legal tender, it's highly unlikely the US will follow suit anytime soon. The inherent volatility of Bitcoin, the lack of necessary infrastructure, and the potential disruption to the established financial system pose insurmountable obstacles. While the future of Bitcoin remains uncertain, its path to legal tender status in a major global economy like the US appears to be a long and arduous one, if achievable at all. The lessons from El Salvador serve as a stark reminder of the complexities involved in such a monumental shift.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Bitcoin Become Legal Tender In The US? Lessons From El Salvador's Experiment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rivalidad Italiana El Enfrentamiento Por Un Premio De 1 Millon

May 19, 2025

Rivalidad Italiana El Enfrentamiento Por Un Premio De 1 Millon

May 19, 2025 -

Roma Vs Milan Live Score And Match Highlights May 19 2025

May 19, 2025

Roma Vs Milan Live Score And Match Highlights May 19 2025

May 19, 2025 -

Beyond The Hype Analyzing Teslas Prospects In The Lucrative Ai Chip Industry

May 19, 2025

Beyond The Hype Analyzing Teslas Prospects In The Lucrative Ai Chip Industry

May 19, 2025 -

Romas New Coaching Structure Ghisolfi Confirms Ranieris Appointment

May 19, 2025

Romas New Coaching Structure Ghisolfi Confirms Ranieris Appointment

May 19, 2025 -

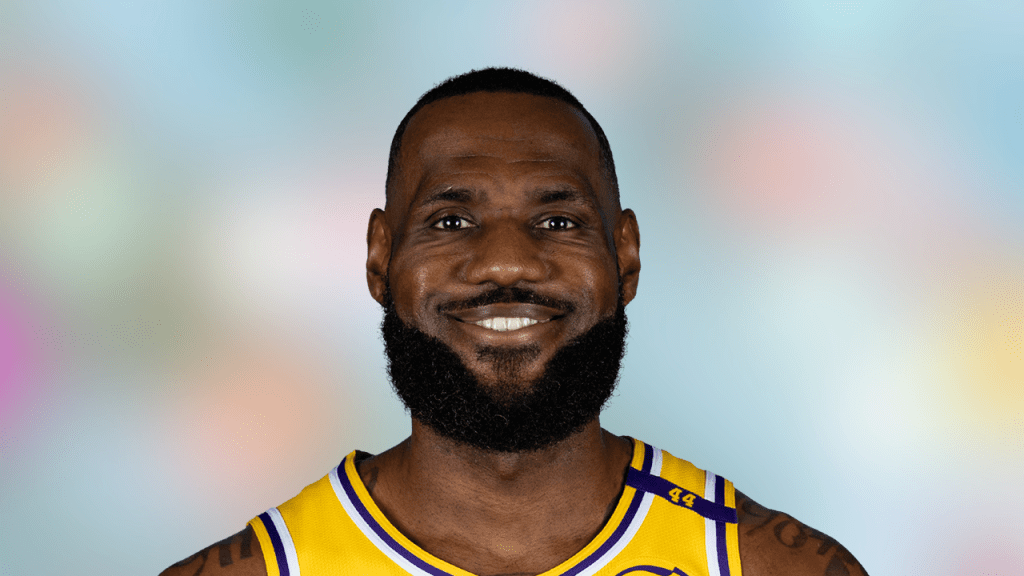

Shaqtin A Fool Mvp Le Bron James Claims Inaugural Award

May 19, 2025

Shaqtin A Fool Mvp Le Bron James Claims Inaugural Award

May 19, 2025