Will Bitcoin Thrive Or Crash In 2025? Analyzing The Statistical Indicators

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Bitcoin Thrive or Crash in 2025? Analyzing the Statistical Indicators

Bitcoin's price volatility has kept investors on the edge of their seats for years. Will 2025 bring further growth, or will the cryptocurrency finally succumb to a significant crash? Predicting the future is impossible, but by analyzing key statistical indicators, we can paint a clearer – albeit still uncertain – picture of Bitcoin's potential trajectory.

The Halving Factor: A Key Determinant

One of the most significant events impacting Bitcoin's price is the halving. This event, which occurs approximately every four years, cuts the reward for miners in half. Historically, halvings have preceded significant price increases. The next halving is projected for sometime in 2024. This reduced supply, coupled with consistent demand, is a bullish factor that many analysts believe could fuel a price surge in 2025. However, it's crucial to remember that past performance isn't indicative of future results.

Adoption and Institutional Investment: Fueling the Fire?

The increasing adoption of Bitcoin by institutional investors and mainstream businesses is another important factor. Companies like MicroStrategy and Tesla have made significant Bitcoin investments, lending credibility and driving demand. Further mainstream adoption, perhaps driven by regulatory clarity in various jurisdictions, could significantly boost Bitcoin's price. Conversely, a major regulatory crackdown could trigger a sharp downturn.

Technological Advancements and Network Security

Bitcoin's underlying technology continues to evolve, with ongoing improvements to scalability and transaction speed. The Lightning Network, for example, aims to address scalability issues, making Bitcoin more practical for everyday transactions. Strong network security, a hallmark of Bitcoin, remains crucial, as any significant security breach could severely damage confidence and impact price.

Macroeconomic Factors: A Wild Card

Global macroeconomic conditions exert a considerable influence on Bitcoin's price. Inflation, interest rate hikes, and geopolitical instability can all impact investor sentiment and lead to significant price fluctuations. For example, periods of high inflation might drive investors towards Bitcoin as a hedge against inflation, while rising interest rates might make other investment options more attractive. Predicting the macroeconomic landscape in 2025 is inherently challenging, making it a significant wildcard in Bitcoin's price forecast.

Analyzing the Statistical Indicators: A Cautious Outlook

While historical data suggests a potential price surge after the 2024 halving, it's crucial to remain cautious. Several statistical models attempt to predict Bitcoin's price, but these models are often based on assumptions that might not hold true. The volatility of the cryptocurrency market makes accurate long-term predictions extremely difficult.

Conclusion: A Balanced Perspective

Will Bitcoin thrive or crash in 2025? The answer, unfortunately, remains elusive. While the halving and increased institutional adoption point towards potential growth, macroeconomic factors and regulatory uncertainty present significant risks. Investors should approach Bitcoin with a balanced perspective, acknowledging both the potential rewards and inherent risks. Thorough research, diversification, and a long-term investment strategy are crucial for navigating the unpredictable world of cryptocurrencies. Only time will reveal Bitcoin's true trajectory in 2025.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Bitcoin Thrive Or Crash In 2025? Analyzing The Statistical Indicators. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

1 5 Million Bitcoin Ark Invests Bold Prediction And Its Conditions

Apr 27, 2025

1 5 Million Bitcoin Ark Invests Bold Prediction And Its Conditions

Apr 27, 2025 -

Shib Uptrend Gains Momentum Will The Rally Continue

Apr 27, 2025

Shib Uptrend Gains Momentum Will The Rally Continue

Apr 27, 2025 -

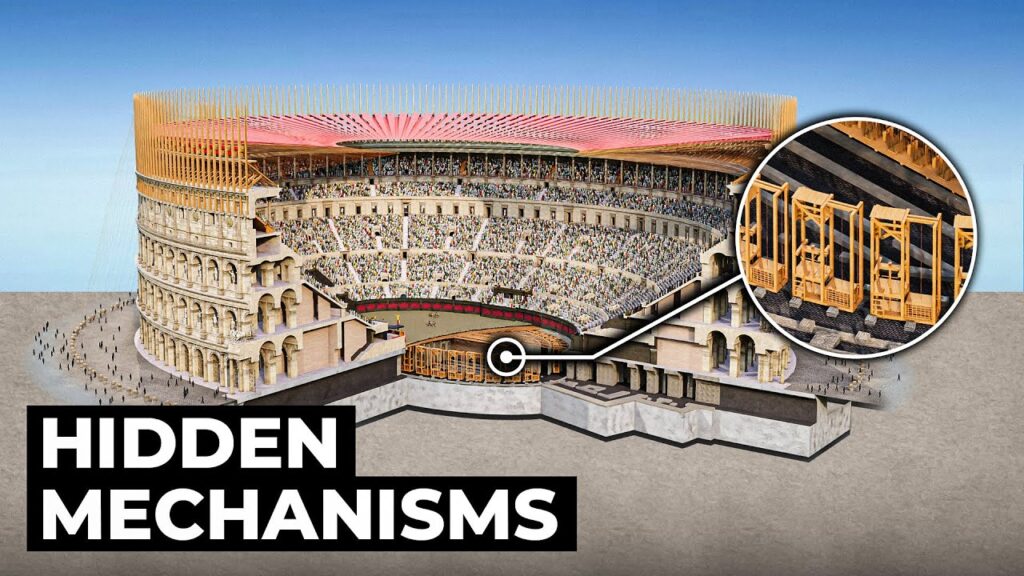

Romes Colosseum New 3 D Animation Shows Hidden Structures

Apr 27, 2025

Romes Colosseum New 3 D Animation Shows Hidden Structures

Apr 27, 2025 -

Scottish Premiership Showdown Celtic Aim For Championship Win Against Dundee United

Apr 27, 2025

Scottish Premiership Showdown Celtic Aim For Championship Win Against Dundee United

Apr 27, 2025 -

Premier League And Fa Cup Expert Betting Tips And Predictions For Liverpools Matches

Apr 27, 2025

Premier League And Fa Cup Expert Betting Tips And Predictions For Liverpools Matches

Apr 27, 2025