Will China Tariffs Impact MCX Gold Rates? A Price Outlook Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will China Tariffs Impact MCX Gold Rates? A Price Outlook Analysis

The ongoing trade tensions between the US and China continue to send ripples through global markets, impacting everything from consumer goods to precious metals. A key question on many investors' minds is: how will potential new Chinese tariffs affect MCX (Multi Commodity Exchange) gold rates? This analysis delves into the complex interplay between geopolitical events and the price of gold in India, a significant gold consumer.

Understanding the Link Between Geopolitical Uncertainty and Gold Prices

Gold is often viewed as a safe-haven asset. When global economic uncertainty rises – be it due to trade wars, political instability, or currency fluctuations – investors tend to flock to gold as a hedge against risk. Increased demand typically leads to higher prices. The potential for further escalation in US-China trade disputes therefore holds significant implications for gold's price trajectory.

China's Role in the Global Gold Market

China is a major player in the global gold market, both as a consumer and a producer. Any economic slowdown in China, potentially triggered by increased tariffs, could impact global demand for gold, influencing MCX gold rates. However, the relationship isn't straightforward. While decreased economic activity might lower some gold demand, the increased uncertainty could simultaneously boost safe-haven buying, creating a countervailing force.

Analyzing the Impact of Tariffs on MCX Gold Rates

Several factors will determine the actual impact of Chinese tariffs on MCX gold prices:

- Severity of Tariffs: The extent and scope of any new tariffs will be crucial. Minor tariffs might have a negligible impact, while widespread, substantial tariffs could significantly influence investor sentiment and gold prices.

- Global Market Reaction: The overall market response to the tariffs will be key. A widespread sell-off across global markets could drive investors towards gold, pushing prices upward despite any negative impact from reduced Chinese demand.

- Indian Rupee's Value: The Indian Rupee's performance against the US dollar also plays a significant role. A weakening Rupee can make gold more expensive for Indian buyers, impacting MCX rates even independent of global price fluctuations.

- Domestic Demand in India: India's robust domestic gold demand, driven by festivals and weddings, often acts as a price support mechanism, mitigating the impact of global market fluctuations to some extent.

Price Outlook: A Cautious Optimism

While the precise impact remains uncertain, a cautious optimism prevails regarding MCX gold rates in the context of escalating US-China tensions. The increased global uncertainty is likely to outweigh the potential decrease in Chinese demand, leading to a rise in prices. However, the extent of this rise will depend heavily on the factors outlined above.

What to Watch For:

- Official announcements regarding new tariffs from China.

- Reactions from global financial markets to these announcements.

- Fluctuations in the Indian Rupee against the US dollar.

- Trends in Indian domestic gold demand.

Conclusion:

The potential impact of China tariffs on MCX gold rates is a complex issue with no easy answer. While a decrease in Chinese demand is a possibility, the safe-haven appeal of gold in times of geopolitical uncertainty is likely to be the dominant factor, potentially leading to higher MCX gold prices. Investors should closely monitor global economic developments and market sentiment to make informed decisions. This analysis provides a framework for understanding the intricate relationship between international trade policies and the price of gold in the Indian market, allowing for a more nuanced perspective on future price movements.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will China Tariffs Impact MCX Gold Rates? A Price Outlook Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Thursday Nights Mcg Security Issues Cause Extensive Fan Delays

Apr 08, 2025

Thursday Nights Mcg Security Issues Cause Extensive Fan Delays

Apr 08, 2025 -

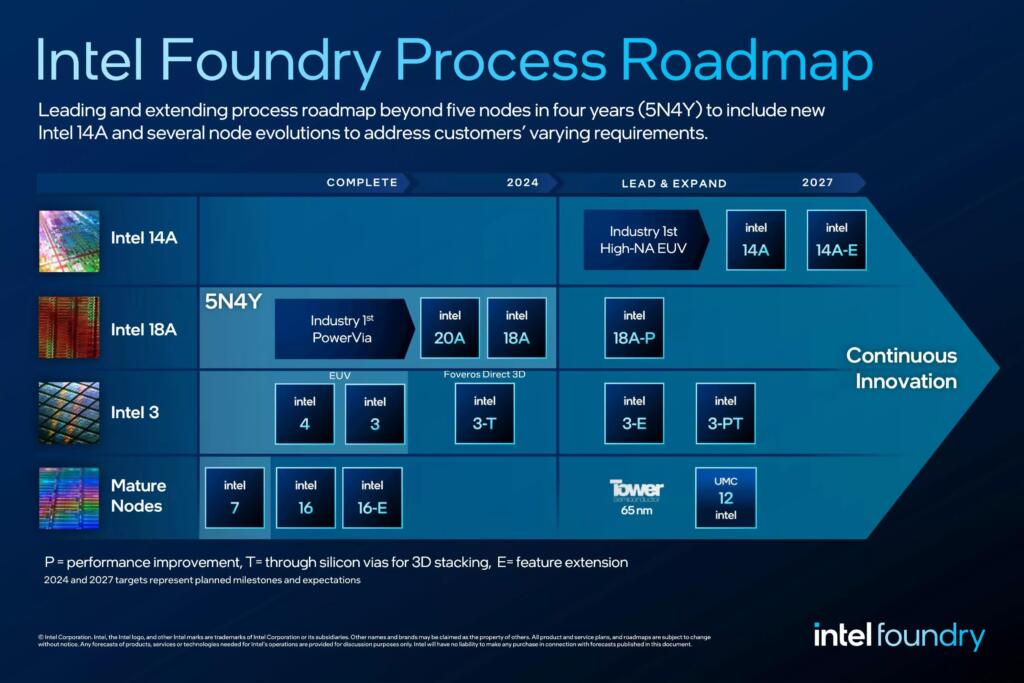

2025 Intels 18 Angstrom Chips Enter Mass Production A New Era

Apr 08, 2025

2025 Intels 18 Angstrom Chips Enter Mass Production A New Era

Apr 08, 2025 -

Doge Secures 500 M Federal Building Vance Comments On Musks Potential Exit

Apr 08, 2025

Doge Secures 500 M Federal Building Vance Comments On Musks Potential Exit

Apr 08, 2025 -

Minecraft Movie Debuts To Huge Success Grossing 157 Million

Apr 08, 2025

Minecraft Movie Debuts To Huge Success Grossing 157 Million

Apr 08, 2025 -

Copom Decisao De Juros E Perspectivas Para A Industria Brasileira Frente Ao Ipca

Apr 08, 2025

Copom Decisao De Juros E Perspectivas Para A Industria Brasileira Frente Ao Ipca

Apr 08, 2025