Will MicroStrategy Stock (MSTR) Outpace Bitcoin (BTC) In 2025?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will MicroStrategy Stock (MSTR) Outpace Bitcoin (BTC) in 2025? A Bold Prediction

MicroStrategy (MSTR), the business intelligence company famously known for its massive Bitcoin holdings, has become inextricably linked to the cryptocurrency's performance. But will MSTR stock actually outperform BTC in 2025? It's a question that's captivating investors and sparking heated debates across financial forums. The answer, however, is far from straightforward and hinges on several crucial factors.

The Bitcoin Bet: A Double-Edged Sword for MicroStrategy

MicroStrategy's CEO, Michael Saylor, has been a staunch Bitcoin advocate, making the company a significant player in the crypto market. Their substantial Bitcoin holdings represent a significant portion of their assets, meaning BTC's price directly impacts MSTR's valuation. This creates a fascinating correlation: if Bitcoin skyrockets, MSTR could potentially see dramatic gains. Conversely, a Bitcoin downturn could severely impact the company's stock price.

Factors Favoring MicroStrategy (MSTR) in 2025:

- Diversification Beyond Bitcoin: While Bitcoin remains a central factor, MicroStrategy isn't solely reliant on crypto's success. Their core business in enterprise analytics and software continues to generate revenue, offering a degree of insulation against Bitcoin volatility. Future growth in this sector could potentially outpace Bitcoin's gains, leading to MSTR outperforming BTC.

- Institutional Adoption of Bitcoin: Increased institutional investment in Bitcoin could drive up prices significantly, benefitting both MSTR's Bitcoin holdings and its overall market perception. This increased legitimacy and mainstream acceptance could lead to a higher valuation for MSTR independent of Bitcoin's price action.

- Strategic Partnerships and Acquisitions: MicroStrategy's strategic moves in the tech industry, including potential acquisitions or partnerships, could drive independent growth and boost the stock price. This diversification strategy could mitigate risks associated with crypto market fluctuations.

Factors Favoring Bitcoin (BTC) in 2025:

- Bitcoin's Scarcity and Deflationary Nature: Bitcoin's fixed supply of 21 million coins contributes to its perceived long-term value. As adoption increases and demand surpasses supply, the price could appreciate dramatically, potentially outpacing MSTR's growth.

- Technological Advancements and Network Upgrades: Ongoing development and upgrades to the Bitcoin network enhance its scalability, security, and efficiency. These advancements can lead to increased adoption and a rise in price.

- Global Economic Uncertainty: In times of economic uncertainty, Bitcoin's role as a hedge against inflation and traditional financial systems could drive strong demand, leading to price appreciation.

The Verdict: A Difficult Prediction

Predicting whether MSTR will outpace BTC in 2025 is exceedingly challenging. While MicroStrategy’s bet on Bitcoin has been bold, its success hinges on multiple interwoven factors: Bitcoin's price trajectory, MicroStrategy's ability to maintain and grow its core business, and the broader macroeconomic environment.

Investors should conduct thorough due diligence, considering their own risk tolerance and investment goals before making any decisions regarding either MSTR or BTC. This analysis offers insights, but it's crucial to remember that the cryptocurrency market is inherently volatile and subject to unpredictable shifts. The future performance of both assets remains uncertain, emphasizing the importance of careful consideration and diversified investment strategies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will MicroStrategy Stock (MSTR) Outpace Bitcoin (BTC) In 2025?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Port Adelaide Power Vs Fremantle Dockers Your Guide To Afl Round 11 2025

May 24, 2025

Port Adelaide Power Vs Fremantle Dockers Your Guide To Afl Round 11 2025

May 24, 2025 -

Slam Dunk Festival 2024 5 Modern Metal Bands Not To Miss

May 24, 2025

Slam Dunk Festival 2024 5 Modern Metal Bands Not To Miss

May 24, 2025 -

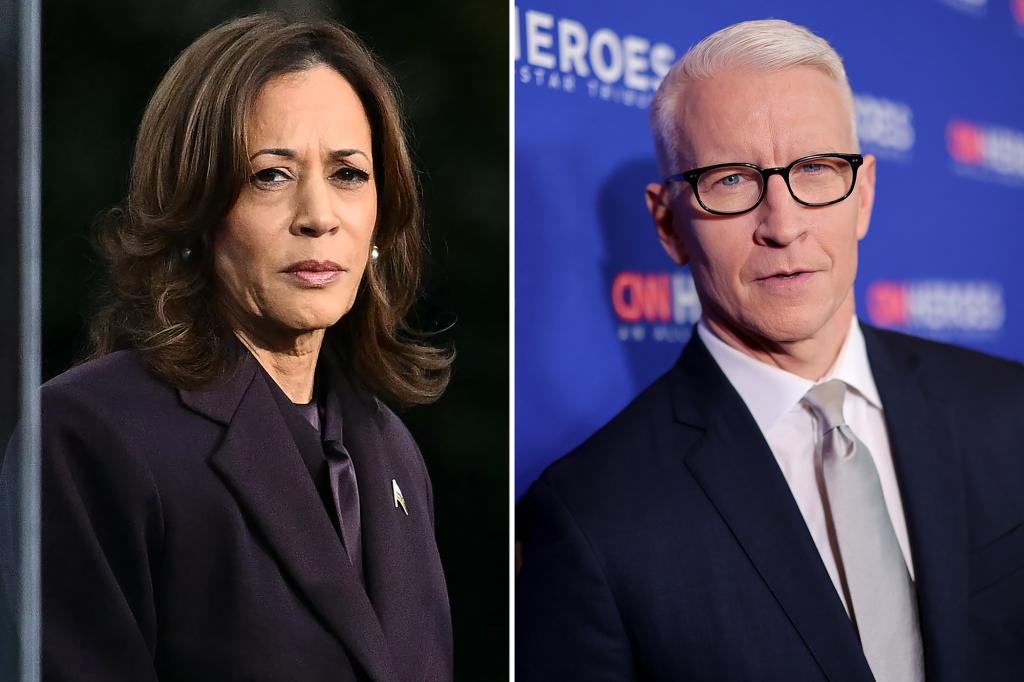

Tense Interview Fallout Kamala Harris Profanity Laced Reaction To Anderson Coopers Biden Debate Questions

May 24, 2025

Tense Interview Fallout Kamala Harris Profanity Laced Reaction To Anderson Coopers Biden Debate Questions

May 24, 2025 -

Vivid Sydneys Martin Place Changes A Food Charitys Struggle For Relocation

May 24, 2025

Vivid Sydneys Martin Place Changes A Food Charitys Struggle For Relocation

May 24, 2025 -

Belgian Cats Vertrouwen Op Julie Vanloo En Julie Allemand Na Linskens Blessure

May 24, 2025

Belgian Cats Vertrouwen Op Julie Vanloo En Julie Allemand Na Linskens Blessure

May 24, 2025