Will MSTR Stock Outpace Bitcoin In 2025? A February Update And Investment Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will MSTR Stock Outpace Bitcoin in 2025? A February Update and Investment Outlook

MicroStrategy (MSTR), the business intelligence company that's become synonymous with Bitcoin investment, has captivated investors with its aggressive BTC holdings. But the question on many minds is: will MSTR stock outperform Bitcoin itself by 2025? This February update examines the current market landscape and offers an outlook on this intriguing investment proposition.

The connection between MSTR stock price and Bitcoin's value is undeniable. As Bitcoin's price fluctuates, so too does MSTR's, often with amplified volatility. This inherent correlation presents both significant opportunities and considerable risks for investors.

Understanding the Intertwined Destinies of MSTR and Bitcoin

MSTR's strategy of accumulating Bitcoin as a treasury asset has been both lauded and criticized. While it positions the company as a significant player in the cryptocurrency space, it also exposes it to the inherent volatility of the digital asset market. This means that MSTR's stock price is heavily influenced not only by its own financial performance but also, and perhaps more significantly, by the price movements of Bitcoin.

Factors Favoring MSTR Stock Outperformance in 2025:

- Bitcoin Price Appreciation: The most obvious factor is a significant surge in Bitcoin's price. If Bitcoin were to reach, say, $100,000 or even higher by 2025, MSTR's substantial Bitcoin holdings would translate into massive unrealized gains, potentially boosting the stock price significantly.

- Increased Institutional Adoption of Bitcoin: Continued adoption of Bitcoin by institutional investors could further drive up the price, indirectly benefiting MSTR.

- MicroStrategy's Business Growth: If MicroStrategy's core business performs well and shows consistent growth independently of Bitcoin's performance, this could add another layer of support to its stock price. This diversification lessens the dependence solely on Bitcoin's price movements.

- Strategic Partnerships and Innovation: Any successful strategic partnerships or technological innovations by MicroStrategy could enhance its overall value proposition and attract more investors.

Factors Hindering MSTR Stock Outperformance in 2025:

- Bitcoin Price Correction: A significant correction in Bitcoin's price could severely impact MSTR's stock price, potentially leading to underperformance compared to Bitcoin itself.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain globally. Negative regulatory developments could negatively affect Bitcoin's price and, consequently, MSTR's stock.

- Competition in the Business Intelligence Market: MicroStrategy faces competition in its core business. Failure to maintain a competitive edge could hinder its overall financial performance, regardless of Bitcoin's price.

- Market Sentiment: Negative market sentiment towards both Bitcoin and the broader tech sector could negatively influence MSTR's stock performance.

Investment Outlook: Navigating the Risks and Rewards

Predicting whether MSTR stock will outpace Bitcoin by 2025 is inherently speculative. The outcome depends on a complex interplay of factors, including Bitcoin's price trajectory, regulatory developments, MicroStrategy's business performance, and overall market sentiment.

For investors considering MSTR:

- High-Risk, High-Reward: Investing in MSTR is inherently high-risk due to the volatility associated with Bitcoin. Only investors with a high-risk tolerance should consider this investment.

- Diversification is Key: It's crucial to diversify your portfolio to mitigate the risk associated with MSTR's significant exposure to Bitcoin.

- Thorough Due Diligence: Conduct comprehensive research and understand the risks before making any investment decisions.

Conclusion:

While MSTR's aggressive Bitcoin strategy presents an intriguing investment proposition, the possibility of it outperforming Bitcoin by 2025 is far from certain. A multitude of factors will influence the outcome, making it essential for investors to carefully consider the risks and rewards before committing their capital. This February update provides a snapshot of the current landscape, but continuous monitoring of market developments is vital for informed decision-making. Remember, this is not financial advice, and conducting your own thorough research is crucial before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will MSTR Stock Outpace Bitcoin In 2025? A February Update And Investment Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Julianne Moores Sirens A Fun Preposterous Cult Series Review

May 25, 2025

Julianne Moores Sirens A Fun Preposterous Cult Series Review

May 25, 2025 -

Two Decades On Examining The Potential Of A 28 Days Later Sequel

May 25, 2025

Two Decades On Examining The Potential Of A 28 Days Later Sequel

May 25, 2025 -

Celebrity Sightings Russell Wilson Ciara And More At Knicks Game

May 25, 2025

Celebrity Sightings Russell Wilson Ciara And More At Knicks Game

May 25, 2025 -

Breaking News The Wheel Of Time Future Uncertain Coen Brothers New Film And Cannes Winners Announced

May 25, 2025

Breaking News The Wheel Of Time Future Uncertain Coen Brothers New Film And Cannes Winners Announced

May 25, 2025 -

Philadelphia Hosts 2025 Fifa Club World Cup Your Ultimate Guide

May 25, 2025

Philadelphia Hosts 2025 Fifa Club World Cup Your Ultimate Guide

May 25, 2025

Latest Posts

-

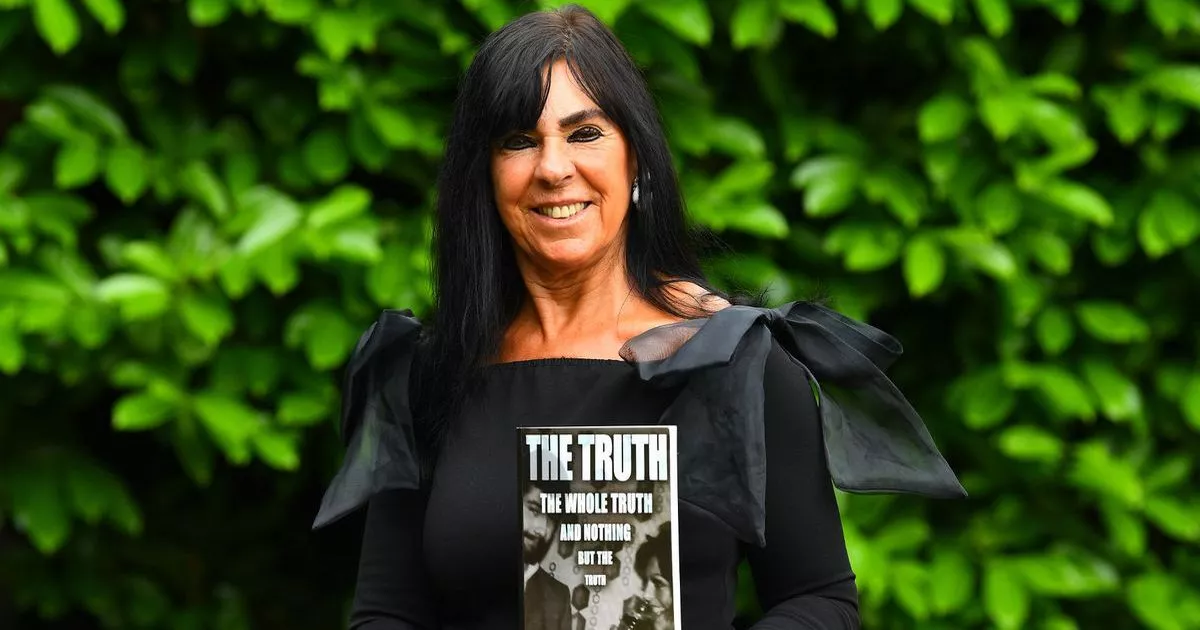

Behind Bars A Wifes Perspective On Life With A Notorious Uk Criminal

May 25, 2025

Behind Bars A Wifes Perspective On Life With A Notorious Uk Criminal

May 25, 2025 -

Hamilton Blames This For Verstappens Monaco Penalty Decision

May 25, 2025

Hamilton Blames This For Verstappens Monaco Penalty Decision

May 25, 2025 -

Cinq Points Cles Sur La Vie D Elmer Moller

May 25, 2025

Cinq Points Cles Sur La Vie D Elmer Moller

May 25, 2025 -

Acer Portable Monitor With Dual Full Hd Displays And Touchscreen A Detailed Review

May 25, 2025

Acer Portable Monitor With Dual Full Hd Displays And Touchscreen A Detailed Review

May 25, 2025 -

From Tongue To Tech Innovations In Taste Recording And Reproduction

May 25, 2025

From Tongue To Tech Innovations In Taste Recording And Reproduction

May 25, 2025