Will Stricter Stablecoin Rules In America Spur CBDC Adoption?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Stricter Stablecoin Rules in America Spur CBDC Adoption?

The crypto world is abuzz with speculation: will the tightening regulatory grip on stablecoins in the US accelerate the adoption of a Central Bank Digital Currency (CBDC)? Recent proposals for stricter oversight of stablecoins like Tether and USDC, aimed at mitigating systemic risk, have ignited a debate about the future of digital finance and the potential role of a government-backed digital dollar.

While stablecoins offer a bridge between traditional finance and the decentralized world, their inherent volatility and lack of robust regulation have raised concerns among policymakers. The potential for bank runs and market instability fueled by algorithmic stablecoins has highlighted the need for stricter controls. This regulatory push, however, may inadvertently create a fertile ground for the adoption of a CBDC.

The Case for CBDCs: Stability and Trust

A key argument in favor of CBDCs is their inherent stability and transparency. Backed by the full faith and credit of the government, a digital dollar would theoretically eliminate the risks associated with privately issued stablecoins. This inherent stability is a powerful selling point, especially for consumers wary of the volatility inherent in the cryptocurrency market. Features like:

- Reduced counterparty risk: Eliminates the risk associated with relying on private entities to maintain the peg of a stablecoin.

- Enhanced financial inclusion: Could potentially provide banking services to the unbanked population.

- Improved payment efficiency: Offers faster and cheaper transaction processing compared to traditional systems.

could all contribute to wider acceptance. Furthermore, a CBDC could provide a more efficient and secure way for the government to implement monetary policy.

The Challenges Remain

Despite the potential benefits, significant hurdles remain before a US CBDC becomes a reality. These include:

- Privacy concerns: Striking a balance between maintaining user privacy and preventing illicit activities is crucial.

- Technological hurdles: Developing and implementing a secure and scalable CBDC infrastructure requires substantial investment and technical expertise.

- Political opposition: Resistance from various stakeholders, including banks and private sector players, could hinder progress.

The Stablecoin Squeeze: A Catalyst for Change?

The increasingly stringent regulatory environment for stablecoins might inadvertently push users and businesses towards the perceived safety and stability of a government-backed digital dollar. If stablecoins face stricter capital requirements, audits, and reserve transparency mandates, they could become less attractive, driving users toward a regulated alternative – the CBDC. This is particularly true for institutional investors and businesses seeking a low-risk, readily available digital asset for transactions.

The Future of Digital Finance in America

The future of digital finance in the US is likely to be shaped by the interplay between stablecoin regulation and CBDC development. While a CBDC is not a guaranteed outcome, the tightening regulatory environment for stablecoins significantly increases the likelihood of its exploration and eventual adoption. The next few years will be crucial in determining whether this regulatory push acts as a catalyst for the widespread adoption of a digital dollar, ultimately reshaping the American financial landscape. The ongoing debate surrounding stablecoin regulation and the potential for a US CBDC will continue to dominate headlines and shape the future of digital finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Stricter Stablecoin Rules In America Spur CBDC Adoption?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nothings Sub Brand Cmf Announces New Phone And Earbuds Specs And Release Date

Apr 29, 2025

Nothings Sub Brand Cmf Announces New Phone And Earbuds Specs And Release Date

Apr 29, 2025 -

Wps Response Ge 2025 And The Income Allianz Deal A Hypothetical Approval

Apr 29, 2025

Wps Response Ge 2025 And The Income Allianz Deal A Hypothetical Approval

Apr 29, 2025 -

Marvels Thunderbolts A Mixed Bag Elevated By Florence Pughs Stellar Acting

Apr 29, 2025

Marvels Thunderbolts A Mixed Bag Elevated By Florence Pughs Stellar Acting

Apr 29, 2025 -

Steelers Part Ways With Cornerback Ryan Watts Retirement Confirmed

Apr 29, 2025

Steelers Part Ways With Cornerback Ryan Watts Retirement Confirmed

Apr 29, 2025 -

Ramit Sethi Gen Z Can Achieve Millions Like Warren Buffett Heres How

Apr 29, 2025

Ramit Sethi Gen Z Can Achieve Millions Like Warren Buffett Heres How

Apr 29, 2025

Latest Posts

-

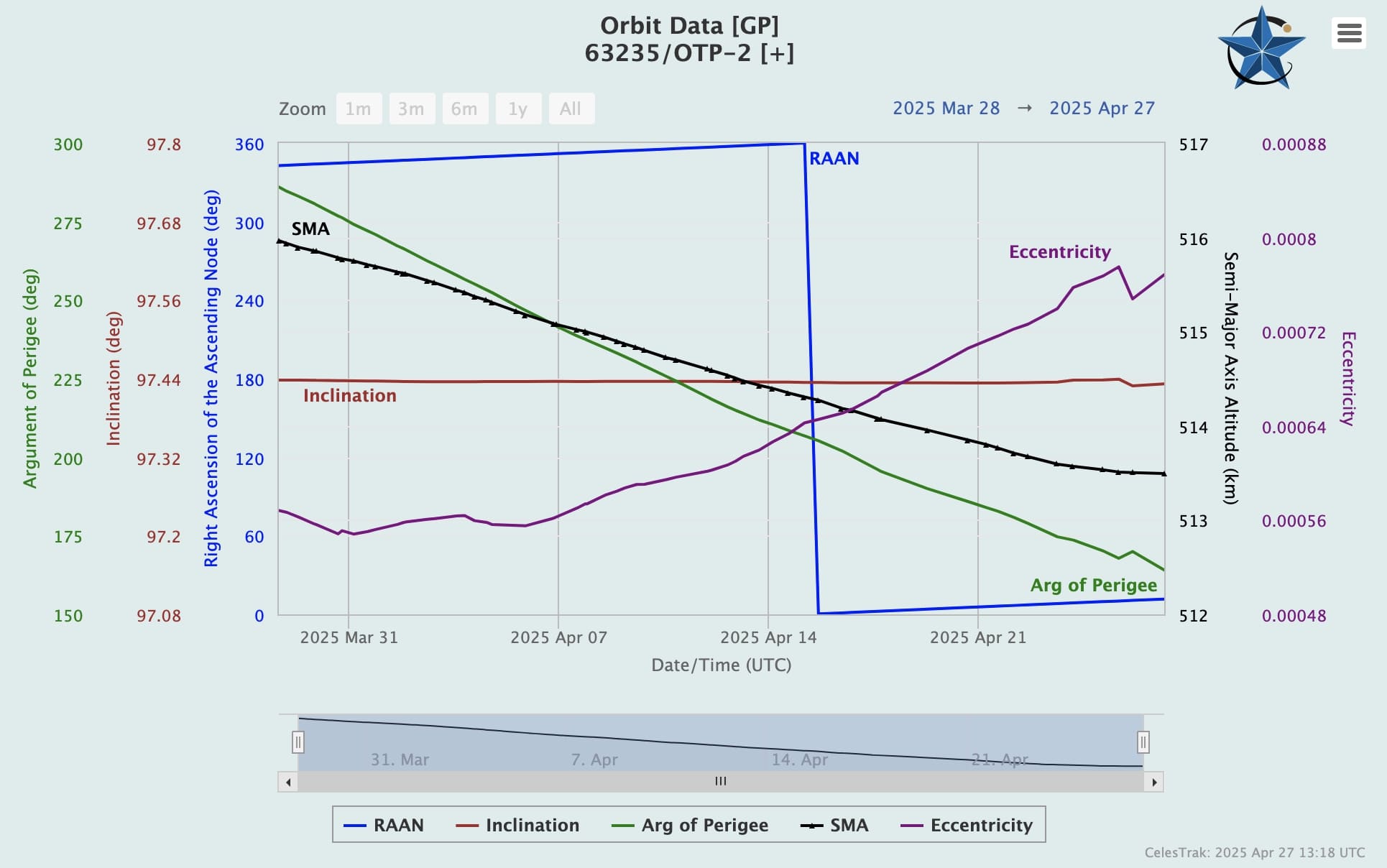

Next Big Future Update Otp 2 Propellantless Drive Demonstrates Reduced Orbital Decay

Apr 29, 2025

Next Big Future Update Otp 2 Propellantless Drive Demonstrates Reduced Orbital Decay

Apr 29, 2025 -

Qantas Launches Huge International Sale Book Now

Apr 29, 2025

Qantas Launches Huge International Sale Book Now

Apr 29, 2025 -

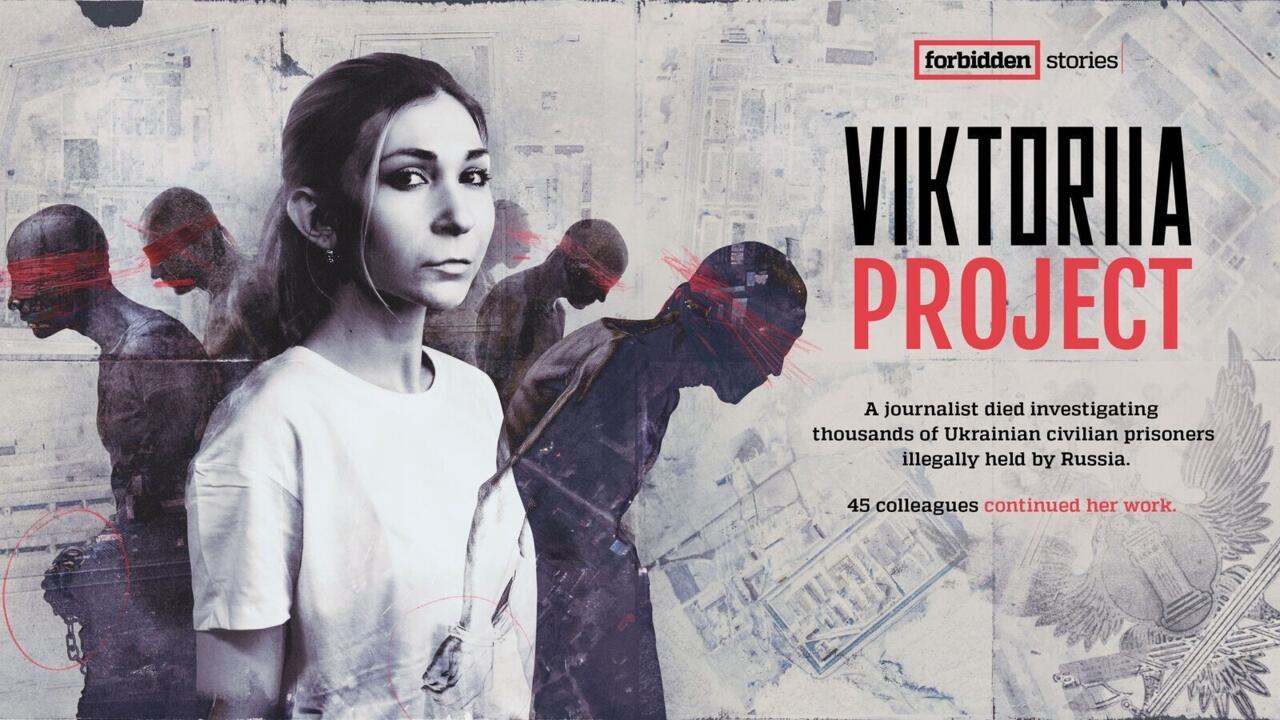

Forbidden Stories The Perilous Pursuit Of Truth In Russian Occupied Ukraine

Apr 29, 2025

Forbidden Stories The Perilous Pursuit Of Truth In Russian Occupied Ukraine

Apr 29, 2025 -

2 35 Xrp Futures Etf Greenlight Fuels Price Jump

Apr 29, 2025

2 35 Xrp Futures Etf Greenlight Fuels Price Jump

Apr 29, 2025 -

Dte Energy Proposes 574 Million Rate Hike What It Means For Customers

Apr 29, 2025

Dte Energy Proposes 574 Million Rate Hike What It Means For Customers

Apr 29, 2025