Will Trump Tariffs Prevent Bitcoin (BTC) From Reaching $100K?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Trump Tariffs Prevent Bitcoin (BTC) from Reaching $100K? Unlikely, But Economic Uncertainty Remains a Factor

The cryptocurrency market is notoriously volatile, influenced by a complex web of factors ranging from technological advancements to global economic events. A question frequently debated among investors is whether the lingering effects of Trump-era tariffs could hinder Bitcoin's (BTC) potential to reach the coveted $100,000 price point. While a direct causal link is unlikely, the economic uncertainty stemming from these policies continues to play a role in the overall market sentiment.

The Indirect Impact of Trade Wars on Bitcoin:

Trump's trade policies, characterized by significant tariffs on goods from various countries, created a period of global economic uncertainty. This uncertainty often leads investors to seek safe haven assets, and historically, both gold and Bitcoin have benefited from such periods. However, the impact is indirect and complex.

-

Increased Inflation and Dollar Devaluation: Tariffs can contribute to inflation by increasing the cost of imported goods. If the US dollar weakens as a result, investors might turn to Bitcoin as a hedge against inflation and a store of value, potentially driving up its price.

-

Market Volatility and Risk Aversion: The overall economic instability generated by trade wars can increase market volatility. This can lead to increased risk aversion among investors, causing them to pull back from riskier assets, including Bitcoin, and potentially suppressing its price.

-

Global Economic Slowdown: Trade wars can negatively impact global economic growth. A slower global economy can reduce demand for Bitcoin, affecting its price trajectory.

Why Tariffs Alone Won't Determine Bitcoin's $100K Fate:

While the economic fallout from Trump's tariffs undoubtedly contributes to the broader market landscape, attributing Bitcoin's price solely to this factor is an oversimplification. Several other critical elements significantly influence Bitcoin's price:

-

Adoption Rate: Wider adoption by institutional investors and mainstream consumers is crucial for driving Bitcoin's price higher. Increased regulatory clarity and user-friendly applications are key drivers of adoption.

-

Technological Advancements: Improvements in blockchain technology, such as the Lightning Network, enhancing scalability and transaction speed, positively impact Bitcoin's appeal and potential for growth.

-

Regulatory Landscape: Government regulations play a significant role. Clear and supportive regulations can boost investor confidence, while overly restrictive measures can stifle growth.

-

Market Sentiment and Speculation: Speculative trading and overall market sentiment are powerful forces influencing Bitcoin's price fluctuations. News events, social media trends, and even celebrity endorsements can drastically affect price action.

Conclusion: A Complex Equation

While the lingering effects of Trump-era tariffs contribute to a complex economic environment that influences investor behavior and market sentiment, they are not the sole determinant of Bitcoin's price. Reaching $100,000 will depend on a convergence of factors, including broader adoption, technological advancements, regulatory clarity, and overall market sentiment. While economic uncertainty remains a factor, it’s unlikely to single-handedly prevent Bitcoin from reaching this milestone. The future price of Bitcoin depends on a multifaceted interplay of economic forces and technological innovation. Investors should carefully consider all contributing factors before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Trump Tariffs Prevent Bitcoin (BTC) From Reaching $100K?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bursa Saham Hong Kong Anjlok Tarif Trump Picu Penurunan Terparah Sejak 2009

Apr 07, 2025

Bursa Saham Hong Kong Anjlok Tarif Trump Picu Penurunan Terparah Sejak 2009

Apr 07, 2025 -

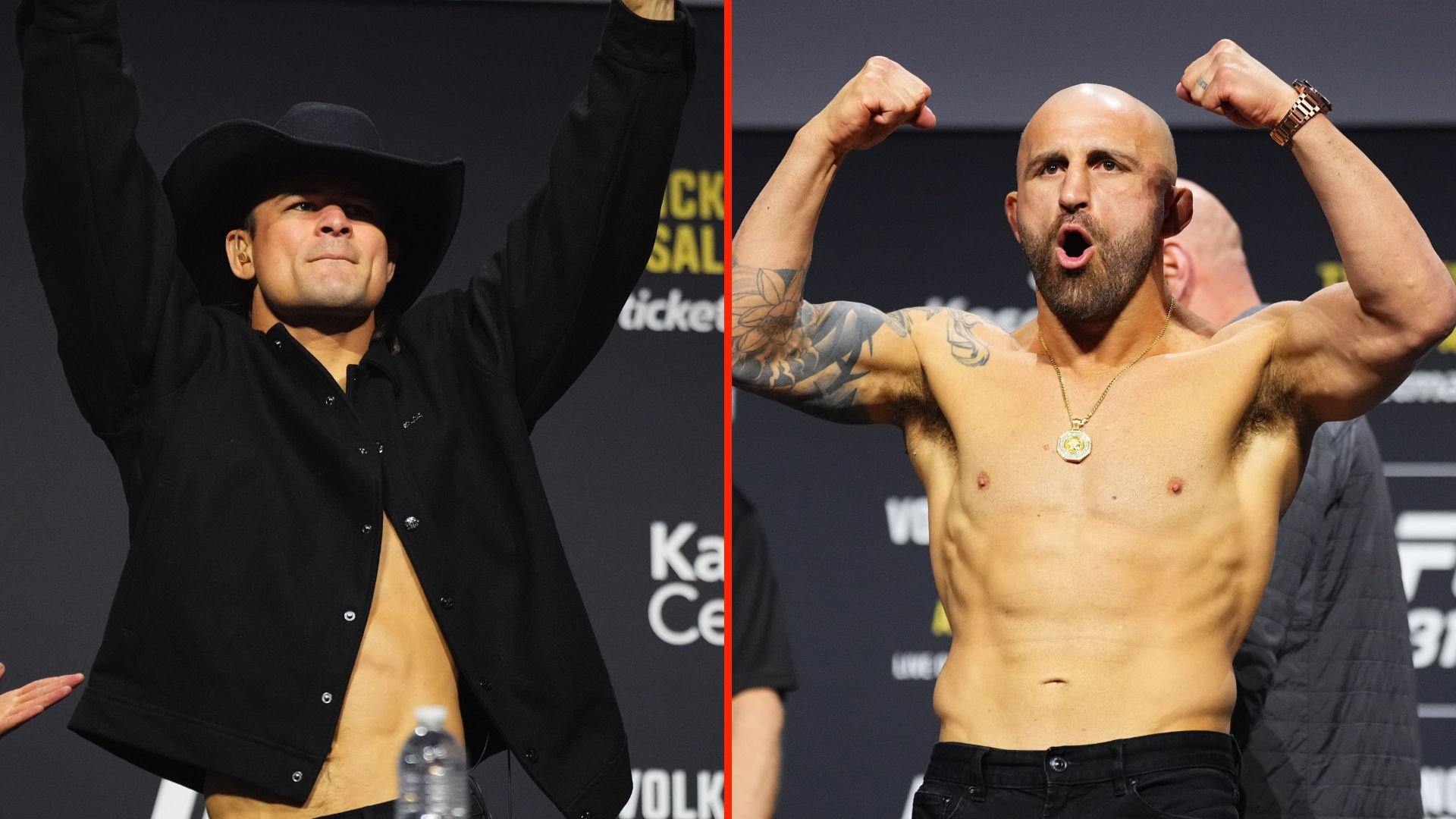

Volkanovski And Lopes First Defense A Common Challenger Emerges

Apr 07, 2025

Volkanovski And Lopes First Defense A Common Challenger Emerges

Apr 07, 2025 -

Asia Pacific Markets Tumble Hong Kong Stocks Suffer Amidst Rising Trade Tensions

Apr 07, 2025

Asia Pacific Markets Tumble Hong Kong Stocks Suffer Amidst Rising Trade Tensions

Apr 07, 2025 -

Strictly 2024 Gemma Atkinsons Response To Gorka Marquezs Participation

Apr 07, 2025

Strictly 2024 Gemma Atkinsons Response To Gorka Marquezs Participation

Apr 07, 2025 -

Phillip Island Homicide Investigation Elderly Man Found Dead

Apr 07, 2025

Phillip Island Homicide Investigation Elderly Man Found Dead

Apr 07, 2025