Will Trump's Regulatory Changes Unlock A US Tether Stablecoin?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Trump's Regulatory Changes Unlock a US Tether Stablecoin?

The cryptocurrency world is buzzing with speculation about the potential impact of a shift in US regulatory policy under a potential second Trump presidency on the future of stablecoins, particularly Tether (USDT). While no concrete policy changes have been announced, the possibility of a more lenient regulatory environment is fueling hopes for a US-based Tether, a development that could significantly reshape the global cryptocurrency landscape.

The Current Regulatory Landscape: A Minefield for Stablecoins

Currently, the regulatory landscape for stablecoins in the US is complex and fragmented. The Securities and Exchange Commission (SEC) has taken a tough stance, classifying certain stablecoins as securities, subjecting them to stringent regulations. This has created significant hurdles for stablecoin issuers, limiting their growth and innovation. The lack of clear, comprehensive legislation leaves many companies in a state of uncertainty, hindering investment and development.

Trump's Potential Impact: A More Laissez-Faire Approach?

Donald Trump's previous administration displayed a generally more laissez-faire approach to financial regulation. While this wasn't specifically focused on cryptocurrencies, it hints at a potential shift away from the heavy-handed regulation currently stifling stablecoin innovation. A second Trump presidency could lead to:

- Reduced SEC scrutiny: A less interventionist approach from the SEC could alleviate the regulatory burden on stablecoin issuers.

- Increased clarity: A more defined regulatory framework, even if less stringent, would provide much-needed certainty for businesses operating in the stablecoin market.

- Faster innovation: A more permissive environment would likely encourage greater investment and innovation within the US stablecoin sector.

Tether's Potential: A US-Based Giant?

Tether, the largest stablecoin by market capitalization, currently operates outside the US, primarily in Hong Kong. A more favorable regulatory climate in the US could incentivize Tether to establish a US-based operation. This would bring several potential benefits:

- Increased transparency and accountability: Operating within a regulated US environment would likely increase pressure on Tether to enhance transparency regarding its reserves.

- Greater accessibility for US investors: A US-based Tether would eliminate many of the complexities and risks currently associated with accessing the stablecoin for US investors.

- Enhanced credibility and legitimacy: A regulated US-based Tether could boost investor confidence and further solidify its position in the market.

Challenges and Considerations

Despite the potential benefits, a shift towards a more lenient regulatory approach isn't without its challenges. Concerns remain about:

- Consumer protection: Less stringent regulations could potentially expose investors to greater risk.

- Market manipulation: A less regulated market could be more susceptible to manipulation and fraud.

- Financial stability: The rapid growth of unregulated stablecoins could pose a threat to the broader financial system.

The Bottom Line: Uncertainty Remains

While the possibility of a more favorable regulatory environment under a potential second Trump administration is exciting for the cryptocurrency community, it's crucial to approach this with caution. The ultimate impact on Tether and the broader stablecoin market remains uncertain. The situation requires careful monitoring and analysis as the political landscape evolves. The future of stablecoins in the US hinges on navigating the complex interplay between innovation, regulation, and investor protection. Only time will tell if a US-based Tether becomes a reality.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Trump's Regulatory Changes Unlock A US Tether Stablecoin?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

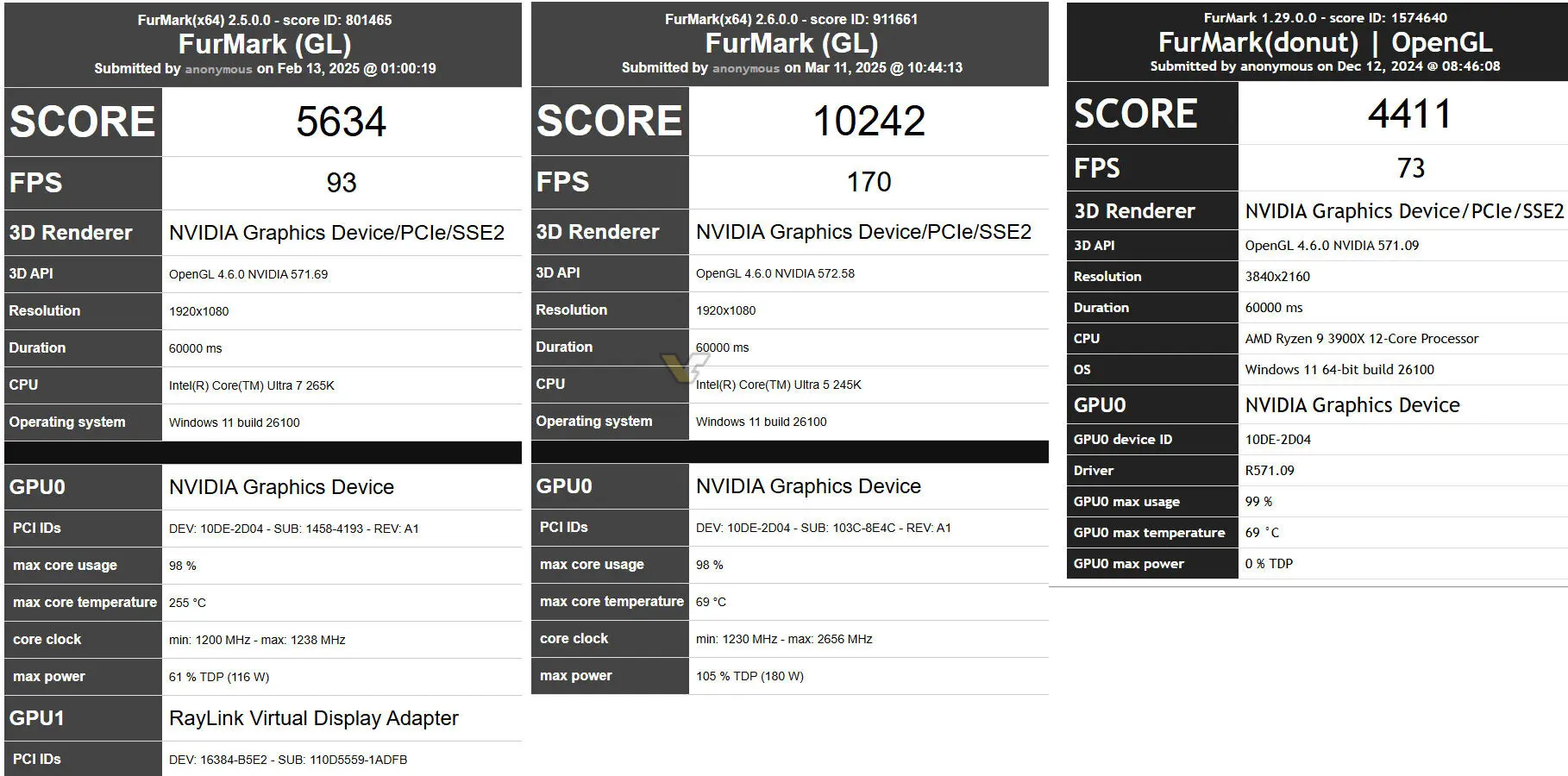

Fur Mark Database Leaks Rtx 5060 Ti Performance At 180 W Tdp Unveiled

Apr 08, 2025

Fur Mark Database Leaks Rtx 5060 Ti Performance At 180 W Tdp Unveiled

Apr 08, 2025 -

The Surprising Inclusion Of A Penguin And Seal Habitat In Trumps Tariff List

Apr 08, 2025

The Surprising Inclusion Of A Penguin And Seal Habitat In Trumps Tariff List

Apr 08, 2025 -

The Myanmar Earthquake A Week On Understanding The Impact And Recovery Efforts

Apr 08, 2025

The Myanmar Earthquake A Week On Understanding The Impact And Recovery Efforts

Apr 08, 2025 -

Angels Rout Guardians Behind Powerful Offensive Display

Apr 08, 2025

Angels Rout Guardians Behind Powerful Offensive Display

Apr 08, 2025 -

Best Tech Stocks Under 100 A 1 000 Investment Guide

Apr 08, 2025

Best Tech Stocks Under 100 A 1 000 Investment Guide

Apr 08, 2025