Will Trump's Tariffs Tip Australia Into Recession? RBA's May Meeting Under Scrutiny

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Trump's Tariffs Tip Australia into Recession? RBA's May Meeting Under Scrutiny

The Reserve Bank of Australia (RBA) faces intense scrutiny as it prepares for its May meeting, with growing concerns that lingering impacts of Donald Trump's tariffs, coupled with global economic uncertainty, could push Australia into recession. The nation's economic health hangs precariously in the balance, prompting anxieties among economists and investors alike.

Trump's Tariff Legacy: A Lingering Threat to Australian Exports

Donald Trump's trade war, while seemingly a relic of the past, continues to cast a long shadow over the Australian economy. His tariffs, primarily targeting China, significantly disrupted global trade flows, impacting Australia's key export sectors, including agriculture and resources. While some recovery has been observed, the scars remain, leaving Australia vulnerable to further economic shocks. The lingering effects include:

- Reduced export demand: The uncertainty created by the tariffs dampened international demand for Australian goods, resulting in slower economic growth.

- Supply chain disruptions: The trade war created significant complexities in global supply chains, increasing costs and reducing efficiency for Australian businesses.

- Price volatility: Fluctuations in global commodity prices, partly due to tariff-related uncertainty, have impacted Australian producers and exporters.

RBA's Tightrope Walk: Inflation vs. Recession

The RBA faces a delicate balancing act. Inflation remains a concern, fueled by rising energy prices and supply chain issues. However, the risk of recession looms large, threatening jobs and economic stability. The May meeting will be crucial in determining the central bank's response. Options include:

- Interest rate hikes: To combat inflation, but this risks further slowing economic growth and potentially triggering a recession.

- Maintaining current rates: This offers stability but could allow inflation to continue unchecked.

- Targeted interventions: The RBA could explore more targeted measures, such as specific support for affected industries, to mitigate the impact of the global economic slowdown.

Global Economic Headwinds: Adding to the Pressure

Beyond the lingering effects of Trump's tariffs, Australia is grappling with a confluence of global economic challenges, including:

- The war in Ukraine: The ongoing conflict is disrupting global energy markets and contributing to inflationary pressures.

- Rising interest rates globally: Increased interest rates in major economies are impacting global investment flows and potentially reducing demand for Australian exports.

- Supply chain bottlenecks: While easing, supply chain disruptions continue to hamper economic activity worldwide.

Australia's Vulnerability: A Perfect Storm?

The combination of these factors has raised concerns that Australia is on the brink of a recession. The nation's reliance on commodity exports makes it particularly susceptible to global economic downturns. The RBA's decision in May will be closely watched, not only in Australia but globally, as it serves as a potential indicator of the broader economic climate.

Looking Ahead: Uncertain Future, Crucial Decisions

The coming months will be critical for the Australian economy. The RBA's actions in May, and the subsequent economic data, will offer crucial insights into the nation's ability to navigate these complex challenges and avoid a recession. The legacy of Trump's tariffs, combined with current global uncertainties, highlights the precarious position of the Australian economy, demanding careful consideration and strategic policy decisions from the RBA and the government. The world waits with bated breath to see how Australia will weather this storm.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Trump's Tariffs Tip Australia Into Recession? RBA's May Meeting Under Scrutiny. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Augusta National Day 2 Following The Leaders At The 2025 Masters

Apr 11, 2025

Augusta National Day 2 Following The Leaders At The 2025 Masters

Apr 11, 2025 -

Gsm Arena Confirms Oppo Find X8 Ultra Boasts Superior Dual Periscope Cameras

Apr 11, 2025

Gsm Arena Confirms Oppo Find X8 Ultra Boasts Superior Dual Periscope Cameras

Apr 11, 2025 -

From Star To Struggle Jaiswals Open Message Following Disappointing Ipl 2025 Performance

Apr 11, 2025

From Star To Struggle Jaiswals Open Message Following Disappointing Ipl 2025 Performance

Apr 11, 2025 -

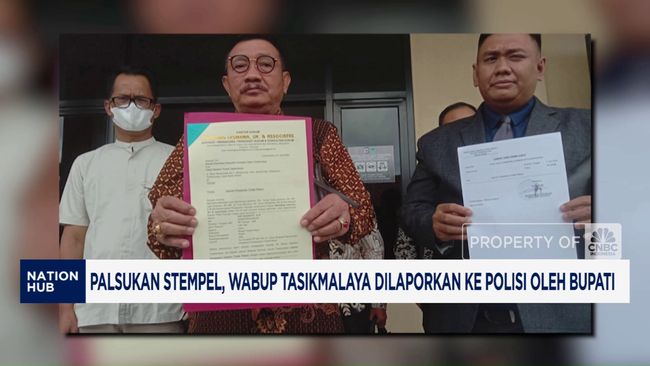

Video Viral Konflik Bupati Dan Wabup Tasikmalaya Berujung Laporan Polisi

Apr 11, 2025

Video Viral Konflik Bupati Dan Wabup Tasikmalaya Berujung Laporan Polisi

Apr 11, 2025 -

Sciences Vital Role In Post Conflict Reconstruction Episode 3

Apr 11, 2025

Sciences Vital Role In Post Conflict Reconstruction Episode 3

Apr 11, 2025