WLFI-Linked Wallet Liquidates ETH Amidst $209M Portfolio Crash

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

WLFI-Linked Wallet Liquidates ETH Amidst $209M Portfolio Crash: DeFi Disaster Strikes

The decentralized finance (DeFi) world is reeling after a wallet linked to the now-defunct Wonderland Finance (WLFI) project liquidated a substantial amount of Ethereum (ETH), triggering a significant drop in its overall portfolio value. The shocking event, which saw the portfolio plummet by a staggering $209 million, has sent shockwaves through the crypto community and raised serious questions about the stability and transparency of DeFi projects.

This dramatic liquidation highlights the inherent risks associated with investing in the volatile DeFi space. The rapid decline in the value of the WLFI-linked wallet's assets underscores the importance of due diligence and risk management for investors, regardless of experience level.

The Fallout: A $209 Million Loss and Counting

The news broke earlier this week, sending ripples through the already turbulent cryptocurrency market. The wallet, long associated with the now-infamous WLFI project, initiated the liquidation of its ETH holdings, likely triggered by automated liquidation protocols designed to protect against further losses. The move, while potentially intended to mitigate further damage, ultimately resulted in a massive $209 million decrease in the portfolio's overall value. This figure represents a significant percentage of the wallet's initial holdings, leaving many investors wondering about the future of similar projects.

What Caused the Crash? Unraveling the Wonderland Collapse

The collapse of Wonderland Finance and the subsequent liquidation of its associated wallet is a complex issue with several contributing factors:

- Algorithmic Instability: WLFI relied on complex algorithmic mechanisms to maintain its price stability. These algorithms, however, proved vulnerable to market fluctuations and manipulation, ultimately leading to a significant price drop.

- Lack of Transparency: Concerns about the project's transparency and the true identity of its key figures fueled investor distrust, triggering a cascade of sell-offs. A lack of clear auditing practices and readily available information exacerbated the problem.

- Market Volatility: The broader cryptocurrency market's inherent volatility played a crucial role. A downturn in the overall market amplified the negative impact on WLFI and its associated assets.

- Liquidity Crisis: The combination of these factors resulted in a severe liquidity crisis, making it impossible for the project to maintain its operations and ultimately leading to the liquidation of its ETH holdings.

The Implications for the DeFi Ecosystem

This event serves as a stark reminder of the inherent risks within the DeFi space. Investors need to carefully assess the risks involved before committing their funds to any project. Key factors to consider include:

- Team Transparency: Investigate the team behind the project, their experience, and their track record.

- Project Audits: Look for independent audits that verify the security and functionality of the smart contracts.

- Risk Management: Diversify your investments and understand the potential downsides of each project.

The WLFI incident underscores the need for improved regulation and transparency within the DeFi sector. As the DeFi landscape continues to evolve, robust risk management practices and enhanced regulatory oversight are crucial to protect investors and maintain the integrity of the ecosystem. The ongoing investigation into the circumstances surrounding the liquidation will likely shape future DeFi projects and investor behaviour. Stay informed and proceed with caution in this rapidly changing environment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on WLFI-Linked Wallet Liquidates ETH Amidst $209M Portfolio Crash. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Aurovilles Cdac Tie Up Examining Implications For Community Control

Apr 11, 2025

Aurovilles Cdac Tie Up Examining Implications For Community Control

Apr 11, 2025 -

Confirming Cartridge Upgrades For Nintendo Switch 2 Games The Breath Of The Wild Dlc Question

Apr 11, 2025

Confirming Cartridge Upgrades For Nintendo Switch 2 Games The Breath Of The Wild Dlc Question

Apr 11, 2025 -

Thinner And More Powerful Oppos Find X8 Ultra Unveiled

Apr 11, 2025

Thinner And More Powerful Oppos Find X8 Ultra Unveiled

Apr 11, 2025 -

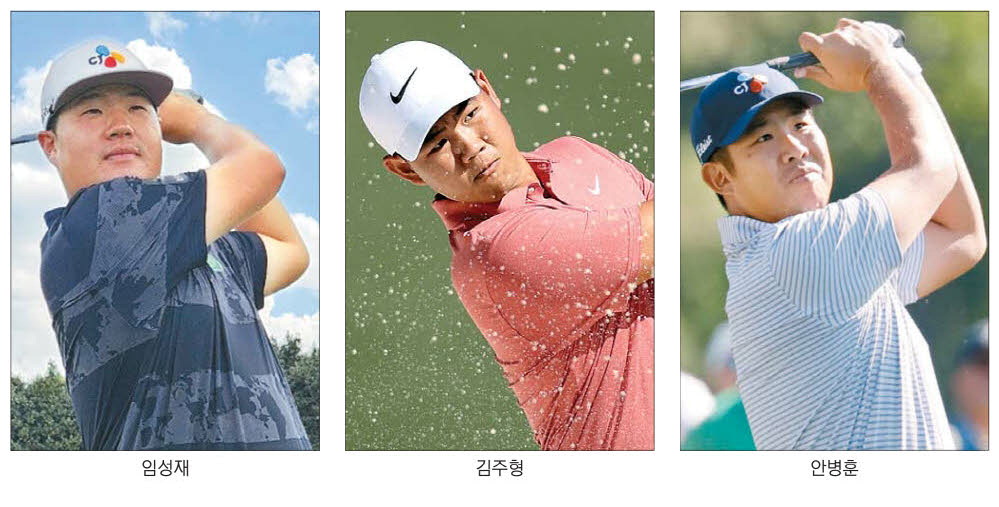

Rising Stars Lim Sung Jae Kim Joo Hyung And Ahn Byung Hoons Impact On Korean Golf

Apr 11, 2025

Rising Stars Lim Sung Jae Kim Joo Hyung And Ahn Byung Hoons Impact On Korean Golf

Apr 11, 2025 -

Benchmark Tests Oppos New Flagship Beats Samsung Galaxy S25

Apr 11, 2025

Benchmark Tests Oppos New Flagship Beats Samsung Galaxy S25

Apr 11, 2025