WP's Take On Income-Allianz Deal: Approval Likely, Says SM Lee (GE2025)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

WP's Take on Income-Allianz Deal: Approval Likely, Says SM Lee (GE2025)

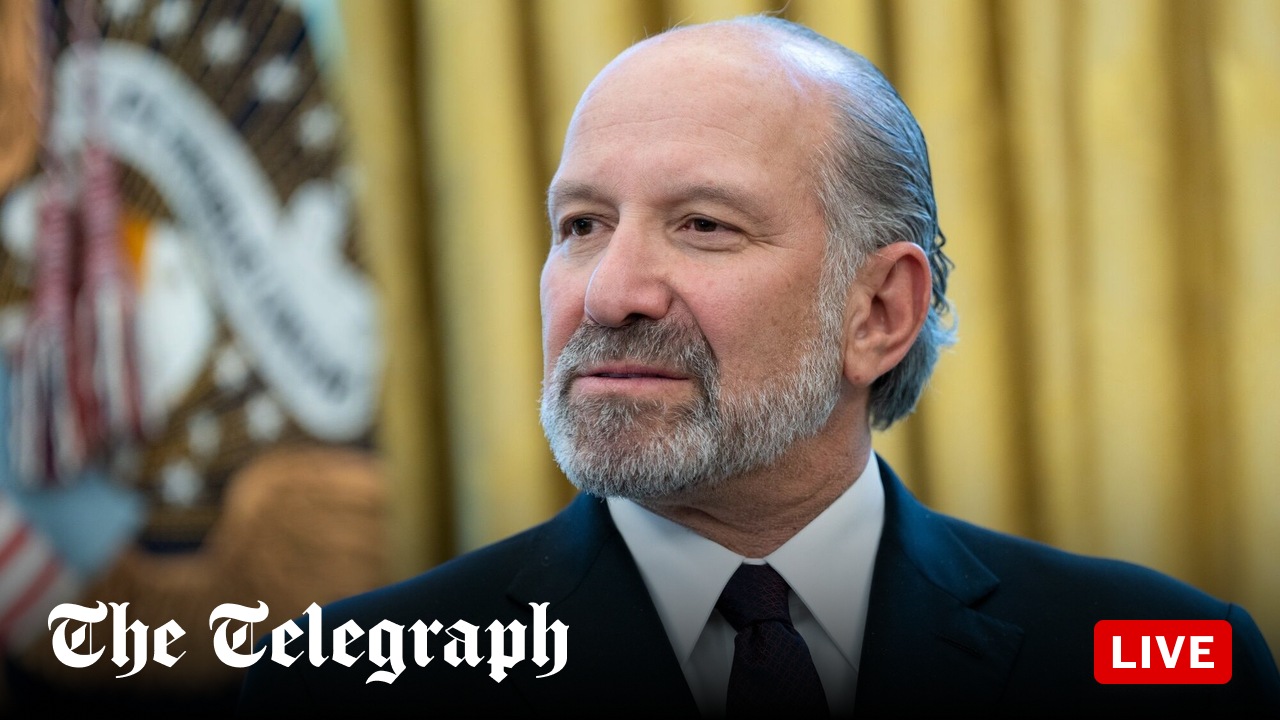

Singapore's political landscape is buzzing with anticipation surrounding the potential approval of the Income-Allianz deal, a significant merger in the insurance sector. With General Elections (GE2025) looming, the Workers' Party (WP) has weighed in, offering a cautiously optimistic outlook. Senior Member of Parliament (MP) Lee has hinted at a likely approval, but emphasized the importance of thorough regulatory scrutiny.

Understanding the Significance of the Income-Allianz Deal

The proposed merger between Income, a homegrown insurer, and Allianz, a global insurance giant, represents a watershed moment for Singapore's financial industry. This deal promises to create a formidable player in the regional insurance market, potentially boosting Singapore's position as a leading financial hub. However, such a significant consolidation also necessitates careful consideration of its implications for competition, consumer protection, and the overall health of the insurance sector.

WP's Stance: Cautious Optimism amidst Regulatory Scrutiny

SM Lee's comments reflect a measured approach from the WP. While expressing a belief that the deal is likely to receive approval, the emphasis on robust regulatory oversight underscores the party's commitment to protecting consumers and maintaining a competitive insurance market. This careful balancing act highlights the WP's pragmatic approach to economic policy, prioritizing both growth and safeguarding the interests of Singaporeans.

Key Considerations for Regulatory Approval:

The Monetary Authority of Singapore (MAS), the country's central bank and financial regulator, will play a crucial role in determining the fate of the merger. Several key factors will likely influence their decision, including:

- Competitive Landscape: MAS will assess the impact of the merger on competition within the insurance sector. Will the combined entity hold excessive market power, potentially leading to higher premiums or reduced consumer choice?

- Consumer Protection: Safeguarding consumer interests is paramount. MAS will carefully examine the proposed merger's implications for policyholders, ensuring that their rights and protections are not compromised.

- Financial Stability: The regulator will scrutinize the financial health and stability of the merged entity, ensuring it can withstand potential economic shocks and continue to fulfill its obligations to policyholders.

- Synergies and Benefits: MAS will also weigh the potential economic benefits of the merger, such as increased efficiency, innovation, and improved services for consumers.

GE2025 and the Impact on Economic Policy

The impending GE2025 adds another layer of complexity to the situation. The WP's stance on this crucial economic issue will undoubtedly be a key talking point during the election campaign. Their measured approach, balancing potential economic benefits with the need for robust regulation, is likely to resonate with voters concerned about both economic growth and consumer protection.

Conclusion: A Wait-and-See Approach

While SM Lee's comments suggest a positive outlook for the Income-Allianz deal, the final decision rests with the MAS. The ongoing regulatory review process will be crucial in determining the ultimate outcome and shaping the future of Singapore's insurance sector. The WP's position, characterized by cautious optimism and a focus on responsible regulation, highlights their commitment to a balanced economic approach that benefits both businesses and consumers. The coming months will be crucial as Singaporeans await the MAS’s final decision and observe how this issue plays out in the lead-up to GE2025.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on WP's Take On Income-Allianz Deal: Approval Likely, Says SM Lee (GE2025). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ge 2025 A Comparative Analysis Of Four Key Constituencies

Apr 29, 2025

Ge 2025 A Comparative Analysis Of Four Key Constituencies

Apr 29, 2025 -

Trump Tariffs Impact Uk Trade Deals Fate Rests With Prime Minister And Parliament

Apr 29, 2025

Trump Tariffs Impact Uk Trade Deals Fate Rests With Prime Minister And Parliament

Apr 29, 2025 -

Ge 2025 Good Faith Behind Allianz Income Deal Ntuc To Enhance Services Says Ng

Apr 29, 2025

Ge 2025 Good Faith Behind Allianz Income Deal Ntuc To Enhance Services Says Ng

Apr 29, 2025 -

Meet The Pap Team Serving Punggol Grc Your Representatives For The Next General Election

Apr 29, 2025

Meet The Pap Team Serving Punggol Grc Your Representatives For The Next General Election

Apr 29, 2025 -

Ge 2025 Pritam Singh Addresses Allegations Of Negative Campaigning By Wp

Apr 29, 2025

Ge 2025 Pritam Singh Addresses Allegations Of Negative Campaigning By Wp

Apr 29, 2025

Latest Posts

-

Five Pivotal Factors To Decide The Afc Champions League Semi Finals In Jeddah

Apr 30, 2025

Five Pivotal Factors To Decide The Afc Champions League Semi Finals In Jeddah

Apr 30, 2025 -

Trumps Partial Tariff Relief For Automakers A Win Or A Loss

Apr 30, 2025

Trumps Partial Tariff Relief For Automakers A Win Or A Loss

Apr 30, 2025 -

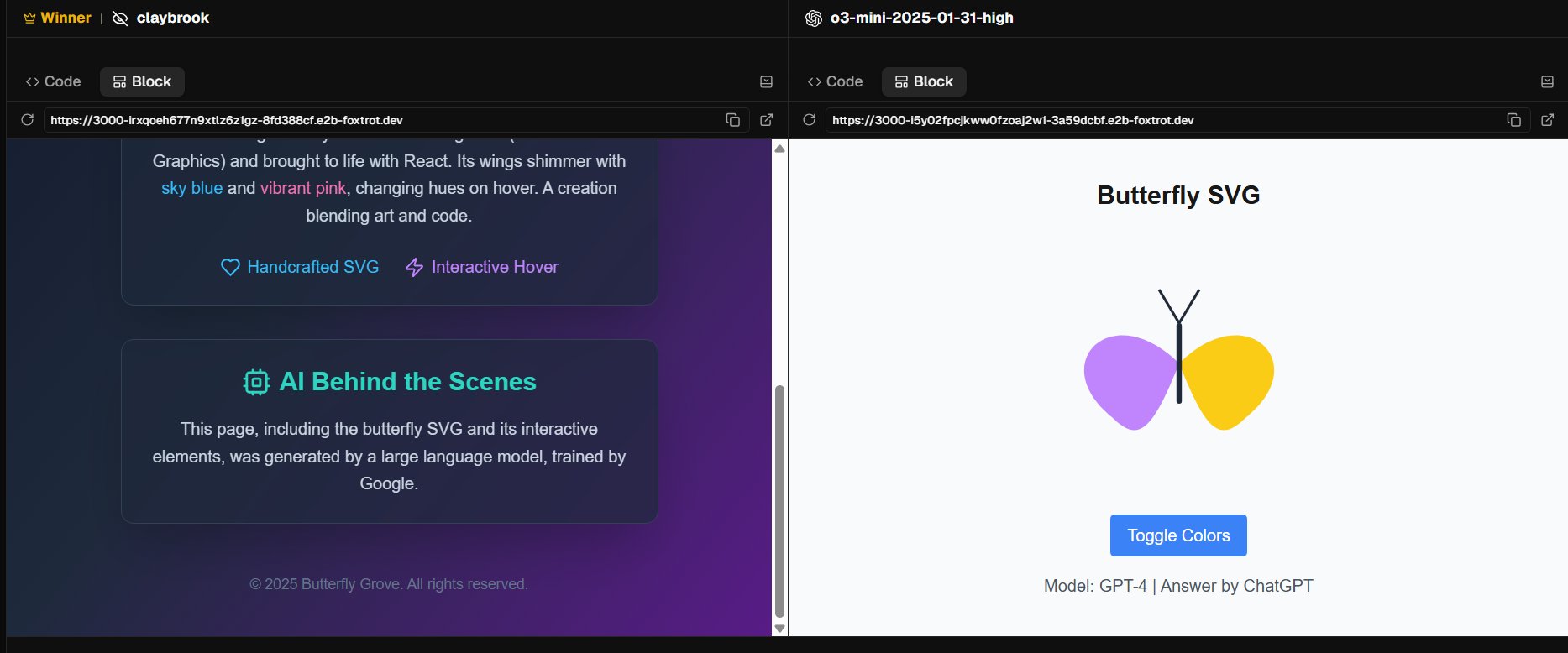

Claybrook Ai From Google Improving Ui Ux Coding And Web Development Workflows

Apr 30, 2025

Claybrook Ai From Google Improving Ui Ux Coding And Web Development Workflows

Apr 30, 2025 -

Health Records Exposed Database Flaw In Medical Software Company

Apr 30, 2025

Health Records Exposed Database Flaw In Medical Software Company

Apr 30, 2025 -

Documentary About Medvedev Hes Not Interested I Would Go Crazy

Apr 30, 2025

Documentary About Medvedev Hes Not Interested I Would Go Crazy

Apr 30, 2025