Yellen Expects Quieter Period For US Bond Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Yellen Expects Quieter Period for US Bond Market After Tumultuous Year

The US bond market, which experienced significant volatility in 2023, is expected to see calmer waters ahead, according to Treasury Secretary Janet Yellen. This shift comes after a year marked by aggressive interest rate hikes by the Federal Reserve and concerns about inflation and the overall economic outlook. Yellen's prediction offers a glimmer of hope for investors navigating the complex landscape of fixed-income securities.

A Year of Upheaval in the Bond Market

2023 witnessed a dramatic surge in bond yields as the Federal Reserve embarked on a series of interest rate increases to combat stubbornly high inflation. This aggressive monetary policy directly impacted bond prices, leading to significant losses for many investors. The uncertainty surrounding the future path of interest rates, coupled with concerns about a potential recession, further fueled market volatility. This turbulence created a challenging environment for both individual investors and large institutional players.

Yellen's Optimism and the Factors Contributing to it

In recent statements, Yellen expressed her belief that the bond market is poised for a period of relative calm. Several factors underpin this expectation:

- Easing Inflation: While inflation remains above the Federal Reserve's target, recent data suggests a slowing trend. This decreased inflationary pressure reduces the likelihood of further aggressive interest rate hikes, thereby stabilizing bond yields.

- Potential Pause in Rate Hikes: The Federal Reserve's upcoming meetings will be closely scrutinized for indications of a potential pause or even a reversal in its rate-hiking cycle. A pause would significantly reduce uncertainty in the bond market.

- Improved Economic Outlook (relatively): Although recessionary risks persist, the US economy has shown some resilience, suggesting a potentially softer landing than previously feared. A less pessimistic economic outlook tends to lessen the demand for safe-haven assets like government bonds, leading to less dramatic price swings.

What this Means for Investors

Yellen's prediction doesn't signal the end of market fluctuations entirely. Unexpected economic data or shifts in Federal Reserve policy could still trigger volatility. However, the prospect of a quieter period offers some relief after a turbulent year. Investors should still maintain a diversified portfolio and carefully consider their risk tolerance. It's crucial to remember that past performance is not indicative of future results, and professional financial advice is always recommended.

Looking Ahead: Navigating the Bond Market in 2024

The coming year will be crucial for the US bond market. Investors should closely monitor:

- Inflation data: Continued declines in inflation will solidify the expectation of a calmer market.

- Federal Reserve announcements: Any shifts in monetary policy will directly impact bond yields and prices.

- Economic growth: Stronger-than-expected economic growth could lead to renewed upward pressure on interest rates.

The bond market remains a complex and dynamic environment. While Yellen's prediction offers a degree of optimism, investors must remain vigilant and adapt their strategies based on evolving market conditions. Staying informed and seeking professional guidance is crucial for navigating the complexities of the bond market successfully. The coming months will be pivotal in determining whether Yellen's prediction holds true.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Yellen Expects Quieter Period For US Bond Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Accessible Ai Search Sentients Vision For The Future Of Information Retrieval

Apr 10, 2025

Accessible Ai Search Sentients Vision For The Future Of Information Retrieval

Apr 10, 2025 -

Improved Locomotion And Actuators Teslas Optimus Robot Advances

Apr 10, 2025

Improved Locomotion And Actuators Teslas Optimus Robot Advances

Apr 10, 2025 -

Misquoted Again Washington Sundar Addresses Recent Media Reports

Apr 10, 2025

Misquoted Again Washington Sundar Addresses Recent Media Reports

Apr 10, 2025 -

Delhi Capitals Struggle Rcb Dominates In Ipl 2025 Match

Apr 10, 2025

Delhi Capitals Struggle Rcb Dominates In Ipl 2025 Match

Apr 10, 2025 -

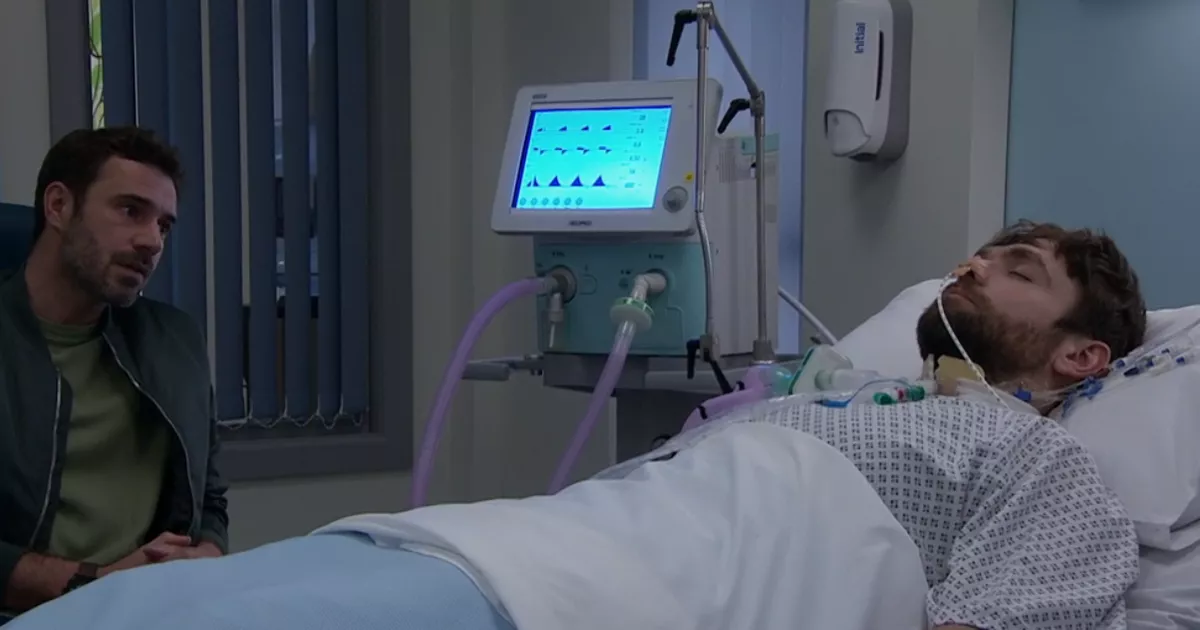

Shock Twist Emmerdale Unmasks John Sugdens Mystery Patient

Apr 10, 2025

Shock Twist Emmerdale Unmasks John Sugdens Mystery Patient

Apr 10, 2025