Yield-Heavy Energy Plays: CIBC Analyst's Top Recommendations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Yield-Heavy Energy Plays: CIBC Analyst's Top Recommendations for Income-Seeking Investors

The energy sector is experiencing a surge in interest, not just from growth investors chasing high-flying stocks, but also from income-seeking investors drawn to the robust dividend yields offered by some energy companies. A recent report from CIBC analyst [Analyst's Name, if available, otherwise remove this sentence] highlights several compelling yield-heavy energy plays currently commanding attention in the market. These recommendations provide a valuable insight for investors seeking attractive dividend income streams with potential for capital appreciation.

Why Energy Stocks are Attracting Income Investors:

Several factors contribute to the energy sector's current appeal to income investors. Firstly, the global energy transition, while significant, is not happening overnight. Fossil fuels remain crucial to global energy needs, generating strong cash flows for established producers. Secondly, many energy companies are prioritizing returning capital to shareholders through generous dividend payouts, making them attractive options for those seeking stable income streams. Thirdly, unlike some sectors heavily reliant on economic growth, energy demand tends to be more resilient even during economic downturns.

CIBC's Top Yield-Heavy Energy Picks:

While specific stock recommendations can change rapidly based on market conditions, the CIBC report (if publicly available, cite the report here) focused on companies exhibiting strong fundamentals, sustainable dividend policies, and attractive yield profiles. The analyst likely considered factors such as:

- Free Cash Flow (FCF): A measure of a company's profitability after accounting for capital expenditures. High FCF is crucial for sustaining dividend payouts.

- Debt Levels: Excessive debt can jeopardize a company's ability to maintain dividends. Lower debt levels indicate greater financial stability.

- Dividend Growth History: A consistent track record of dividend increases signals management's commitment to rewarding shareholders.

- Valuation: The analyst likely considered valuation metrics to ensure the recommendations offer compelling risk-adjusted returns.

Key Considerations for Investors:

Before investing in any energy stock, it's crucial to conduct thorough due diligence. Remember:

- Past performance is not indicative of future results. While a strong dividend history is positive, it doesn't guarantee future payouts.

- Diversification is key. Don't put all your eggs in one basket. Diversify your portfolio across different energy companies and other sectors.

- Understand the risks. The energy sector is cyclical and susceptible to price volatility. Geopolitical events and regulatory changes can significantly impact individual company performance.

- Seek professional advice. Consulting a financial advisor can provide personalized guidance based on your individual financial goals and risk tolerance.

Beyond the Top Picks: Exploring the Broader Energy Landscape:

While CIBC's recommendations offer valuable starting points, investors should explore the broader energy landscape. Consider researching companies involved in renewable energy, such as solar and wind power, which offer long-term growth potential alongside potentially attractive dividends in the future. The energy sector is evolving, presenting opportunities across various sub-sectors.

Conclusion:

The energy sector presents intriguing opportunities for investors seeking attractive dividend yields. CIBC's top recommendations, while not explicitly named here to avoid outdated information, highlight the potential for generating income while participating in a sector crucial to the global economy. However, remember to conduct thorough research and seek professional advice before making any investment decisions. The information provided here is for educational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Yield-Heavy Energy Plays: CIBC Analyst's Top Recommendations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unprecedented Ai Power Exploring Anthropics New Claude 4 Models

May 24, 2025

Unprecedented Ai Power Exploring Anthropics New Claude 4 Models

May 24, 2025 -

Criptomoeda De Rede Social Sofre Queda Brutal De 98 Em Seu Lancamento

May 24, 2025

Criptomoeda De Rede Social Sofre Queda Brutal De 98 Em Seu Lancamento

May 24, 2025 -

Miley Cyruss New Years Eve Performance Interrupted By Ovarian Cyst Emergency

May 24, 2025

Miley Cyruss New Years Eve Performance Interrupted By Ovarian Cyst Emergency

May 24, 2025 -

Sex Education Star Gillian Anderson Reveals Unexpected Details About Her Love Life

May 24, 2025

Sex Education Star Gillian Anderson Reveals Unexpected Details About Her Love Life

May 24, 2025 -

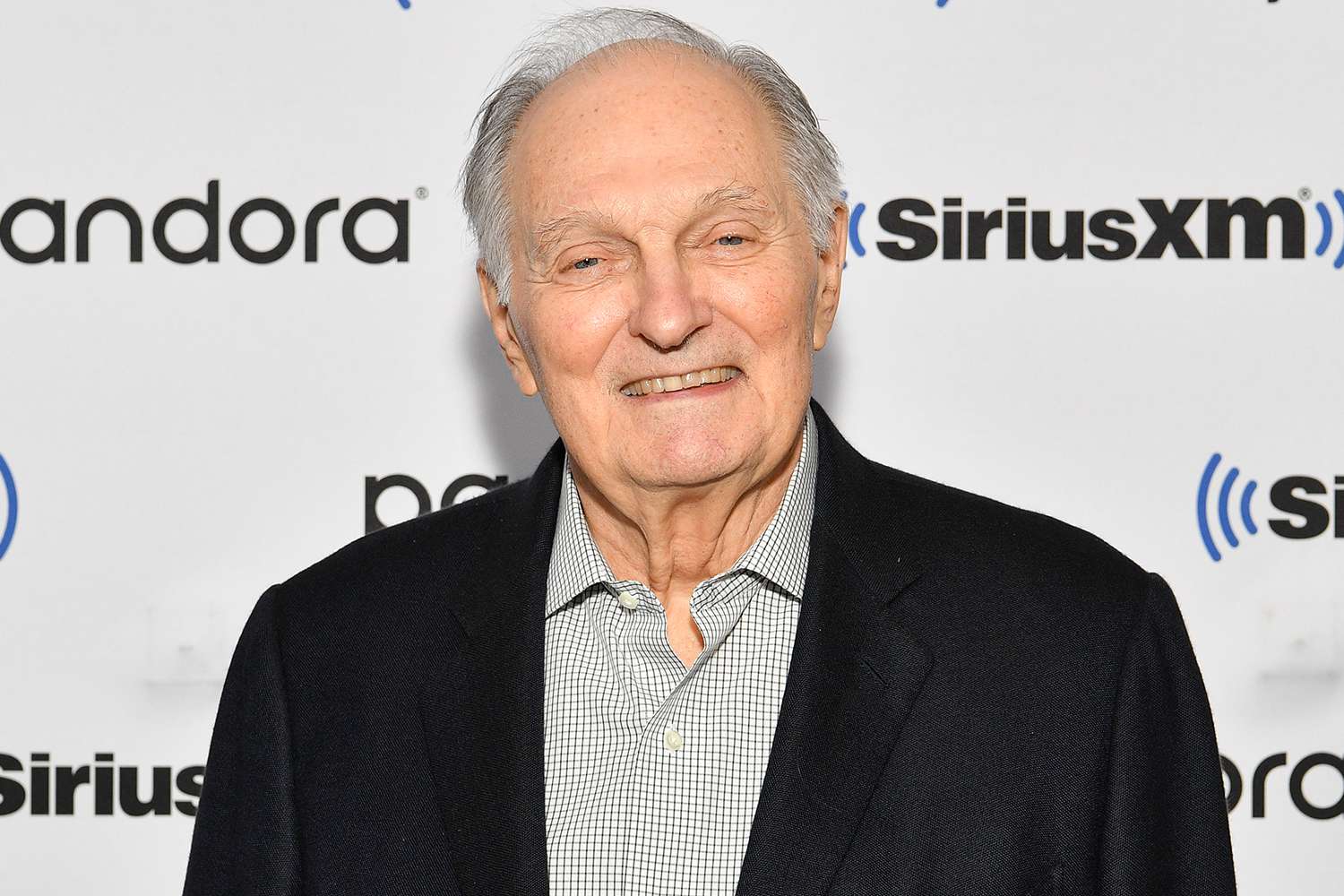

Parkinsons Diagnosis Alan Alda 89 On Managing The Disease And Finding Joy

May 24, 2025

Parkinsons Diagnosis Alan Alda 89 On Managing The Disease And Finding Joy

May 24, 2025