$1,000 Tech Stock Portfolio: Building Wealth With Strategic Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$1,000 Tech Stock Portfolio: Building Wealth with Strategic Investments

The tech sector's dynamism offers incredible potential for growth, making it an attractive arena for investors, even those starting with a modest sum. This article explores how to build a profitable $1,000 tech stock portfolio, focusing on strategic investment strategies and risk mitigation. Whether you're a seasoned investor or just beginning your journey, understanding the fundamentals of tech stock investing is key to maximizing your returns.

Understanding the Tech Landscape: Navigating the Volatility

The tech market is known for its volatility. While offering high growth potential, it's also susceptible to significant swings. Before diving in, it's crucial to understand the current market trends and identify promising sectors within the tech industry. Factors to consider include:

- Artificial Intelligence (AI): AI is rapidly transforming various industries, creating opportunities in software, hardware, and data analytics. Companies leading in AI development are often prime candidates for investment.

- Cloud Computing: The increasing reliance on cloud-based services presents substantial growth potential for cloud infrastructure providers and software-as-a-service (SaaS) companies.

- Cybersecurity: With growing cyber threats, cybersecurity companies are experiencing heightened demand, making them a potentially lucrative investment.

- Renewable Energy Technologies: The shift towards sustainable energy sources fuels innovation in solar, wind, and battery technologies, offering strong investment possibilities.

- E-commerce and Fintech: The continued growth of online shopping and digital payments presents opportunities in e-commerce platforms and financial technology companies.

Building Your $1,000 Tech Stock Portfolio: A Step-by-Step Guide

With a clear understanding of the market, let's build a diversified portfolio. Diversification is crucial to mitigate risk. Avoid putting all your eggs in one basket. Here's a sample portfolio strategy, but remember to conduct thorough research before investing:

-

Allocate your funds: Divide your $1,000 into several smaller investments (e.g., $100-$250 per stock). This limits potential losses if one stock underperforms.

-

Select your stocks: Based on your research, choose 4-5 tech companies representing different sectors. Consider established giants alongside promising smaller companies with high growth potential. Example:

- Established Giant (e.g., Microsoft, Apple): Offers stability and potential for steady growth.

- Growth Stock (e.g., a promising AI company): Higher risk, but potentially higher reward.

- Cloud Computing Company (e.g., AWS, Google Cloud): Taps into the booming cloud market.

- Cybersecurity Firm (e.g., Crowdstrike, Palo Alto Networks): Capitalizes on increasing security concerns.

-

Dollar-Cost Averaging (DCA): Instead of investing your entire $1,000 at once, consider using DCA. This strategy involves investing smaller amounts at regular intervals (e.g., monthly), mitigating the risk of investing at a market peak.

-

Monitor and Rebalance: Regularly review your portfolio's performance. Rebalance your holdings periodically to maintain your desired asset allocation and adjust to changing market conditions.

Risk Management: Protecting Your Investment

Investing in the stock market always involves risk. To minimize potential losses:

- Thorough Research: Before investing in any company, conduct extensive research, analyzing financial statements, industry trends, and competitive landscape.

- Diversification: A diversified portfolio reduces the impact of any single stock's underperformance.

- Long-Term Perspective: Investing in the tech sector is a long-term strategy. Avoid impulsive decisions based on short-term market fluctuations.

- Consult a Financial Advisor: Seeking advice from a qualified financial advisor can provide valuable insights and personalized guidance.

Conclusion: Building Long-Term Wealth in Tech

Building a successful $1,000 tech stock portfolio requires careful planning, research, and discipline. By diversifying your investments, employing strategies like dollar-cost averaging, and staying informed about market trends, you can significantly increase your chances of building long-term wealth in the dynamic world of tech stocks. Remember, this information is for educational purposes, and individual investment decisions should be made after thorough research and consideration of your personal financial situation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $1,000 Tech Stock Portfolio: Building Wealth With Strategic Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

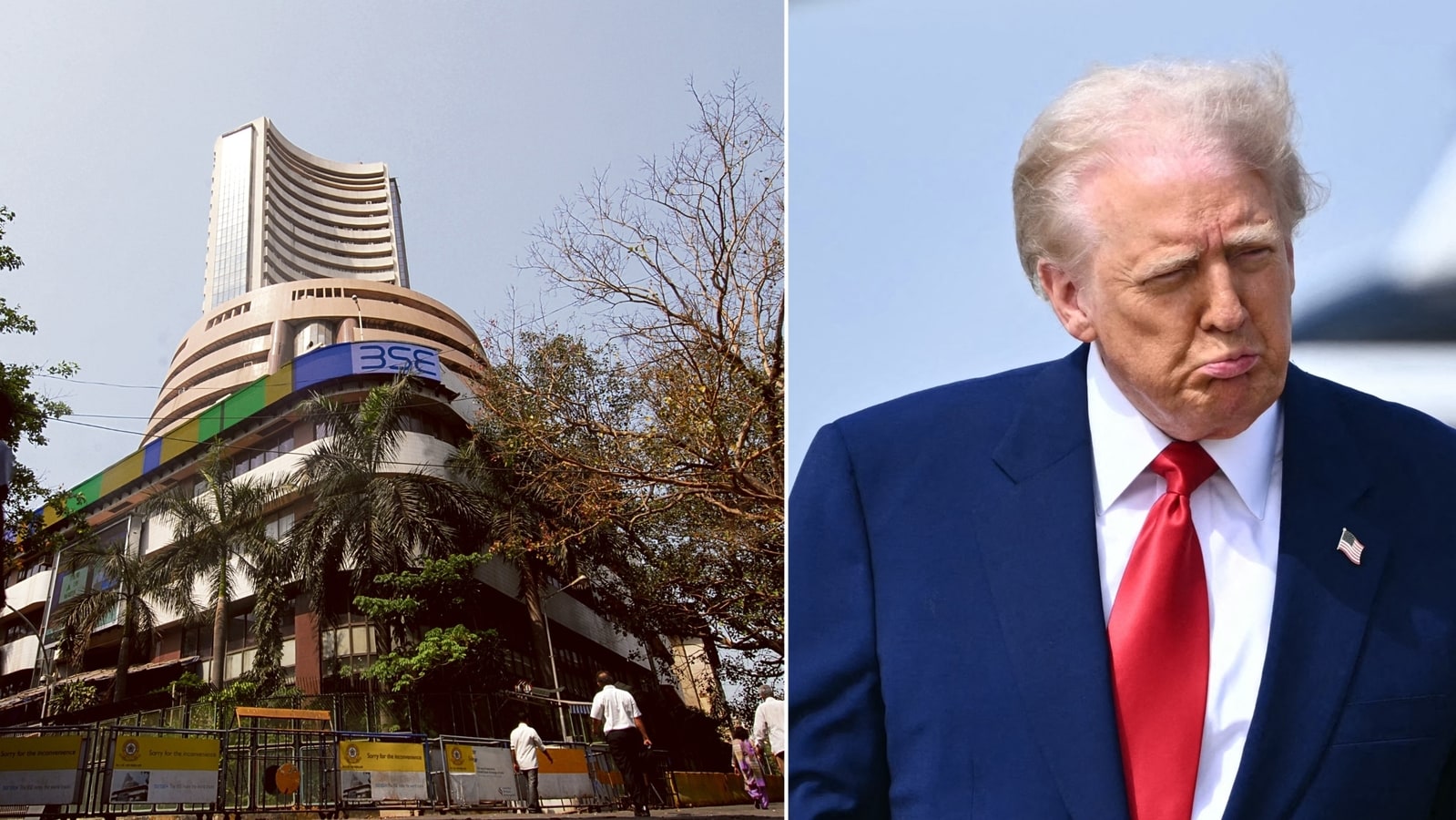

Why Is The Indian Stock Market Crashing Understanding The Sensex And Nifty Decline

Apr 07, 2025

Why Is The Indian Stock Market Crashing Understanding The Sensex And Nifty Decline

Apr 07, 2025 -

Tarif Dagang Trump Bagaimana China Membalas Strategi Agresif As

Apr 07, 2025

Tarif Dagang Trump Bagaimana China Membalas Strategi Agresif As

Apr 07, 2025 -

Potential For Growth Investing In Amazon In The Current Market

Apr 07, 2025

Potential For Growth Investing In Amazon In The Current Market

Apr 07, 2025 -

Investimentos Da Berkshire Greg Abel O Sucessor De Buffett Assume O Comando

Apr 07, 2025

Investimentos Da Berkshire Greg Abel O Sucessor De Buffett Assume O Comando

Apr 07, 2025 -

F1 Japan Verstappens Strong Start Alonso And Gaslys Intense Battle

Apr 07, 2025

F1 Japan Verstappens Strong Start Alonso And Gaslys Intense Battle

Apr 07, 2025