£9.3 Million Share Buyback: Standard Chartered's HKEX Filing Details

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Standard Chartered Announces £9.3 Million Share Buyback: HKEX Filing Details Unveiled

Standard Chartered PLC (STAN.L) sent ripples through the financial markets today with the announcement of a £9.3 million share buyback program, as detailed in a filing with the Hong Kong Exchanges and Clearing (HKEX). This move signals a vote of confidence in the bank's future prospects and offers valuable insights into its capital management strategy. The buyback, a significant development for shareholders, adds another layer to the ongoing narrative surrounding Standard Chartered's performance and future growth.

Key Details from the HKEX Filing:

The HKEX filing, a crucial document for transparency and regulatory compliance, revealed several key details about the share buyback program. Here are some of the highlights:

- Buyback Amount: A total of £9.3 million will be allocated to the repurchase of Standard Chartered's ordinary shares.

- Timing: The buyback program is expected to commence shortly and will likely continue for a period yet to be definitively specified in further announcements.

- Market Conditions: The actual number of shares bought back will be dependent on prevailing market conditions and share price fluctuations. This flexible approach allows Standard Chartered to strategically optimize its investment in its own stock.

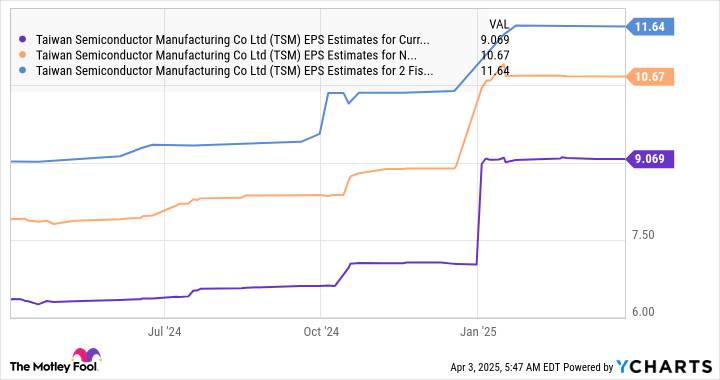

- Shareholder Value: The buyback is designed to enhance shareholder value by reducing the number of outstanding shares, potentially increasing earnings per share (EPS). This is a common strategy employed by companies confident in their future performance.

- Strategic Implications: This move underlines Standard Chartered's belief in its long-term growth and financial stability. The buyback suggests the bank sees its shares as undervalued at the current market price.

Analyzing Standard Chartered's Strategy:

This share buyback program is not an isolated incident but rather a strategic move within a broader context. It reflects Standard Chartered's commitment to returning capital to shareholders while demonstrating confidence in the bank's ability to generate strong future returns. This is particularly relevant given the current economic climate and the ongoing challenges facing the global banking sector.

Impact on Investors:

The announcement is likely to be well-received by many investors. Share buybacks often lead to increased share prices due to reduced supply and potential EPS growth. However, investors should consider this alongside the broader financial performance and future outlook of Standard Chartered before making any investment decisions. Independent financial advice is always recommended.

Looking Ahead:

Standard Chartered's £9.3 million share buyback represents a significant step in its capital management strategy. It will be interesting to observe the impact of the program on the share price and the bank's overall financial performance in the coming months. Further updates from the bank will be keenly awaited by investors and market analysts alike. The success of this buyback will be a key factor to monitor as Standard Chartered continues to navigate the complexities of the global financial landscape.

Keywords: Standard Chartered, share buyback, HKEX filing, £9.3 million, STAN.L, shareholder value, capital management, earnings per share (EPS), stock repurchase, investment strategy, market conditions, global banking, financial performance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on £9.3 Million Share Buyback: Standard Chartered's HKEX Filing Details. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brshlwnt Ywkd Inyjw Martynyz Yghyb En Mwajht Ryal Bytys Bsbb Alisabt

Apr 07, 2025

Brshlwnt Ywkd Inyjw Martynyz Yghyb En Mwajht Ryal Bytys Bsbb Alisabt

Apr 07, 2025 -

Dampak Sosial Ekonomi Judi Online Kamboja Terhadap Masyarakat Indonesia

Apr 07, 2025

Dampak Sosial Ekonomi Judi Online Kamboja Terhadap Masyarakat Indonesia

Apr 07, 2025 -

Ai Stock Plunges 25 Is This A Buying Opportunity Before April 17

Apr 07, 2025

Ai Stock Plunges 25 Is This A Buying Opportunity Before April 17

Apr 07, 2025 -

One Week After Myanmar Earthquake Understanding The Impact And The Road To Recovery

Apr 07, 2025

One Week After Myanmar Earthquake Understanding The Impact And The Road To Recovery

Apr 07, 2025 -

Acciones De Apple Warren Buffett Reduce Su Participacion En Un 13 Analisis De La Decision

Apr 07, 2025

Acciones De Apple Warren Buffett Reduce Su Participacion En Un 13 Analisis De La Decision

Apr 07, 2025