AI Stock Plunges 25%: Is This A Buying Opportunity Before April 17?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AI Stock Plunges 25%: Is This a Buying Opportunity Before April 17?

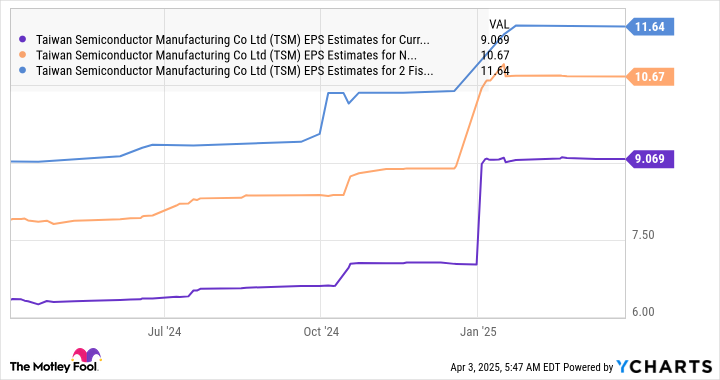

Artificial intelligence (AI) stocks took a significant hit this week, with several major players experiencing a dramatic 25% plunge. This sharp decline has left investors reeling and questioning whether this represents a compelling buying opportunity before the crucial April 17th deadline – a date many analysts are eyeing for potential market shifts. But is it a flash sale or a warning sign? Let's delve into the details.

The Market Meltdown: What Triggered the AI Stock Drop?

The recent AI stock slump isn't attributable to a single event. Instead, it's a confluence of factors contributing to the market's volatility. Several key elements are at play:

- Profit-Taking: After a period of substantial growth, many investors are taking profits, leading to a sell-off. This is a natural market correction, often seen after periods of rapid expansion in high-growth sectors like AI.

- Regulatory Uncertainty: Growing concerns surrounding AI regulation, particularly in the US and EU, are impacting investor confidence. The uncertainty surrounding future regulations adds risk, prompting some investors to pull back.

- Overvaluation Concerns: Some analysts argue that certain AI stocks were overvalued, leading to a necessary price correction. The current downturn might be a market adjustment to more realistic valuations.

- Economic Headwinds: The broader economic climate, characterized by inflation and potential interest rate hikes, is also contributing to the market's overall nervousness, impacting even high-growth sectors like AI.

April 17th: A Crucial Date for AI Investors?

Many analysts are focusing on April 17th as a potential turning point. This date is significant because several key earnings reports are expected, alongside potential announcements regarding new AI regulations. The market reaction to this information could significantly impact AI stock prices. However, it's crucial to remember that predicting market movements with certainty is impossible.

Is This a Buying Opportunity? A Cautious Approach

The 25% drop in AI stocks presents a tempting buying opportunity for some. However, a cautious approach is advised. While the potential for growth remains significant, several risks need careful consideration:

- Continued Regulatory Uncertainty: The lack of clarity around AI regulations poses a significant risk, potentially leading to further price corrections.

- Economic Slowdown: A potential economic slowdown could negatively impact investment in AI technologies, affecting stock prices.

- Competition: The AI market is increasingly competitive, and not all companies will succeed. Thorough due diligence is crucial before investing.

What to Do Now:

- Conduct Thorough Research: Before investing, thoroughly research individual companies and their financial health. Understand their business models, competitive landscape, and potential risks.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversification is key to mitigating risk. Spread your investments across different asset classes and AI companies.

- Consider Your Risk Tolerance: AI stocks are inherently high-risk, high-reward investments. Ensure your investment strategy aligns with your risk tolerance.

- Consult a Financial Advisor: Seek advice from a qualified financial advisor before making any investment decisions.

Conclusion:

The recent 25% plunge in AI stocks presents both a potential opportunity and a considerable risk. While the long-term prospects for AI remain strong, the current market volatility requires careful consideration. A thorough understanding of the underlying factors driving the decline, coupled with a well-defined investment strategy, is crucial for navigating this uncertain market landscape. The period leading up to April 17th will undoubtedly be pivotal, but remember, the market is unpredictable, and no investment guarantees a profit.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AI Stock Plunges 25%: Is This A Buying Opportunity Before April 17?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Experience The Future Of Sci Fi Action Tron Ares Teaser Unveiled

Apr 07, 2025

Experience The Future Of Sci Fi Action Tron Ares Teaser Unveiled

Apr 07, 2025 -

Bucks Clinch Playoff Spot As Western Conference Battle Intensifies

Apr 07, 2025

Bucks Clinch Playoff Spot As Western Conference Battle Intensifies

Apr 07, 2025 -

Market In Freefall 1300 Point Dow Drop Amidst Trump Tariff Crisis

Apr 07, 2025

Market In Freefall 1300 Point Dow Drop Amidst Trump Tariff Crisis

Apr 07, 2025 -

Film Jumbo Vs Qodrat 2 Perebutan Puncak Box Office Lewati 1 Juta Penonton

Apr 07, 2025

Film Jumbo Vs Qodrat 2 Perebutan Puncak Box Office Lewati 1 Juta Penonton

Apr 07, 2025 -

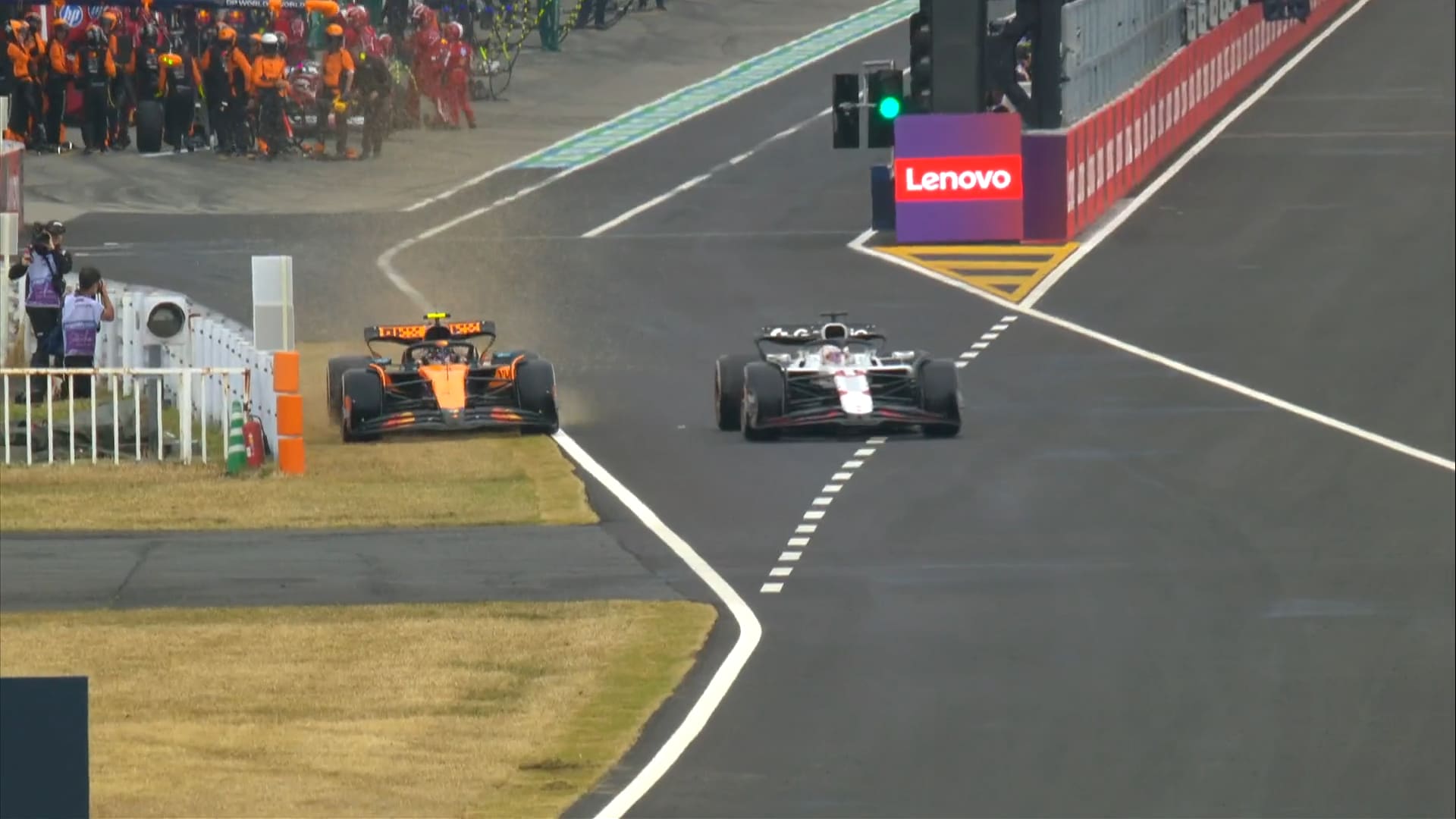

Live Coverage 2025 Japanese Grand Prix F1 Action From Suzuka

Apr 07, 2025

Live Coverage 2025 Japanese Grand Prix F1 Action From Suzuka

Apr 07, 2025