Abu Dhabi, Binance, And USD1: Unpacking The $2 Billion Investment And Trump Family Links

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Abu Dhabi, Binance, and USD1: Unpacking the $2 Billion Investment and Trump Family Links

A whirlwind of finance, politics, and family connections swirls around Binance's recent $2 billion investment from Abu Dhabi's sovereign wealth fund. This significant injection of capital into the world's largest cryptocurrency exchange raises eyebrows, particularly given the reported involvement of individuals connected to the Trump family. The deal, shrouded in a degree of secrecy, demands closer scrutiny.

The investment, reportedly channeled through a USD1-denominated investment vehicle, represents a massive vote of confidence in Binance, despite ongoing regulatory scrutiny globally. Abu Dhabi's strategic move signals a growing interest in the cryptocurrency sector from major players in the Middle East, potentially positioning the region as a key hub for digital asset development.

Abu Dhabi's Strategic Play: Beyond Cryptocurrency

Abu Dhabi's decision to invest such a substantial amount in Binance is more than just a financial maneuver. It's a calculated strategic play with far-reaching implications:

- Diversification of Investments: The investment aligns with Abu Dhabi's strategy of diversifying its massive sovereign wealth fund away from traditional oil-based economies. Cryptocurrency represents a high-growth, albeit volatile, asset class.

- Technological Advancement: The move underscores Abu Dhabi's commitment to embracing technological innovation and securing a foothold in the burgeoning blockchain technology sector.

- Geopolitical Positioning: By investing in a global player like Binance, Abu Dhabi strengthens its international financial standing and influence.

The Trump Connection: A Tangled Web of Allegations

Reports linking individuals connected to the Trump family to the investment have fueled considerable speculation. While the exact nature of these connections remains unclear and requires further investigation, the allegations raise questions about potential conflicts of interest and the influence of political connections in high-stakes financial deals. Transparency regarding the investors and the structuring of the investment is crucial to addressing these concerns.

USD1: Understanding the Investment Vehicle

The use of a USD1-denominated investment vehicle adds another layer of complexity. While details surrounding this specific vehicle remain limited, the use of such structures is often employed for tax optimization and regulatory compliance purposes. Further investigation is needed to ascertain the full implications of this structure within the context of this significant investment.

Regulatory Scrutiny and Future Implications

Binance, despite its market dominance, continues to face regulatory hurdles in various jurisdictions globally. This investment, while positive for the exchange, will likely intensify regulatory scrutiny. Authorities will be closely examining the source of funds, the compliance procedures involved, and the overall transparency of the deal. The long-term implications of this investment will depend heavily on how these regulatory challenges are addressed.

Conclusion: A Deal Demanding Transparency

The $2 billion investment by Abu Dhabi's sovereign wealth fund into Binance is a significant event with far-reaching consequences. The potential involvement of individuals linked to the Trump family demands thorough investigation and complete transparency. Only through open scrutiny can we fully understand the motivations behind this deal and its impact on the global cryptocurrency landscape, financial markets, and geopolitical dynamics. The coming months will undoubtedly reveal more information as the details of this complex transaction unfold.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Abu Dhabi, Binance, And USD1: Unpacking The $2 Billion Investment And Trump Family Links. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Historic Moment Paris Fc Joins Psg In Ligue 1 After 46 Year Absence

May 03, 2025

Historic Moment Paris Fc Joins Psg In Ligue 1 After 46 Year Absence

May 03, 2025 -

Ethena Integrates Ton For Dollar Payments On Telegrams Vast Network

May 03, 2025

Ethena Integrates Ton For Dollar Payments On Telegrams Vast Network

May 03, 2025 -

Sequel To 2018 Comedy Flops Missing The Mark

May 03, 2025

Sequel To 2018 Comedy Flops Missing The Mark

May 03, 2025 -

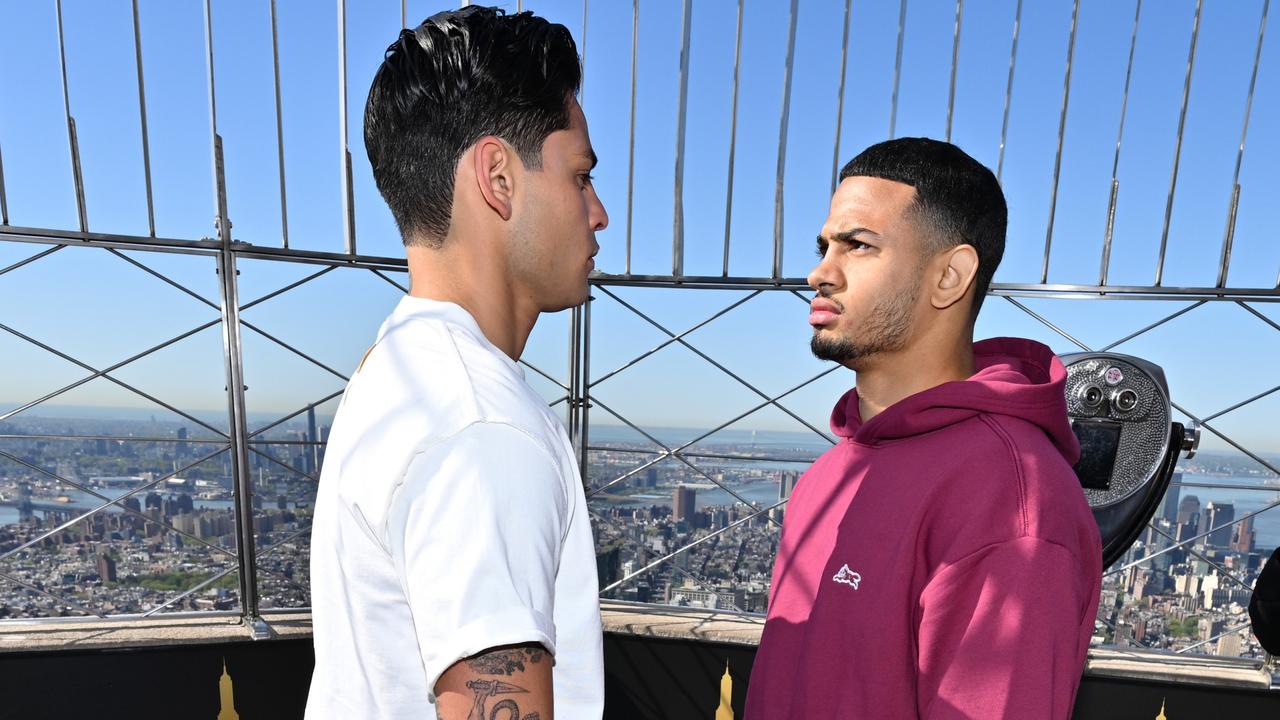

The Controversial Fighter Returns Your Ultimate Guide To The New York Event

May 03, 2025

The Controversial Fighter Returns Your Ultimate Guide To The New York Event

May 03, 2025 -

Beyond Paradise Relationship On The Rocks Couples Exit Confirmed By Bbc

May 03, 2025

Beyond Paradise Relationship On The Rocks Couples Exit Confirmed By Bbc

May 03, 2025

Latest Posts

-

Historic Promotion Paris Fc Earns Ligue 1 Spot With 1 1 Draw At Martigues

May 04, 2025

Historic Promotion Paris Fc Earns Ligue 1 Spot With 1 1 Draw At Martigues

May 04, 2025 -

Baseball Predictions For May 2nd Focusing On Fernando Tatis Jr S Potential

May 04, 2025

Baseball Predictions For May 2nd Focusing On Fernando Tatis Jr S Potential

May 04, 2025 -

Reinforcement Learning And Ai Separating Hype From Reality

May 04, 2025

Reinforcement Learning And Ai Separating Hype From Reality

May 04, 2025 -

Exploring The New Features In Apples Updated Tv App

May 04, 2025

Exploring The New Features In Apples Updated Tv App

May 04, 2025 -

Singapore Election Fallout Heated Exchange Between Pm Wong And Wp

May 04, 2025

Singapore Election Fallout Heated Exchange Between Pm Wong And Wp

May 04, 2025