Amazon Stock Slumps Amidst Rising Tariffs: Is Now The Time To Buy?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Amazon Stock Slumps Amidst Rising Tariffs: Is Now the Time to Buy?

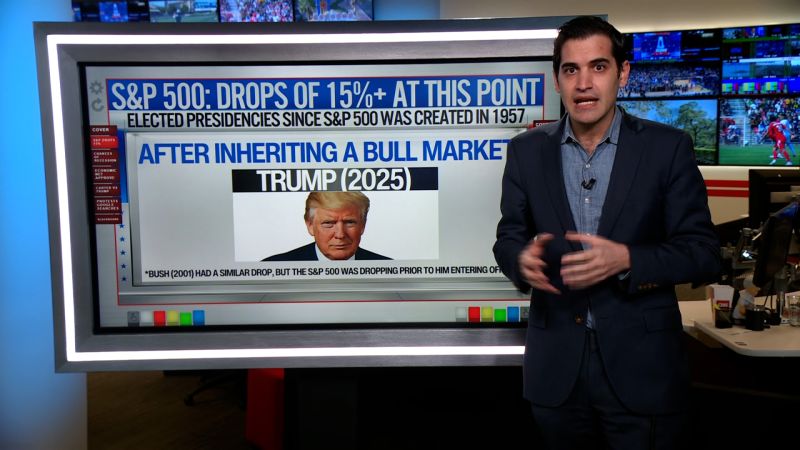

Amazon, the e-commerce giant, has seen its stock price take a significant hit recently, largely attributed to the escalating impact of rising tariffs. This downturn has left many investors wondering: is this a buying opportunity, or a sign of further trouble to come? Let's delve into the situation and explore the potential implications for investors.

The Tariff Tightrope: Amazon's Exposure

The recent increase in tariffs, particularly those affecting goods imported from China, has placed considerable pressure on Amazon. As a company heavily reliant on global supply chains and importing a vast array of products, Amazon is uniquely vulnerable to these trade wars. Higher tariffs translate directly into increased costs for Amazon, squeezing profit margins and potentially impacting its bottom line. This impact is felt across various aspects of Amazon's business, including its retail operations, AWS (Amazon Web Services), and its burgeoning third-party seller ecosystem.

Analyzing the Stock Slump: More Than Just Tariffs?

While tariffs are a significant contributing factor to Amazon's recent stock slump, it's crucial to consider other influencing factors. Increased competition, particularly from other e-commerce giants and the growing popularity of brick-and-mortar experiences, adds to the complexity of the situation. Furthermore, concerns about slowing economic growth, both domestically and internationally, contribute to investor apprehension.

Potential Impacts on Consumers and Sellers:

The ripple effect of these challenges isn't limited to Amazon's stock price. Consumers might experience higher prices on goods sold on the Amazon platform, while third-party sellers face reduced profitability due to increased costs. Navigating this environment requires both agility and strategic planning from Amazon and its ecosystem of sellers.

Is This a Buying Opportunity? A Cautious Perspective:

The question on many investors' minds is whether this dip presents a buying opportunity. The answer isn't straightforward. While the current price might seem attractive, the long-term impact of rising tariffs and other economic uncertainties remains unclear.

- Arguments for Buying: Amazon's dominance in e-commerce, its diverse revenue streams (including AWS), and its history of innovation suggest strong long-term potential. The current dip could represent a temporary setback.

- Arguments Against Buying: The ongoing tariff situation presents considerable uncertainty, and the competitive landscape remains fiercely competitive. A sustained period of slower growth is a real possibility.

What Investors Should Do:

Before making any investment decisions, thorough research and consideration of your personal risk tolerance are paramount. Consider the following:

- Diversify your portfolio: Don't put all your eggs in one basket. Spread your investments across various asset classes to mitigate risk.

- Long-term perspective: Amazon's long-term prospects are generally viewed positively, but short-term volatility is expected.

- Consult a financial advisor: Seek professional advice tailored to your specific financial situation and investment goals.

Conclusion: A Waiting Game?

The Amazon stock slump amidst rising tariffs presents a complex scenario. While the current price might appear attractive to some, the uncertainty surrounding the long-term effects of tariffs and broader economic factors necessitates a cautious approach. Investors should conduct thorough research, consider their risk tolerance, and potentially seek professional advice before making any decisions. The near future might dictate whether this is a genuine buying opportunity or a temporary lull before further price fluctuations. Staying informed about ongoing trade developments and Amazon's strategic responses will be key for navigating this dynamic situation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Amazon Stock Slumps Amidst Rising Tariffs: Is Now The Time To Buy?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Klaim Link Dana Kaget Panduan Lengkap And Strategi Anti Gagal

Apr 07, 2025

Klaim Link Dana Kaget Panduan Lengkap And Strategi Anti Gagal

Apr 07, 2025 -

Watch The 2025 F1 Japanese Grand Prix Live Uk Broadcast Grid And Race Updates From Suzuka

Apr 07, 2025

Watch The 2025 F1 Japanese Grand Prix Live Uk Broadcast Grid And Race Updates From Suzuka

Apr 07, 2025 -

Dow Futures Plunge Market Sell Off Intensifies

Apr 07, 2025

Dow Futures Plunge Market Sell Off Intensifies

Apr 07, 2025 -

Film Jumbo Vs Qodrat 2 Perebutan Juara Setelah Sama Sama Tembus 1 Juta Penonton

Apr 07, 2025

Film Jumbo Vs Qodrat 2 Perebutan Juara Setelah Sama Sama Tembus 1 Juta Penonton

Apr 07, 2025 -

Masters 2025 Weather Outlook Complete Forecast For Tournament And Practice Rounds

Apr 07, 2025

Masters 2025 Weather Outlook Complete Forecast For Tournament And Practice Rounds

Apr 07, 2025