Dow Futures Plunge: Market Sell-Off Intensifies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

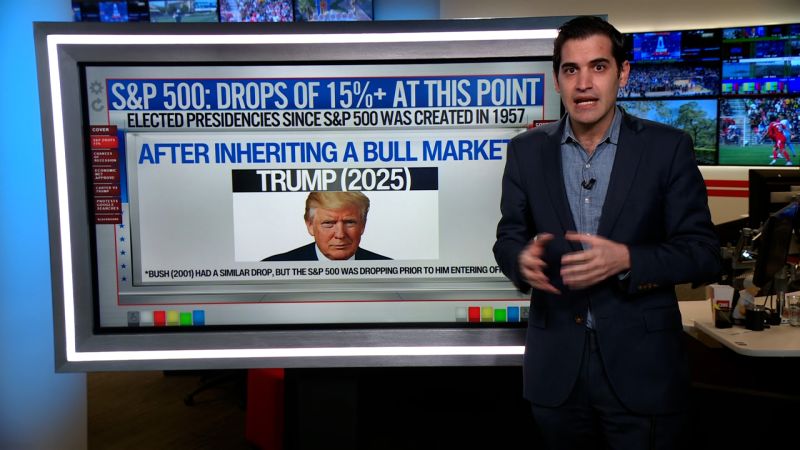

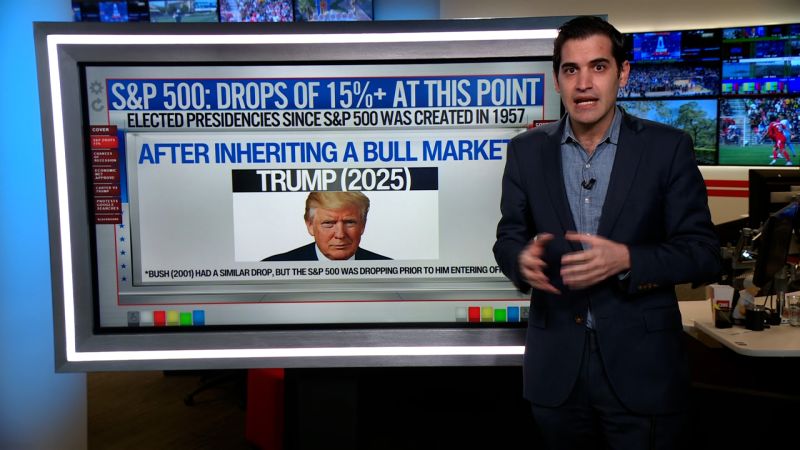

Dow Futures Plunge: Market Sell-Off Intensifies Amidst Growing Economic Uncertainty

Investors brace for another turbulent day as Dow futures plummet, signaling a deepening market sell-off fueled by escalating economic anxieties. The pre-market plunge suggests a continuation of the recent downward trend, leaving investors on edge and prompting concerns about a potential wider market correction. This significant drop follows a week of volatile trading and increasing uncertainty surrounding inflation, interest rates, and global economic growth.

What's Driving the Market Sell-Off?

Several factors are contributing to the intensified market sell-off and the dramatic plunge in Dow futures:

-

Inflationary Pressures: Persistent inflation remains a major headwind, with rising energy prices and supply chain disruptions continuing to exert upward pressure on consumer prices. The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are also contributing to the economic slowdown.

-

Interest Rate Hikes: The Federal Reserve's commitment to combating inflation through interest rate increases is impacting borrowing costs for businesses and consumers, slowing economic activity and potentially triggering a recession. The anticipation of further rate hikes is adding to market volatility.

-

Geopolitical Uncertainty: The ongoing war in Ukraine, coupled with escalating geopolitical tensions in other parts of the world, is creating uncertainty and impacting global supply chains, further exacerbating inflationary pressures.

-

Earnings Season Concerns: Upcoming earnings reports from major corporations are fueling apprehension. Investors are closely monitoring corporate guidance for signs of weakening economic conditions and their potential impact on future profits.

Dow Futures Deep Dive: The Numbers

Dow futures are currently down significantly, indicating a substantial drop is expected when the market opens. This sharp decline follows a similar pattern seen in recent trading sessions, reflecting the growing unease among investors. The magnitude of the drop highlights the severity of the current market sell-off and the heightened level of risk aversion. (Specific numbers will be updated to reflect real-time market data at the time of publication.)

What This Means for Investors:

The current market situation calls for a cautious approach. Investors should carefully review their portfolios and consider their risk tolerance. Diversification remains crucial in mitigating potential losses during periods of market volatility. Consulting with a financial advisor is recommended for personalized guidance based on individual circumstances.

Looking Ahead: Potential Scenarios

While the current market outlook appears bleak, it's crucial to remember that market cycles are inherently cyclical. While a market correction or even a recession remains a possibility, history suggests that periods of volatility are often followed by periods of recovery. However, the timing and duration of any recovery remain uncertain.

Key Takeaways:

- The Dow futures plunge underscores the growing economic uncertainty and its impact on market sentiment.

- Inflation, interest rate hikes, and geopolitical tensions are key drivers of the current sell-off.

- Investors should exercise caution, diversify their portfolios, and seek professional advice.

- While the short-term outlook is uncertain, market history suggests eventual recovery.

This is a developing story. We will continue to update this article as the situation unfolds and provide further analysis of the market's reaction to the ongoing economic challenges. Stay tuned for further updates and in-depth coverage. Remember to consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dow Futures Plunge: Market Sell-Off Intensifies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Starship Advantage Space Xs Vision For Efficient Global Cargo And Fuel

Apr 07, 2025

The Starship Advantage Space Xs Vision For Efficient Global Cargo And Fuel

Apr 07, 2025 -

China Stock Market Plunges Major Indices Down Over 7

Apr 07, 2025

China Stock Market Plunges Major Indices Down Over 7

Apr 07, 2025 -

El Barca Se Conforma Con Un Triunfo Ajustado Analisis Del Partido Y Consecuencias

Apr 07, 2025

El Barca Se Conforma Con Un Triunfo Ajustado Analisis Del Partido Y Consecuencias

Apr 07, 2025 -

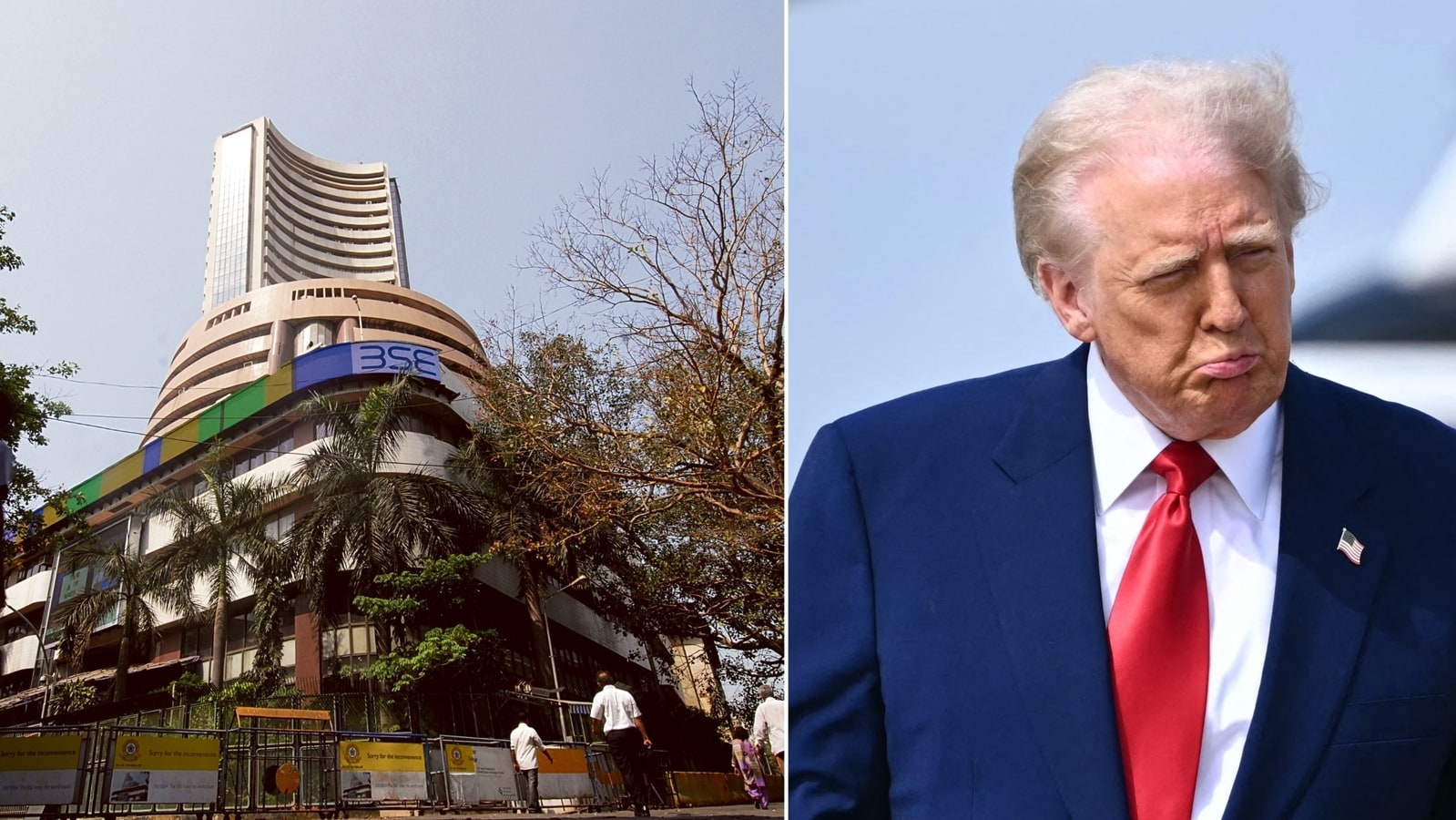

Indian Market Crash Today Sensex And Nifty Fall Explained

Apr 07, 2025

Indian Market Crash Today Sensex And Nifty Fall Explained

Apr 07, 2025 -

Analysis Bitcoin Btc Market Cooling 100 K Milestone In Jeopardy

Apr 07, 2025

Analysis Bitcoin Btc Market Cooling 100 K Milestone In Jeopardy

Apr 07, 2025