America's Biggest Banks Partner On Potential Stablecoin

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

America's Biggest Banks Partner on Potential Stablecoin: A New Era for Digital Finance?

The financial world is buzzing with the news of a potential groundbreaking collaboration: Several of America's largest banks are reportedly joining forces to explore the creation of a stablecoin, a digital currency pegged to the value of a fiat currency like the US dollar. This unprecedented move could reshape the landscape of digital finance and challenge the dominance of existing cryptocurrencies.

This development marks a significant shift in the attitude of traditional financial institutions towards digital assets. For years, many banks remained cautious, even skeptical, about cryptocurrencies. Now, however, facing the growing popularity and potential of blockchain technology, they're actively seeking ways to participate in the burgeoning digital asset market. This partnership signals a potential mainstream adoption of stablecoins, which are considered a more stable and regulated alternative to volatile cryptocurrencies like Bitcoin.

Who's Involved and What Does it Mean?

While specifics remain scarce, reports indicate that prominent players in the US banking sector are involved. The potential benefits for these institutions are numerous:

- Enhanced Efficiency: Stablecoins can streamline cross-border payments and reduce transaction costs, leading to increased efficiency and profitability.

- New Revenue Streams: Participation in a stablecoin network could open up new avenues for revenue generation through transaction fees and other services.

- Competitive Advantage: Being at the forefront of this technological innovation could give participating banks a significant competitive edge in the rapidly evolving financial landscape.

- Improved Customer Experience: A bank-backed stablecoin could offer customers a more seamless and integrated experience when interacting with digital assets.

Addressing Concerns and Challenges:

The creation of a bank-backed stablecoin is not without its challenges. Regulatory hurdles remain a significant obstacle, with concerns around consumer protection, money laundering, and financial stability needing careful consideration. The Federal Reserve and other regulatory bodies will undoubtedly play a crucial role in shaping the future of this initiative. Furthermore, the success of the venture hinges on addressing potential security risks and maintaining public trust.

The Future of Finance: A Stablecoin Revolution?

The potential impact of a bank-backed stablecoin on the US financial system is immense. It could:

- Increase Financial Inclusion: Stablecoins could offer access to financial services to underserved populations.

- Boost Innovation: The development and implementation of this technology could spur innovation across the financial industry.

- Drive Global Competition: The US may regain a competitive edge in the global financial arena through this initiative.

This collaboration by America’s biggest banks represents a watershed moment. While the specifics are yet to be revealed, the potential for this stablecoin to transform the financial landscape is undeniable. We will continue to update this story as more information becomes available. Stay tuned for further developments in this exciting evolution of the financial world. This partnership could be the catalyst for a new era of digital finance, bringing the stability of traditional banking into the fast-paced world of cryptocurrencies. The implications are far-reaching, and the coming months will be crucial in shaping the future of this groundbreaking initiative.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on America's Biggest Banks Partner On Potential Stablecoin. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Urgent Significant Police Activity Reported In South Melbourne

May 25, 2025

Urgent Significant Police Activity Reported In South Melbourne

May 25, 2025 -

Singer Billy Joel Cancels Tour Dates Due To Unexpected Illness

May 25, 2025

Singer Billy Joel Cancels Tour Dates Due To Unexpected Illness

May 25, 2025 -

Ryan Reynolds Pitched An R Rated Star Wars Movie To Disney

May 25, 2025

Ryan Reynolds Pitched An R Rated Star Wars Movie To Disney

May 25, 2025 -

Wwe Smack Down Complete Results Reactions And Snme Tampa Preview

May 25, 2025

Wwe Smack Down Complete Results Reactions And Snme Tampa Preview

May 25, 2025 -

39 Point Game Siakam Leads Pacers To Victory Over Knicks At Msg

May 25, 2025

39 Point Game Siakam Leads Pacers To Victory Over Knicks At Msg

May 25, 2025

Latest Posts

-

Radley Set For Milestone Match Hear The Coachs High Praise

May 25, 2025

Radley Set For Milestone Match Hear The Coachs High Praise

May 25, 2025 -

Love Saves The Day 2025 Tickets Dates Location And Travel Advice

May 25, 2025

Love Saves The Day 2025 Tickets Dates Location And Travel Advice

May 25, 2025 -

Bitcoin Vs Mstr Which Investment Strategy Reigns Supreme In February 2025

May 25, 2025

Bitcoin Vs Mstr Which Investment Strategy Reigns Supreme In February 2025

May 25, 2025 -

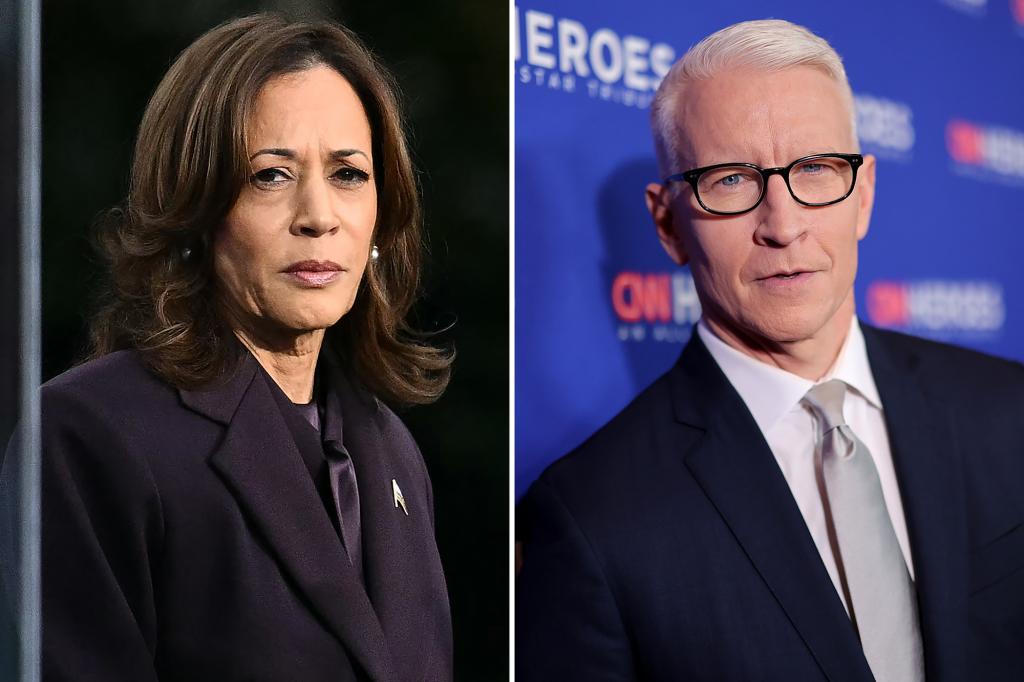

Post Debate Interview Controversy Kamala Harriss Angry Confrontation With Anderson Cooper

May 25, 2025

Post Debate Interview Controversy Kamala Harriss Angry Confrontation With Anderson Cooper

May 25, 2025 -

Beat Wordle Today Nyt Game 1434 May 23 Answer And Hints

May 25, 2025

Beat Wordle Today Nyt Game 1434 May 23 Answer And Hints

May 25, 2025