Analyst Insights: Promising Tech Stocks After Recent Market Corrections

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyst Insights: Promising Tech Stocks After Recent Market Corrections

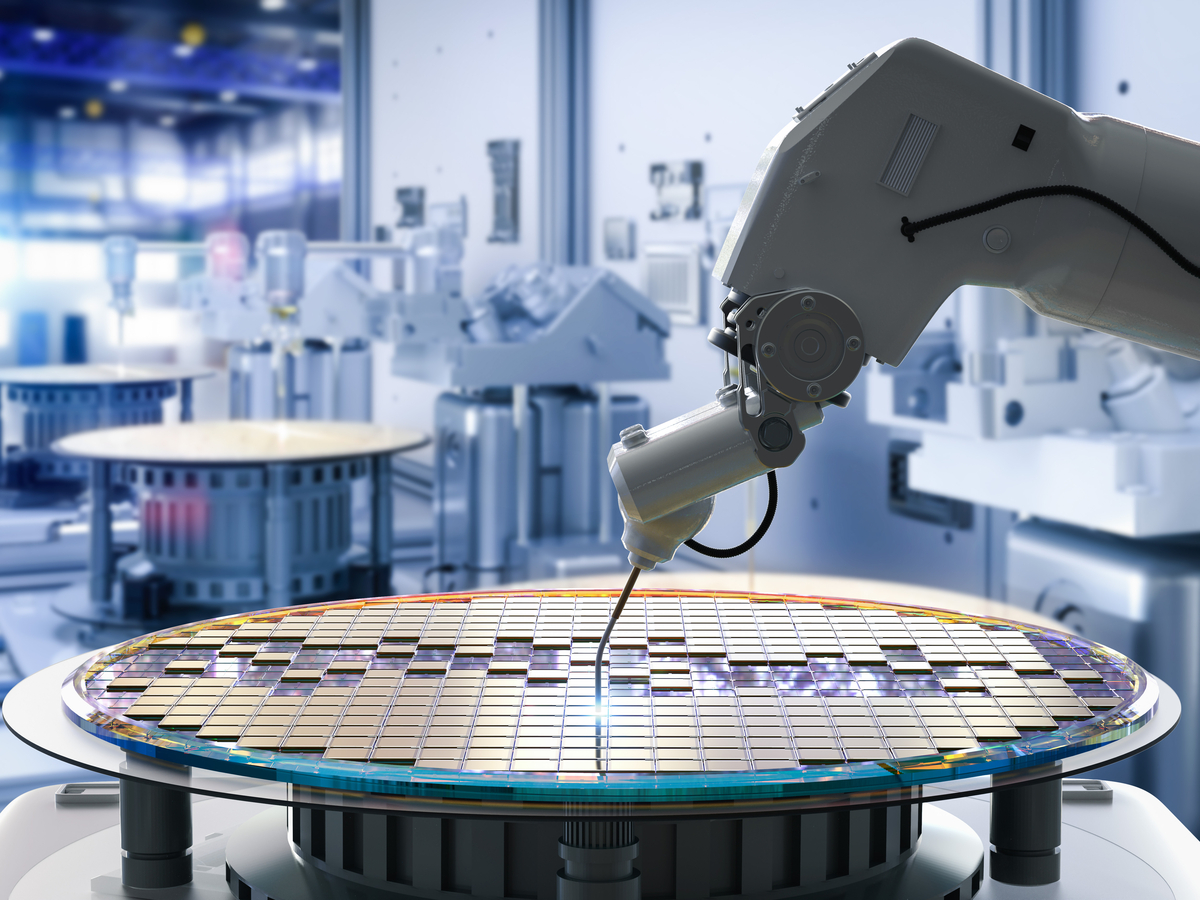

The recent market corrections have left many investors wondering where to put their money. While volatility is a natural part of the market cycle, savvy investors see these dips as opportunities. The tech sector, often hit hardest during corrections, is now presenting some compelling investment prospects. Analysts are pointing to several promising tech stocks poised for significant growth in the coming months and years. Let's delve into some key insights.

H2: Identifying Resilient Tech Giants

The tech sector is diverse, encompassing everything from established giants to innovative startups. While some companies have suffered significantly, others have demonstrated remarkable resilience. Analysts are focusing on companies with strong fundamentals, consistent revenue streams, and a proven track record of innovation. This includes companies with:

- Strong Balance Sheets: Companies with healthy cash reserves and low debt are better positioned to weather economic downturns. This financial strength allows for continued investment in R&D and expansion.

- Recurring Revenue Models: Subscription-based services and software-as-a-service (SaaS) models provide predictable revenue streams, making these companies less vulnerable to market fluctuations.

- Disruptive Technologies: Companies at the forefront of technological advancements, such as artificial intelligence (AI), cloud computing, and cybersecurity, are expected to experience robust growth, regardless of broader market trends.

H2: Top Picks for Post-Correction Growth

Several tech stocks are emerging as favorites among analysts following the recent market corrections. It's crucial to remember that individual stock performance is subject to market risks, and this is not financial advice. Conduct thorough research before making any investment decisions. However, some companies showing promising signs include:

- Cloud Computing Leaders: Companies dominating the cloud infrastructure space, like Amazon Web Services (AWS) and Microsoft Azure, are expected to continue their strong growth trajectory. The increasing reliance on cloud-based solutions across various industries ensures sustained demand for their services.

- AI-Driven Businesses: Companies leveraging artificial intelligence in their products and services are positioned for significant growth. This includes companies developing AI-powered software, hardware, and solutions for various sectors, from healthcare to finance.

- Cybersecurity Firms: With the growing threat of cyberattacks, the demand for robust cybersecurity solutions is rapidly expanding. Companies specializing in cybersecurity software, hardware, and services are likely to experience increased revenue and market share.

H3: Factors to Consider Before Investing

Before investing in any tech stock, several factors deserve careful consideration:

- Valuation: Assess the company's valuation relative to its growth prospects. A high valuation may indicate the market is already pricing in future growth, potentially limiting upside potential.

- Competition: Analyze the competitive landscape. Intense competition can impact a company's market share and profitability.

- Long-Term Vision: Consider the company's long-term strategy and its ability to adapt to evolving market trends.

H2: Managing Risk in a Volatile Market

Investing in the stock market always involves risk. To mitigate potential losses during market corrections, consider employing strategies like:

- Diversification: Spread your investments across multiple stocks and sectors to reduce the impact of any single stock's underperformance.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy reduces the risk of investing a large sum at a market peak.

- Long-Term Perspective: Remember that market corrections are temporary. A long-term investment horizon allows you to ride out short-term volatility and benefit from the potential for long-term growth.

H2: Conclusion: Navigating the Opportunities

While the recent market corrections have created uncertainty, they also present opportunities for astute investors. By focusing on fundamentally strong tech companies with a clear path to growth, investors can potentially capitalize on the post-correction rebound. Remember to conduct thorough research, manage risk effectively, and maintain a long-term perspective to navigate the complexities of the market successfully. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyst Insights: Promising Tech Stocks After Recent Market Corrections. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rare Corpse Flower Blooms At Kew Gardens Londoners Line Up For A Whiff

Apr 08, 2025

Rare Corpse Flower Blooms At Kew Gardens Londoners Line Up For A Whiff

Apr 08, 2025 -

Behind The Scenes Creating A Convincing Unicorn Death In Film

Apr 08, 2025

Behind The Scenes Creating A Convincing Unicorn Death In Film

Apr 08, 2025 -

Investing After The Nasdaq Sell Off Palo Alto Networks Or Nvidia

Apr 08, 2025

Investing After The Nasdaq Sell Off Palo Alto Networks Or Nvidia

Apr 08, 2025 -

Eus Ai Ban Casts Shadow On X Ai Merger And Groks Development

Apr 08, 2025

Eus Ai Ban Casts Shadow On X Ai Merger And Groks Development

Apr 08, 2025 -

Wall Street Weeps Australian Dollar Plummets

Apr 08, 2025

Wall Street Weeps Australian Dollar Plummets

Apr 08, 2025