Are Financial Markets Tanking? Maintaining A Calm Investment Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Are Financial Markets Tanking? Maintaining a Calm Investment Strategy

Financial markets can be volatile beasts. Headlines scream about impending crashes, sparking fear and uncertainty among investors. But are financial markets actually tanking, and what's the best approach for navigating this potential turbulence? Let's delve into the current situation and explore strategies for maintaining a calm and effective investment strategy.

Understanding Market Volatility: It's Normal (Mostly)

Market fluctuations are a natural part of the economic cycle. While significant drops can be unsettling, they are not necessarily indicative of a complete collapse. Factors influencing market performance are complex and multifaceted, including:

-

Inflation and Interest Rates: The Federal Reserve's actions to combat inflation directly impact interest rates, influencing borrowing costs for businesses and consumers, and consequently, market performance. High inflation often leads to increased interest rates, which can slow economic growth and impact stock prices.

-

Geopolitical Events: Global instability, wars, and political uncertainty introduce significant risk and volatility into financial markets. These events can trigger sudden market shifts and investor anxieties.

-

Economic Data Releases: Key economic indicators like employment numbers, GDP growth, and consumer confidence reports significantly influence investor sentiment and market direction. Unexpectedly poor data can trigger sell-offs.

-

Company Performance: Individual company performance, driven by earnings reports, product launches, and management decisions, directly impacts stock prices. Negative news about a major company can ripple through the market.

Is This a Market Correction or a Crash?

Distinguishing between a temporary correction and a full-blown crash is crucial. A correction is a short-term decline of 10-20% from a recent peak, often followed by recovery. A crash, however, signifies a much more significant and prolonged decline, typically exceeding 20%. While current market conditions may feel alarming, it's important to analyze the situation holistically before jumping to conclusions. Look beyond the headlines and consider fundamental economic factors.

Maintaining a Calm Investment Strategy: Key Steps

Instead of panic-selling during market downturns, focus on a long-term perspective and implement these strategies:

1. Diversify Your Portfolio: Don't put all your eggs in one basket. Spread your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk. A diversified portfolio can help cushion the impact of losses in one area.

2. Reassess Your Risk Tolerance: Your risk tolerance may need adjustment based on your age, financial goals, and the current market climate. Consult a financial advisor to determine if your portfolio aligns with your risk profile.

3. Avoid Emotional Decision-Making: Fear and greed are powerful emotions that can lead to poor investment choices. Resist the urge to make impulsive decisions based on short-term market fluctuations. Stick to your long-term investment plan.

4. Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps reduce the risk of investing a lump sum at a market peak.

5. Stay Informed, But Don't Obsess: Keep abreast of market trends and news, but avoid constant monitoring. Overexposure to negative news can fuel anxiety and lead to irrational decisions.

6. Seek Professional Advice: Consider consulting a qualified financial advisor who can provide personalized guidance and help you navigate market volatility.

The Bottom Line: Market uncertainty is inevitable. While current conditions might cause concern, reacting rationally and sticking to a well-defined, diversified investment strategy is key to weathering any storm. Focus on the long-term, avoid panic selling, and remember that market fluctuations are a normal part of the investment landscape. A calm and informed approach is your best defense against market anxieties.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Are Financial Markets Tanking? Maintaining A Calm Investment Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

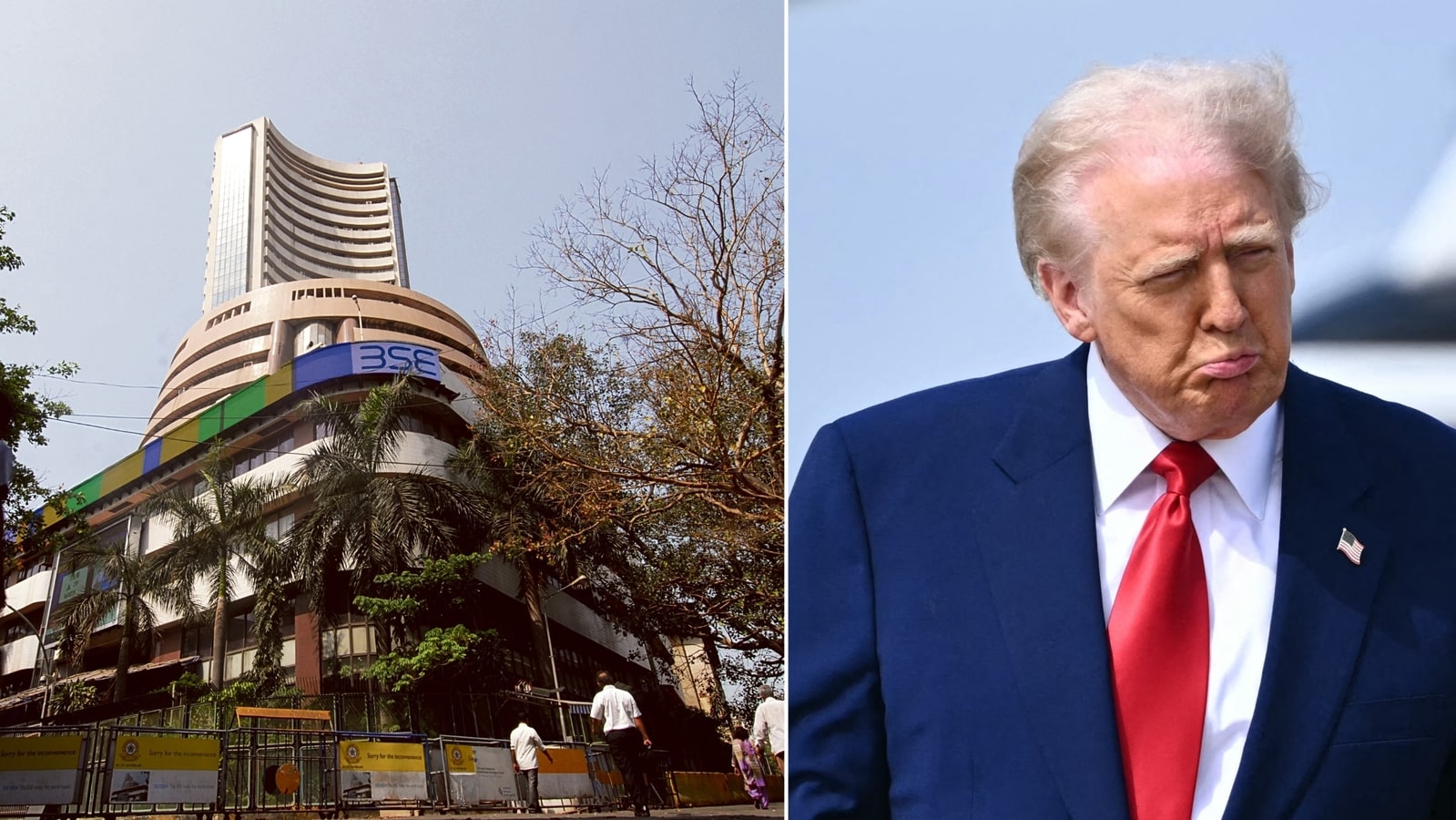

Todays Sharp Fall In Indian Markets A Deep Dive Into The Sensex And Niftys Decline

Apr 07, 2025

Todays Sharp Fall In Indian Markets A Deep Dive Into The Sensex And Niftys Decline

Apr 07, 2025 -

Jacob Elordi Returns Home A Look At His Recent Projects

Apr 07, 2025

Jacob Elordi Returns Home A Look At His Recent Projects

Apr 07, 2025 -

Dan Biggar Retires Wales And Lions Legend Ends 18 Year Rugby Career

Apr 07, 2025

Dan Biggar Retires Wales And Lions Legend Ends 18 Year Rugby Career

Apr 07, 2025 -

Gold Price Plunge Will The Rally Return Experts Weigh In

Apr 07, 2025

Gold Price Plunge Will The Rally Return Experts Weigh In

Apr 07, 2025 -

Asia Pacific Markets Tumble As Hong Kong Stocks Drive Risk Off Sentiment

Apr 07, 2025

Asia Pacific Markets Tumble As Hong Kong Stocks Drive Risk Off Sentiment

Apr 07, 2025