Avalanche (AVAX) Price Analysis: Resistance Zone Holds, Breakout Uncertain

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Avalanche (AVAX) Price Analysis: Resistance Zone Holds, Breakout Uncertain

Avalanche (AVAX), the popular Layer-1 blockchain platform, is currently facing a critical juncture. After a period of relative stability, AVAX's price has encountered significant resistance, leaving investors uncertain about the immediate future direction. This analysis delves into the current market conditions, examining key price action and potential scenarios for Avalanche's price in the coming days and weeks.

Current Market Situation:

The AVAX/USD trading pair has been consolidating for several weeks, bouncing between key support and resistance levels. The recent attempt to breach the critical resistance zone around $20 has been unsuccessful, leading to a period of sideways trading. This resistance zone represents a significant psychological barrier, formed by previous highs and strong selling pressure. The inability to break through suggests strong selling pressure from either profit-taking or cautious investors. Technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), currently show mixed signals, adding to the uncertainty.

Analyzing the Resistance:

The resistance zone around $20 is comprised of several factors:

- Previous Highs: This price level has historically served as a strong resistance level, causing previous price rallies to stall.

- Selling Pressure: High volume trading around $20 indicates significant selling pressure from those who bought at or near these prices.

- Psychological Barrier: The $20 level holds psychological significance for many investors, making it a natural point for profit-taking.

Potential Scenarios:

Several scenarios are possible depending on how the market reacts in the coming days:

- Bearish Scenario: A sustained failure to break through the resistance at $20 could result in a further price decline. Support levels around $17 and $15 would be key areas to watch in a bearish scenario. Increased selling volume and negative technical indicators would reinforce this scenario.

- Bullish Scenario: A decisive breakout above the $20 resistance could trigger a significant price rally. This breakout would need to be accompanied by strong volume to confirm its legitimacy. Subsequent resistance levels could be found around $25 and $30. Positive news related to Avalanche's ecosystem, such as new partnerships or DeFi growth, could fuel this bullish movement.

- Consolidation Scenario: The most likely near-term scenario involves continued consolidation between $18 and $20. This sideways movement could last for several days or even weeks, before a decisive break in either direction.

Factors to Watch:

Several factors will significantly influence the direction of AVAX's price:

- Overall Crypto Market Sentiment: The broader cryptocurrency market's performance will inevitably impact AVAX's price. A bullish market sentiment could provide support, while a bearish trend could put downward pressure on AVAX.

- Avalanche Ecosystem Developments: Positive news related to Avalanche's ecosystem, such as new partnerships, DeFi projects, or upgrades, could trigger a price increase.

- Regulatory Developments: Regulatory clarity or uncertainty surrounding cryptocurrencies could significantly impact AVAX's price.

Conclusion:

Avalanche's price currently faces a critical test at the $20 resistance level. Whether AVAX breaks out to the upside or experiences further decline remains uncertain. Investors should carefully monitor technical indicators, news related to the Avalanche ecosystem, and the broader cryptocurrency market sentiment to gauge the potential direction of the AVAX price. The coming days will be crucial in determining whether Avalanche can overcome this resistance and embark on a new price rally. Remember to always conduct thorough research and manage your risk before investing in any cryptocurrency.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Avalanche (AVAX) Price Analysis: Resistance Zone Holds, Breakout Uncertain. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

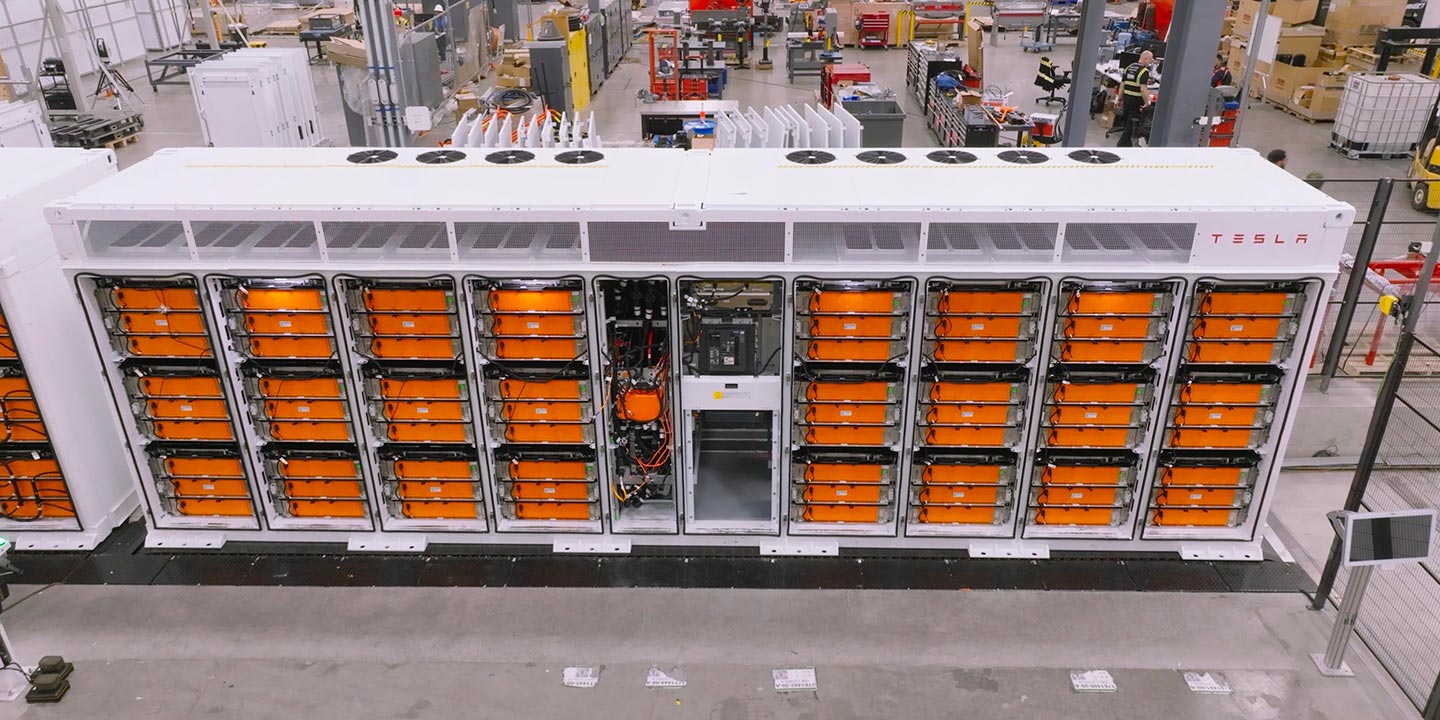

Tesla Battery Production Overcoming Supply Chain Bottlenecks

May 14, 2025

Tesla Battery Production Overcoming Supply Chain Bottlenecks

May 14, 2025 -

Honda Motor Co Ltd Reports Disastrous Earnings 76 Profit Collapse

May 14, 2025

Honda Motor Co Ltd Reports Disastrous Earnings 76 Profit Collapse

May 14, 2025 -

Hondas Financial Troubles Deepen 76 Plunge In Operating Profit Impacts Outlook

May 14, 2025

Hondas Financial Troubles Deepen 76 Plunge In Operating Profit Impacts Outlook

May 14, 2025 -

Capitals De Washington Domines Par Les Hurricanes 5 2

May 14, 2025

Capitals De Washington Domines Par Les Hurricanes 5 2

May 14, 2025 -

Saskatoon Fire 600 K In Damages To Evergreen Homes

May 14, 2025

Saskatoon Fire 600 K In Damages To Evergreen Homes

May 14, 2025

Latest Posts

-

Taiwan On Edge Pla Weapons Test Success Sparks Concerns

May 14, 2025

Taiwan On Edge Pla Weapons Test Success Sparks Concerns

May 14, 2025 -

Dramatic Comeback Thunder Seize 3 2 Advantage Against Nuggets In Nba Playoffs

May 14, 2025

Dramatic Comeback Thunder Seize 3 2 Advantage Against Nuggets In Nba Playoffs

May 14, 2025 -

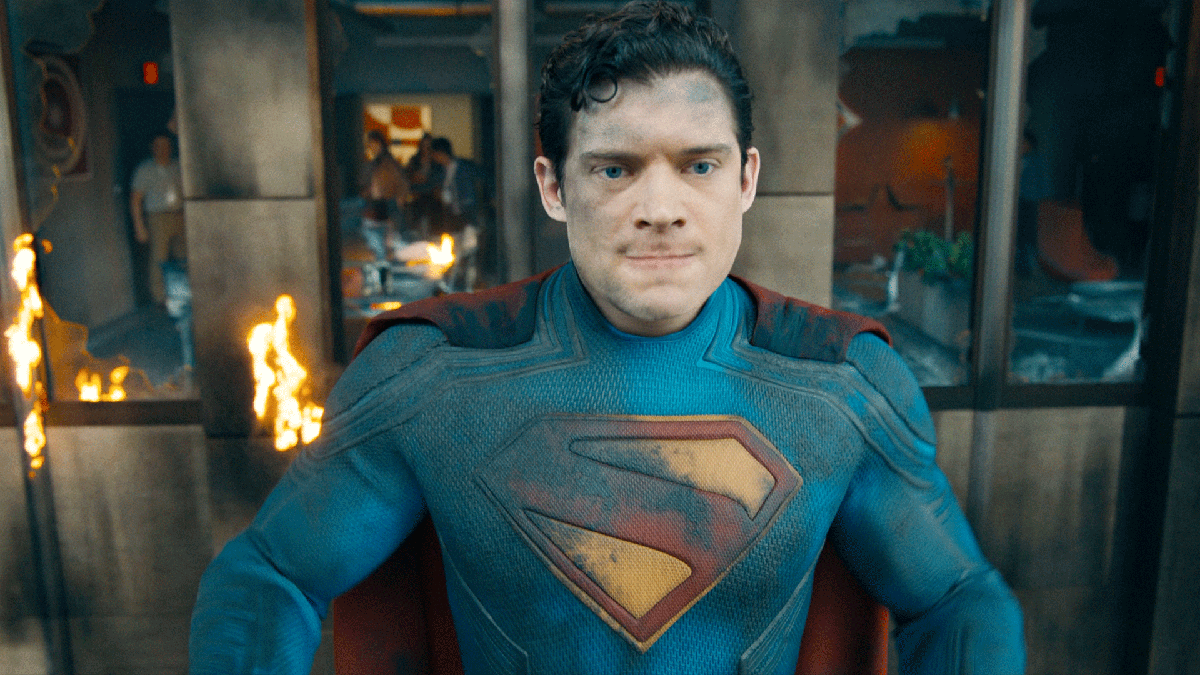

Superman Teaser Trailer 2 Release Date And First Look

May 14, 2025

Superman Teaser Trailer 2 Release Date And First Look

May 14, 2025 -

Phoenix Triumphs Hard Earned Victory Sends Them To Round Of 32

May 14, 2025

Phoenix Triumphs Hard Earned Victory Sends Them To Round Of 32

May 14, 2025 -

Appendicitis Bindi Irwins Urgent Surgery And What You Need To Know

May 14, 2025

Appendicitis Bindi Irwins Urgent Surgery And What You Need To Know

May 14, 2025